- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Explanation of the Delta Posting Logic in Advanced...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Explanation of delta posting logic in Advanced Foreign Currency Valuation

Advanced Foreign Currency Valuation uses the delta posting logic (only) for the amounts to be posted in a valuation run. Because of the delta posting logic the valuation run can be executed at any date and even multiple times on the same day. If no delta is found, nothing will be posted. There are no reversal postings.

Classic Foreign Currency Valuation usually uses reversal posting logic: The valuation adjustments are posted at the end of a fiscal period and reversed (inversed) at the beginning of the next fiscal period. Before a valuation run can be repeated, the valuation posting must be reset.

What does delta posting logic mean in detail?

The Advanced Foreign Currency Valuation run is calculating the delta to be posted as a valuation adjustment as follows:

- Determine groups using the grouping rules.

- Select and aggregate the original amounts of all journal entry items belonging to a group.

- Select and aggregate the valuation adjustments from previous valuations for a group.

- Calculate the new valuated amount at the valuation key date for a group.

- Calculate the difference for each group as follows:

New valuated amount – (original amount + total of value adjustments)

This difference (delta) is posted as new valuation adjustment.

It needs to be considered, that the five steps mentioned previously are focusing on groups (using the configuration ‘Rule for Grouping Journal Entry Line Items for Valuation’).

In the following example, only one outgoing invoice will be used to illustrate how the delta posting logic in Advanced Foreign Currency Valuation works. In the example the invoice amount in document currency is € 1,000.

History | Exchange Rate | Initial amount | New valuated amount | Valuations from previous periods | Sum of initial amount plus valuations from previous periods | Delta posting in current period |

Invoice | (1.0 USD/EUR) | $ 1,000 |

|

|

|

|

Valuation | (1.1 USD/EUR) | $ 1,000 | $ 1,100 | $ 0 | $ 1,000 | $ 100 |

Valuation | (1.5 USD/EUR) | $ 1,000 | $ 1,500 | $ 100 | $ 1,100 | $ 400 |

Valuation | (2.0 USD/EUR) | $ 1,000 | $ 2,000 | $ 500 | $ 1,500 | $ 500 |

Valuation | (1.8 USD/EUR) | $ 1,000 | $ 1,800 | $ 1,000 | $ 2.000 | $ -200 |

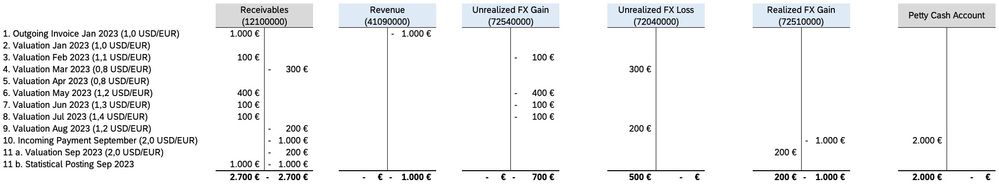

In the subsequent screenshot, the plan is to illustrate the delta posting logic in Advanced Foreign Currency Valuation for an outgoing invoice which was valuated over a couple of months and finally cleared.

In this example, an outgoing invoice posted in January 2023 is valuated monthly until the open gets cleared. Since there is an increase and a decrease of the exchange rates, postings will be made for ‘Unrealized FX Gain’ and for ‘Unrealized FX Loss’.

In step 3, an ‘Unrealized FX Gain’ will be posted, since the exchange rate increased from 1,0 USD/EUR to 1,1 USD/EUR. The € 100 posted onto ‘Unrealized FX Gain’ (cr.) will be immediately posted onto the initial reconciliation account (dr.). With this, always the current value of the initial outgoing invoice is represented at the reconciliation account.

In step 4, an ‘Unrealized FX Loss’ will be posted because of the exchange rate decrease from 1,1 USD/EUR in February 2023 (step 3) to 0,8 USD/EUR in March 2023 (step 4). Because of the delta posting logic, € -300 will be posted onto the initial receivables account in cr. and ‘Unrealized FX Loss’ in dr.

With step 10 the clearing is represented. The exchange rate of the date the clearing will be posted will be applied to post the realized FX effects onto the account maintained for the clearing process. Because of the exchange rate increase to 2,0 USD/EUR, € -1000 (cr.) will be posted as ‘Exchange Rate Differences Realized Gain’.

With the following Advanced Foreign Currency Valuation Run, the ‘Exchange Rate Differences Realized Gain’ posting created with the clearing will be considered and the previous valuation adjustment postings corrected. This is represented in step 11a. In parallel, a statistical posting will be created to fulfill reporting requirements (assignment of SLALITTYPES). This can be seen in step 11b, where the same amount (€ 1,000) will be posted on dr. and cr. side.

In a nutshell: This example illustrates two major innovation hightlights of the Advanced Valuation Runs:

- The FX effects (gain/loss) will be posted immediately onto the initial reconciliation account (in this case Receivables 12100000).

- Only the delta, compared to the previous valuations will be posted. If the exchange rate did not change compared to the previous period, no FX effect will be posted. This can be seen in step 2 where the exchange rate did not change. In such cases, the result list of the Advanced Foreign Currency Valuation run states ‘ZERDEL’ which means zero delta calculated.

- SAP Managed Tags:

- Advanced Financial Closing,

- SAP S/4HANA Finance,

- FIN General Ledger,

- SAP S/4HANA Public Cloud

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

27 -

Expert Insights

114 -

Expert Insights

177 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,682 -

Product Updates

260 -

Roadmap and Strategy

1 -

Technology Updates

1,500 -

Technology Updates

96

- Behavior of Advanced Foreign Currency Valuation after Clearing in Enterprise Resource Planning Blogs by SAP

- Preparing for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- SAP S4HANA Cloud Public Edition Logistics FAQ in Enterprise Resource Planning Blogs by SAP

- Explanation of the Delta Posting Logic in Advanced Foreign Currency Valuation in Enterprise Resource Planning Blogs by SAP

- how to change the valuation view for currency type in finsc_ledger? in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 16 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |