- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Q&A

- What is the best procedure for accelerating deprec...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

What is the best procedure for accelerating depreciation on fixed assets to a date? #COE #MODPIZZA

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 07-23-2021 2:09 AM

Hello,

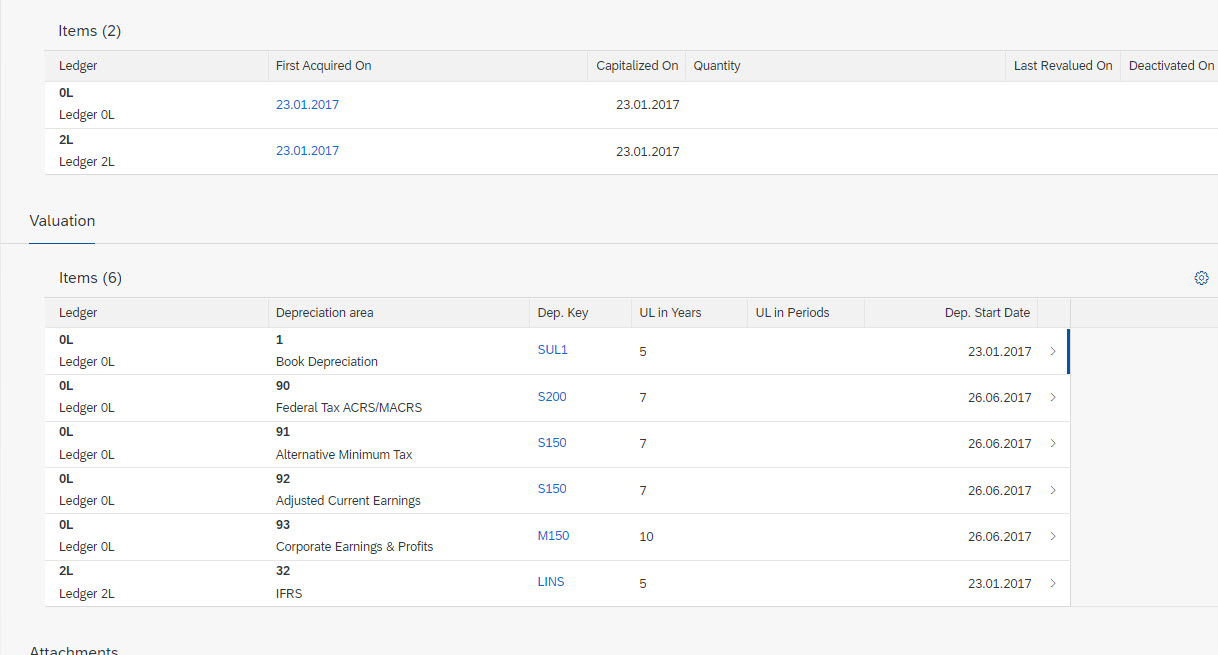

We have a situation where it was announced that we are closing an old store and opening a new store down the street later this year. As a result we need the useful life of the assets in the old store to end by the date the new store opens and for the depreciation to accelerate over the course of the rest of this year until that date (or the closest period based on the depreciation key).

We have roughly 70 assets in that store that we need to make sure are fully depreciated as of Nov 15 2021 (which is right in the middle of one of our 4 week non-month fiscal periods).

Here is an example of one asset, what is the best way to accomplish this accelerated depreciation as efficiently as possible in all of the areas below? Currently we are in the second week of our fiscal period 8, the date above is in between our fiscal periods 12 and 13.

Thanks,

Ryan

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Ryan

Add a time interval for the period you need to accelerate the depreciation with only one period at useful life. You could test the APIs to add the new interval.

Or

Could you create a time interval for November, adopt depreciation key MANU for that period, and manually post the depreciation?

Thanks

Mark

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hi Mark,

I'm not sure how these procedures would work using the example above and specifically in the second instance we don't want to post a manual depreciation since it would appear differently and hit different accounts correct?

Can you elaborate based on the example above how the procedure would work to accelerate the depreciation to end by the end of our fiscal P12 if we're currently in P8.

Thanks,

Ryan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

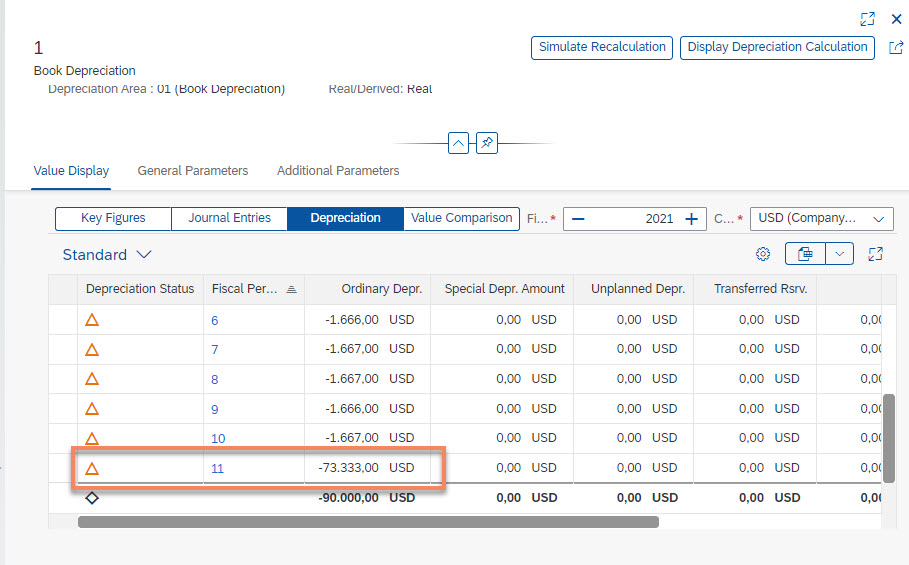

Now the depreciation is going to look like this, the take over value in my asset was 100k

Now you can see overall at the end of period 11 I'll have zero NBV once the depreciation is posted

I suggest you create a sample asset on Q and see if it works out for you, you'll need to do the same to each area in the asset.

For the 70 assets you are looking for the API for adding a new time interval could be used, or you could do manually either depending which is easier for you.

Let me know if that gets you where you want, and you're correct about the manual depreciation, it will hit different GL accounts.

Thanks

Mark

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Thanks Mark,

I tried what you had above in just the 01 area in a similar asset example and the behavior is still perplexing to me. So here's what the team would like to have happen, using my example asset above (which was from Q):

Asset NBV at the beginning of fiscal year 2021: $908.96

Ordinary Depreciation posted FYTD 2021 (thru P7): $449.54

NBV remaining: $459.42

If we recognize that a store is closing in P12 2021 and want to accelerate normal ordinary depreciation to end then and I'm currently in P8, I would think that the new interval and useful life would be one of 2 options:

- New interval would begin at the beginning of the fiscal year and useful life would be 12 periods. The expectation is that the system take the $908.96 / 12 periods and create a posting to catchup up the previously posted periods in the current period and the 5 remaining periods would be (~$75.75).

- New interval would be the start of P8 (7/12/21) and the useful life 5 periods. The expectation in this scenario would be that the system take $449.54 / 5 periods and post that in the remaining periods (~$89.91).

What I've found in both those scenarios is that regardless of what I put in the useful life the system will not post any further than P7 in the first scenario (the beginning of the year) or P8 in the second, posting all of the depreciation at once, why is that?

I recognize that your example above is effectively create an interval for the last period with a 1 period useful life and the system will post the remainder, but I'm curious why the intervals in the two scenarios above are not calculating as we would think they would (and also why you can't delete them and revert if you save).

Thanks,

Ryan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

- Parallel crcy area (crcy type 30) missing for area 01 ch. of deprec. HCL3 ...Message no. ACC_AA116 in Enterprise Resource Planning Q&A

- [Error] Ledger Z2 defined in CoCd JB01 is not active in chart of depreciation 1110 in Enterprise Resource Planning Q&A

- hi in Enterprise Resource Planning Q&A

- Recalculate depreciation S/4 Hana Cloud public in Enterprise Resource Planning Q&A

- F-90 error AU133: Account 'KTANSW : Bal.Sh.Acct APC' could not be found for area 30 in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 104 | |

| 9 | |

| 6 | |

| 6 | |

| 5 | |

| 5 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.