- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by SAP

- Comparison for SAP S/4HANA Basic Credit Management...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

You must know before the content

- The classic credit management(FI-AR-CR) is not available as part of SAP S/4HANA, The functional equivalent in SAP S/4HANA is SAP Credit Management (FIN-FSCM-CR). Using FSCM and classic credit management (FI-AR) in parallel is not supported.

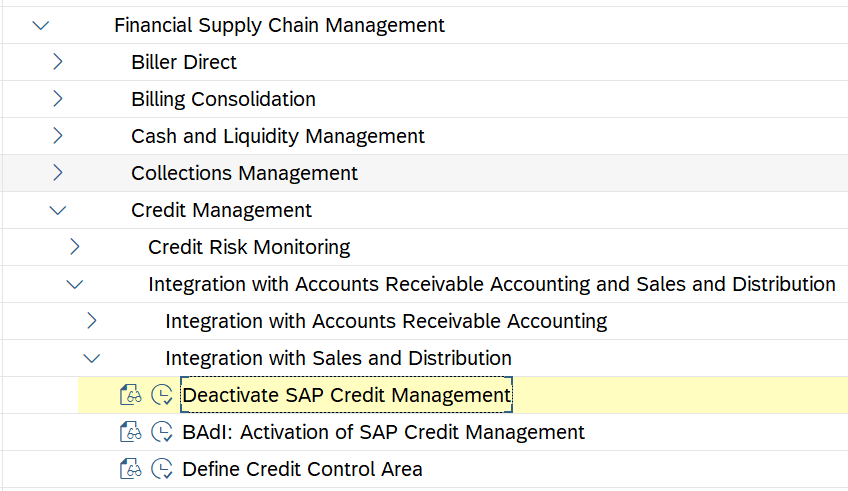

- You can activate/deactivate SAP Credit Management by implementing BAdI UKM_R3_ACTIVATE. Please note, for product versions of SAP S/4HANA 1610 and above, SAP Credit Management is implemented as standard, so deactivation will turn off the functionality completely. 2760814

- In SAP Credit Management (FIN-FSCM-CR), customer credit master data is centralized managed by Business Partner(BP Role: UKM000 Credit Management). You can reach the data by running tcode BP then switch BP role to UKM000, or running tcode UKM_BP directly.

- FSCM requires the configuration of the communication between the Sales and Distribution (SD) and SAP Credit Management (FSCM) system components. You need to activate the integration by BAdI BADI_SD_CM. 2315269

Basic Credit Management

Function Overview

- Set credit limits for a business partner manually

- Set the risk class for a business partner manually

- Do credit checks on sales documents

- Process credit blocked sales documents as documented cedit decision

- Calculate payment behavior key figures

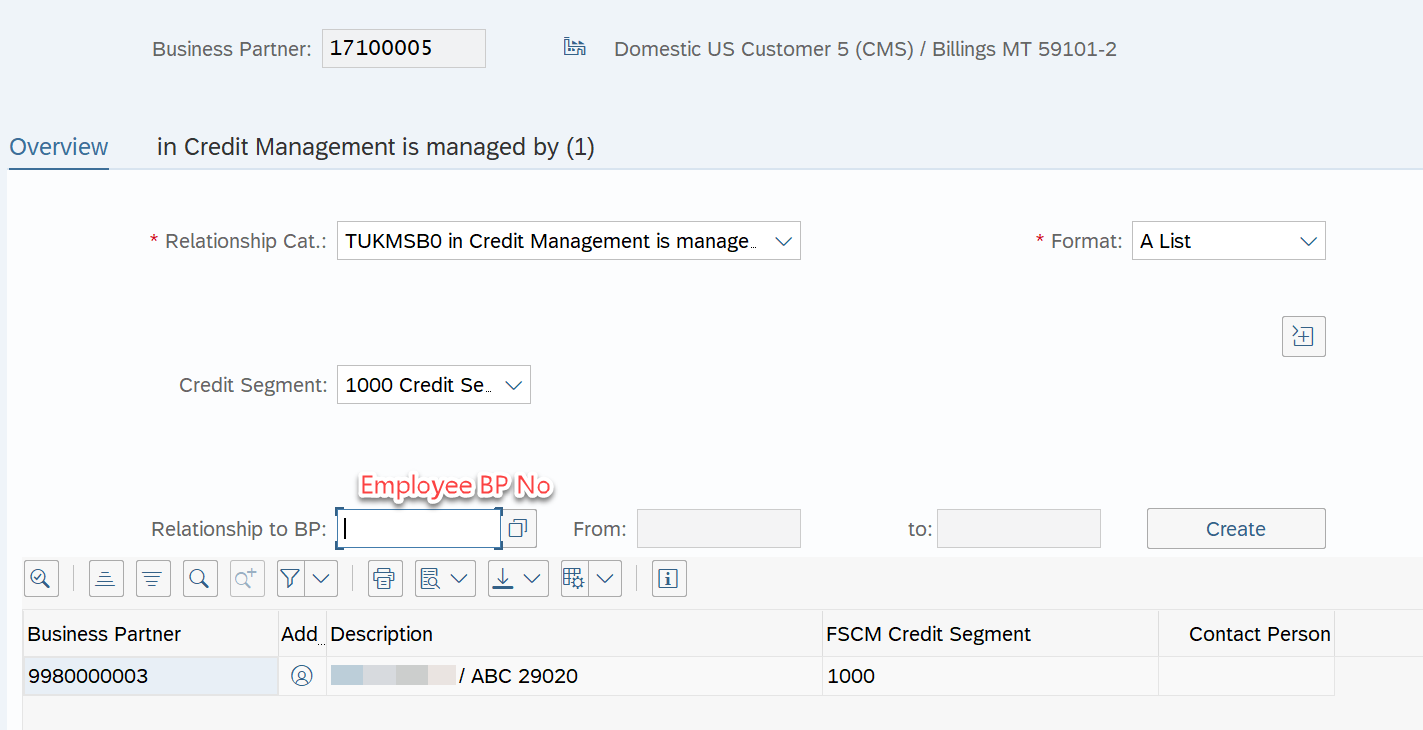

- Define relationships for a business partner (like "in Credit Management is managed by...", “Higher level Credit Management Account of...")

You do not need additional license for above functions in SAP Credit Management.

Main process and Operations

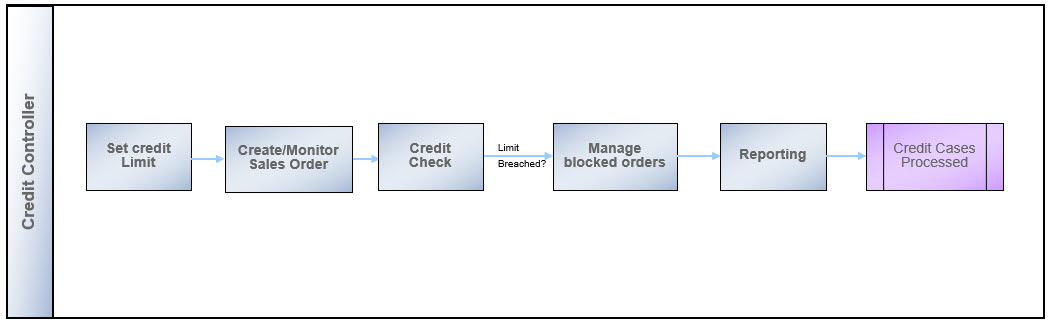

The main process for Basic Credit Management(BD6)

The credit controller maintains customer score, risk class, check rule and credit limit manually by running tcode BP then switch BP role to UKM000 or running UKM_BP directly.

You can click Simulate button to simulate customer credit check. Then assign a credit analyst to a customer by click Relationships on top of the screen.

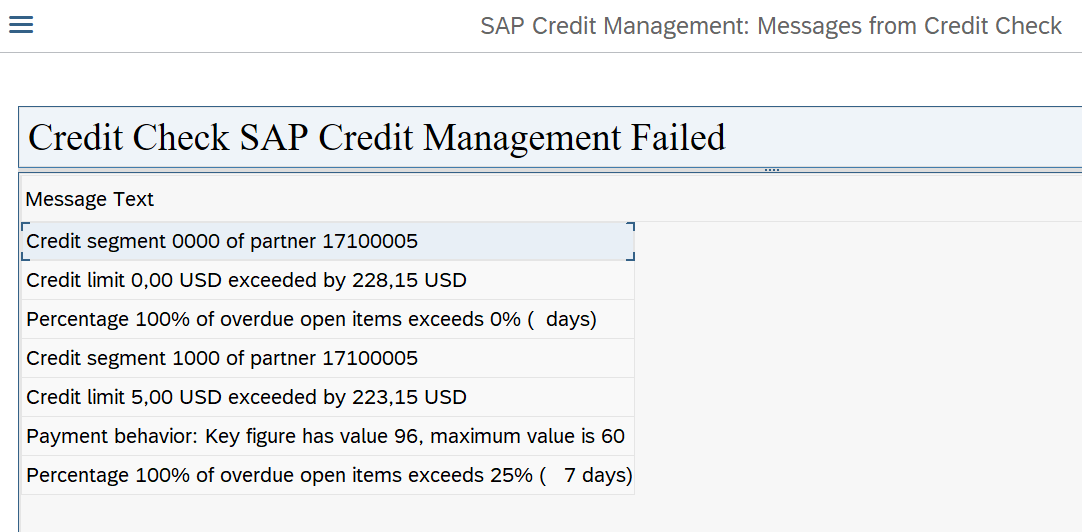

When you create a sales document for credit managed customer, credit checks can be executed for sales documents with different steps, depending the configuration of Credit Checking Rules.

If there is a credit check with negative outcome, the system triggers the creation of a 'Documented Credit Decision' (DCD) as per configuration. Credit analyst or processor can check the DCDs via tcode SCASE, UKM_CASE or UKM_MY_DCDS. They can recheck, release or reject the sales document, and leave note on DCD.

If your sales order or delivery is blocked but DCD is missing. Please refer to Note 2616393.

Configurations

- Activate BAdI UKM_R3_ACTIVATE and BADI_SD_CM

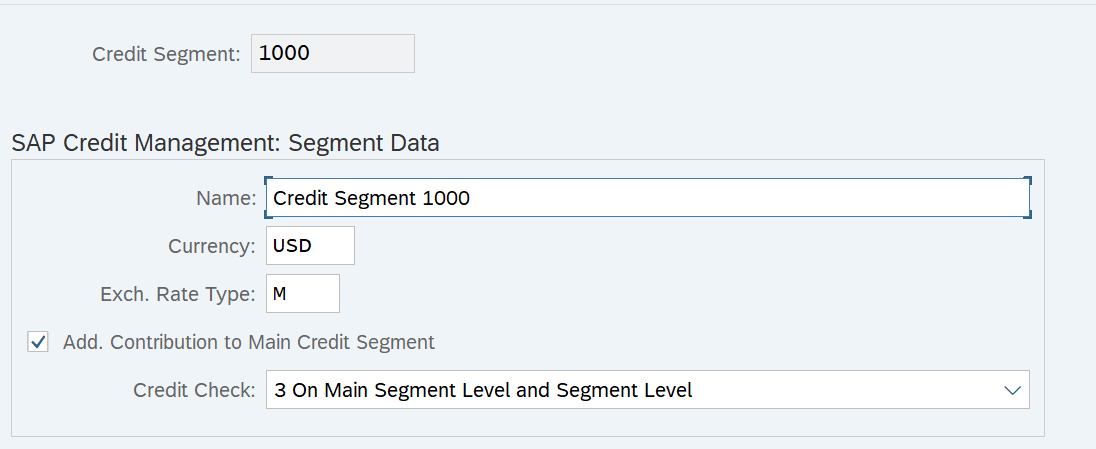

- Credit segment is the organizational unit of FSCM. it needs to be created and assigned to the equivalent credit control area. In FSCM you can use a 'Main Credit Segment' (0000) and flag the setting on the sub-segments to 'Add. contribution to main segment', so the liabilities of the sub-segments will be collected at the main segment level. Create credit segment, and assign to the equivalent credit control area.

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Master Data -> Create Credit Segments

SPRO -> Financial Supply Chain Management -> Credit Management -> Integration with Accounts Receivable Accounting and Sales and Distribution -> Integration with Sales and Distribution -> Assign Credit Control Area and Credit Segment

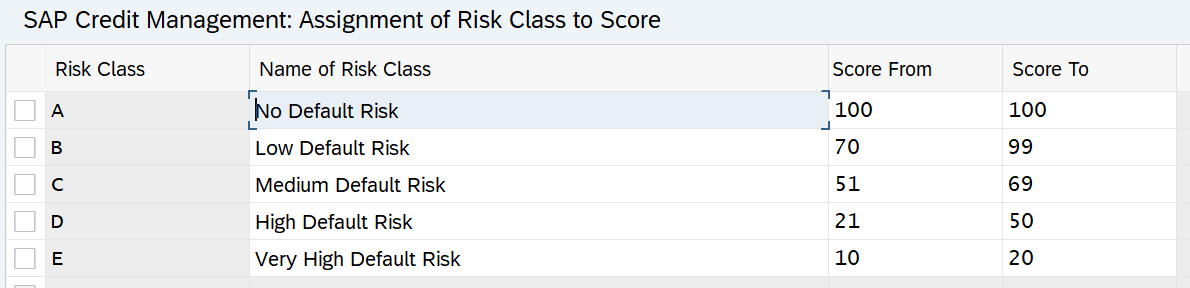

- Risk class is maintained for the whole business partner in UKM_BP on 'General Data' -> 'Credit profile' tab. A distinction is made between the risk category in classic CM and the risk class in SAP Credit Management (FSCM). For each risk category you need to define a risk class with the same ID. The risk class is directly mapped to risk category during the credit master data determination when creating sales documents.

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Master Data -> Create Risk Class

If you need to create a new risk class, then you should create the equivalent risk category as well and assign it to the relevant credit control areas.

SPRO -> Financial Supply Chain Management -> Credit Management -> Integration with Accounts Receivable Accounting and Sales and Distribution -> Integration with Sales and Distribution -> Define Risk Categories

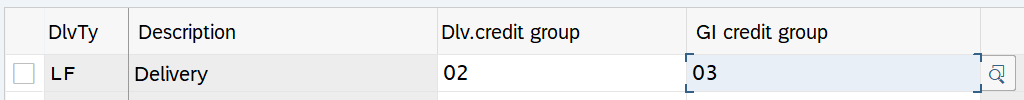

- Credit checks are executed on three levels: sales order, delivery and post goods issue. This is controlled the same way as in classic CM.

SPRO -> Financial Supply Chain Management -> Credit Management -> Integration with Accounts Receivable Accounting and Sales and Distribution -> Integration with Sales and Distribution -> Assign Sales Documents and Delivery Documents

- In order to perform the automatic credit check you need to maintain the relevant CCAr - Risk cat. - Credit Group combination in OVA8 transaction. 2207394

SPRO -> Financial Supply Chain Management -> Credit Management -> Integration with Accounts Receivable Accounting and Sales and Distribution -> Integration with Sales and Distribution -> Define Automatic Credit Control

Credit control is defined by control area/risk category/credit group in classic CM for sales documents credit checking criteria. It performs like a trigger between SD and FSCM, to enable credit check rule maintained in FSCM for sales documents credit checking.

- Flag the item category type “credit active” by OVA7 or VOV7.

In the pricing procedure, subtotal 'A' must be entered in a line for determining the credit value (VBAP-CMPRE), it’s the same with classic CM.

- FSCM is using the liability categories to distinguish between the credit value of sales orders (100), deliveries (400), billing documents (500) and FI documents (200).

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Credit Exposure Update -> Define Liability Categorie

Advanced Credit Management

Function Overview

- All capabilities of Basic Credit Management plus:

- Calculate the internal credit score of a business partner automatically

- Derive the risk class automatically from the internal score

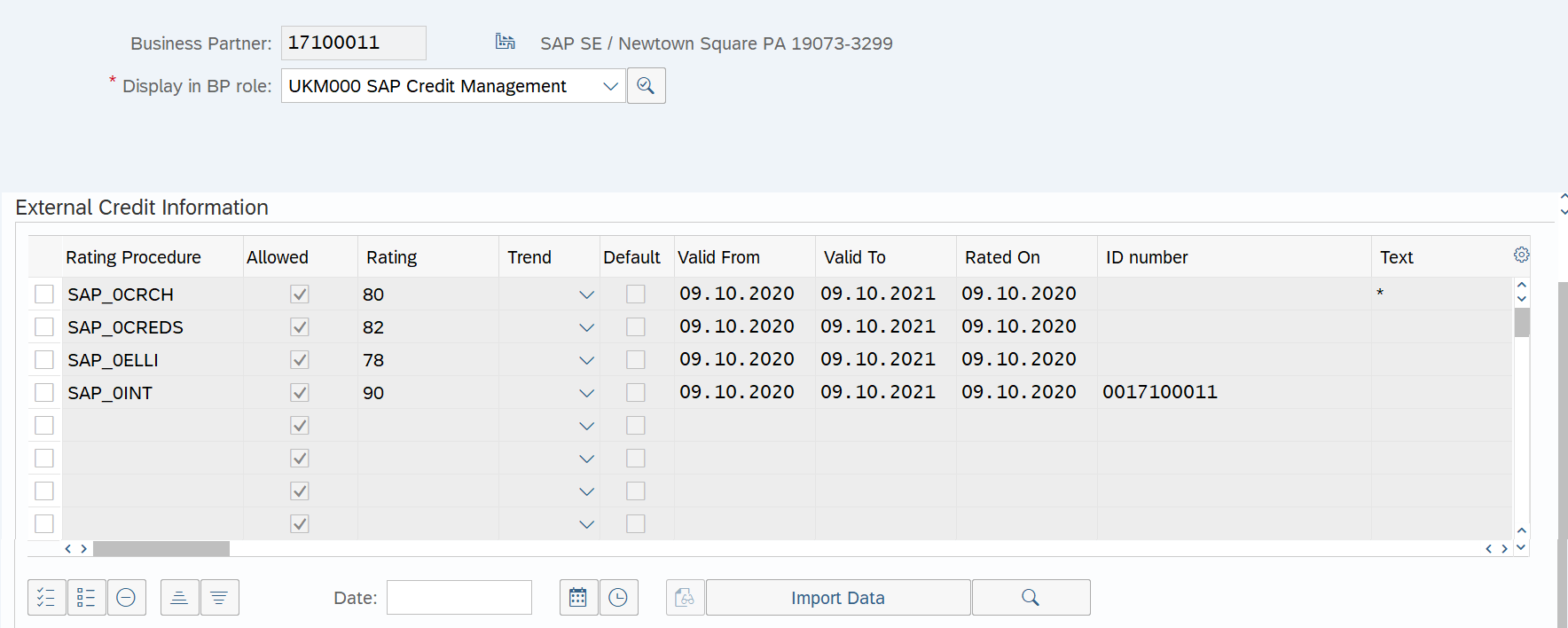

- Store external credit information like a rating from credit agencies on the business partner or to integrate credit agencies in another manner

- Import credit score, credit risk class or credit limits from 3rd party systems and assign it to a business partner

- Automatically calculate credit limits

- Work with credit limit requests

- Work with documented credit decisions (DCD) that are not automatically generated by the system for a sales document

- Use the credit event / follow-on process functionality

- Setup a central Credit Management in a multi-system landscape

You need additional license for above functions in SAP Credit Management. SAP note 2696793.

Main process and operations

Main process for Advanced Credit Management(1QM)

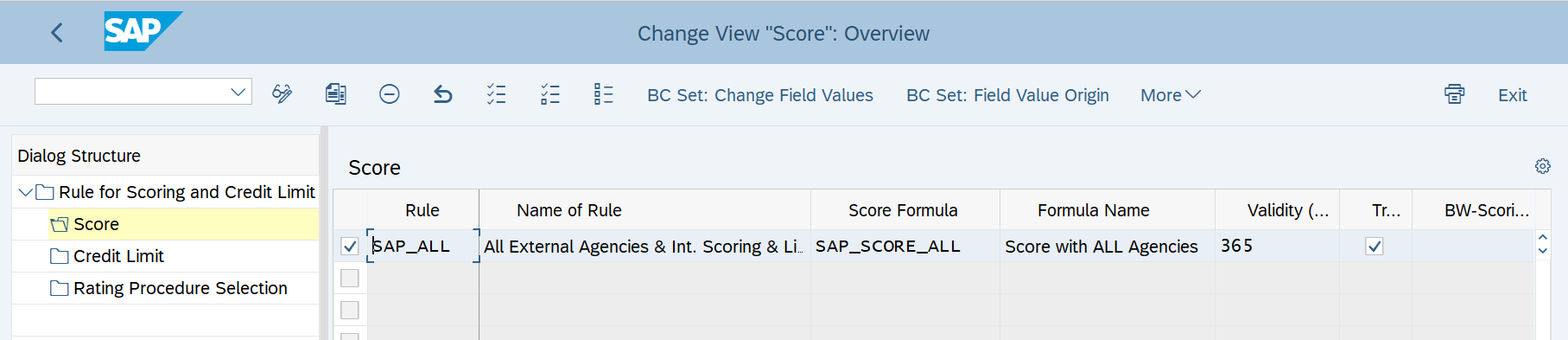

In Advanced Credit Management, it is possible to calculate the internal credit score of a business partner automatically, then derive the risk class automatically from the internal score, and calculate credit limits automatically using credit rule engine and formula editor.

Note The credit limit currency in all company codes is set to use the group currency, which is defined when the solution is activated.

Credit Limit and Risk class can be automatically calculated based on internal and external rating. You can define own calculation logic for internal rating, either import the rating from external 3rd party agencies.

For the link to an external credit agency, an xml formatted file can be added as project work or the data can be input manually on the Business Partner as a part of the base license. An additional license is required for using SAP S/4HANA Cloud for credit integration, access the Configure Credit Agency Integration app and go to Credit Rating under the Maintain Mapping section. The cloud-based service provides about 20-30 credit agencies such as Dun & Bradstreet right out of the box. (SAP Blog: SAP Credit Management in S/4HANA 1909)

Also, additional role authorization may be required for the Credit Controller role to provide access to the credit integration solution app. For more information, see the SAP Help Portal.

The sales representatives are able to access the web-based customer credit information via Display Credit Master Data app(tcode UKM_BP_DISPLAY).

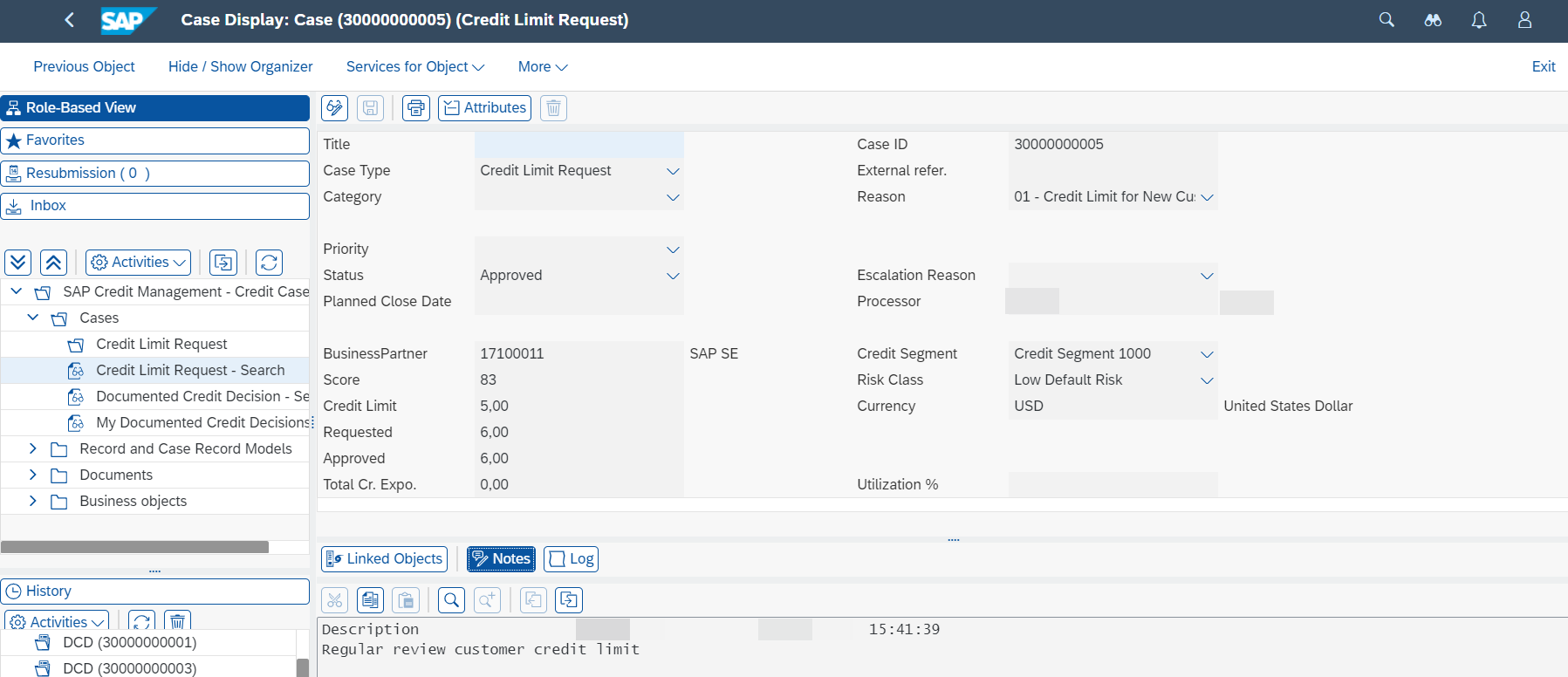

Then they can request a new credit limit for the business partner. The request can be documented as Credit Limit Request in Manage Credit Cases app(tcode SCASE or UKM_CASE).

The credit controller will review the request, monitor customer exposure/limits in a central system, then determine to approve or reject the request with comments.

Configurations

The credit rules engine helps you automate the processes within your credit management. It provides rules for:

- Credit Scoring Rule: automatically calculate the scoring and the Risk Class of your customer. Please check 2803189 for customer credit score calculation.

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Master Data -> Create Rule for Scoring and Credit Limit Calculation

- Credit Limit Rule: automatically propose a credit limit

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Master Data -> Create Rule for Scoring and Credit Limit Calculation

- Rating procedure selection:

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Master Data -> Create Rule for Scoring and Credit Limit Calculation

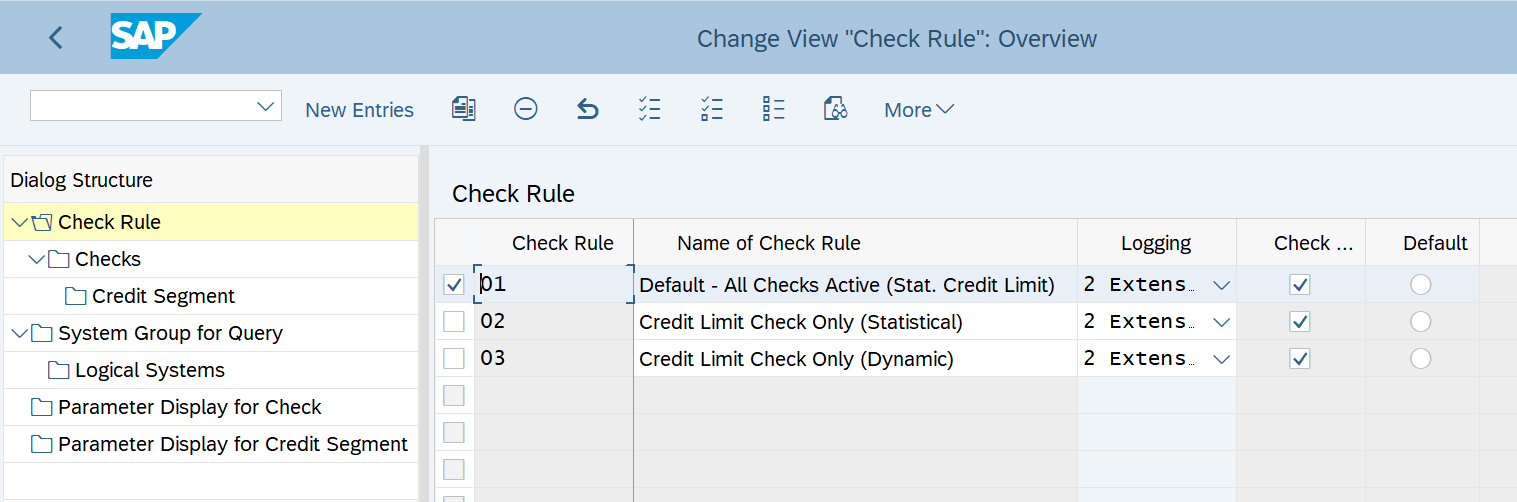

- Credit Check Rule: which credit check steps should be applied for a customer when an external system calls the credit check (e.g. dynamic credit limit check, static credit limit check, oldest open item…) See note 2761313 and 2926009

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Credit Limit Check -> Define Checking Rules

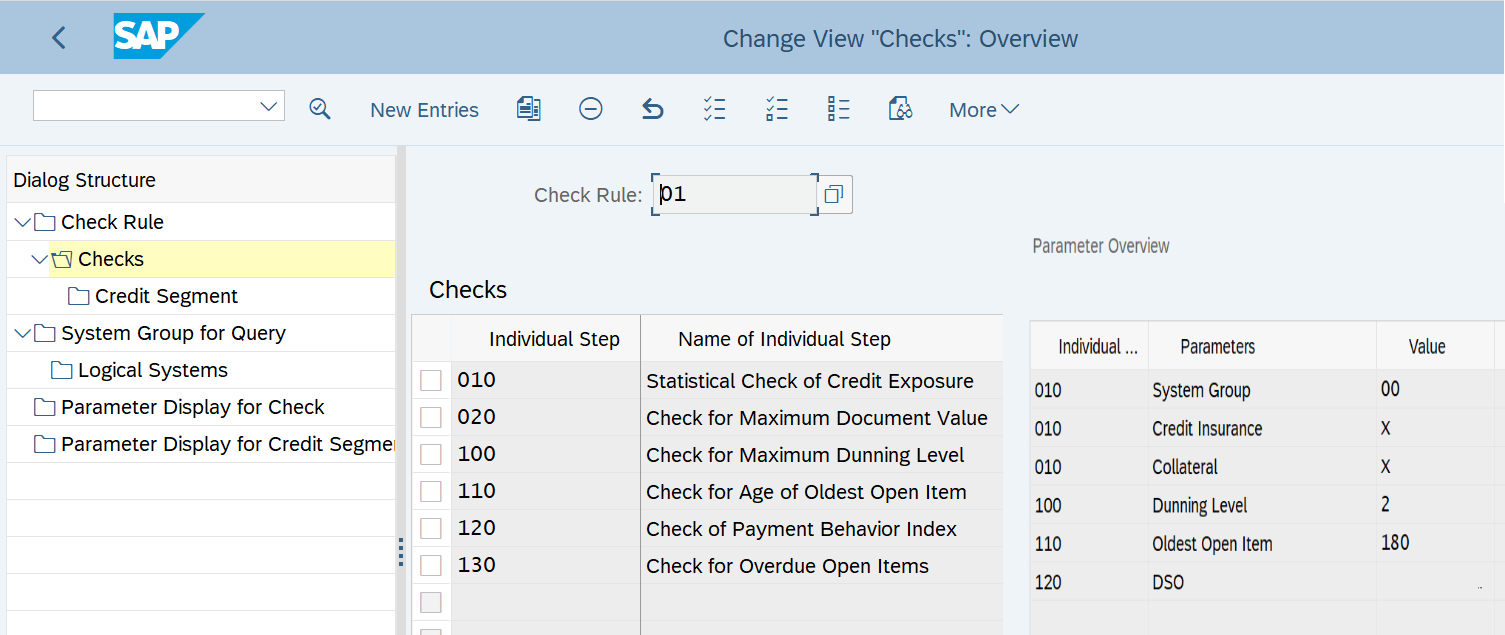

The following check steps are delivered in the standard FSCM:

- 010 Statistical Check of Credit Exposure

- 030 Dynamic Limit Check with Credit Horizon

- 020 Check for Maximum Document Value

- 100 Check for Maximum Dunning Level

- 110 Check for Age of Oldest Open Item

- 120 Check of Payment Behavior Index

- 130 Check for Overdue Open Items

The following five parameters can be maintained on segment level:

- CREDIT_HORIZON - Credit Horizon in Days

- MAX_OVDUE_PC - Percentage Overdue

- MAX_OVDUE_DAYS - Number of Days

- PAY_HIST_LIMIT - Limit for Amt from Payment Behavior

- MAX_DOC_VAL - Maximum Doc. Value

- Define formulas for scoring rule, credit limit calculation and risk class determination.

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Master Data -> Define Formulas

- Credit Check Workflow: which follow up activities should be triggered after a credit check has been executed (e.g. trigger workflow, block customer account)

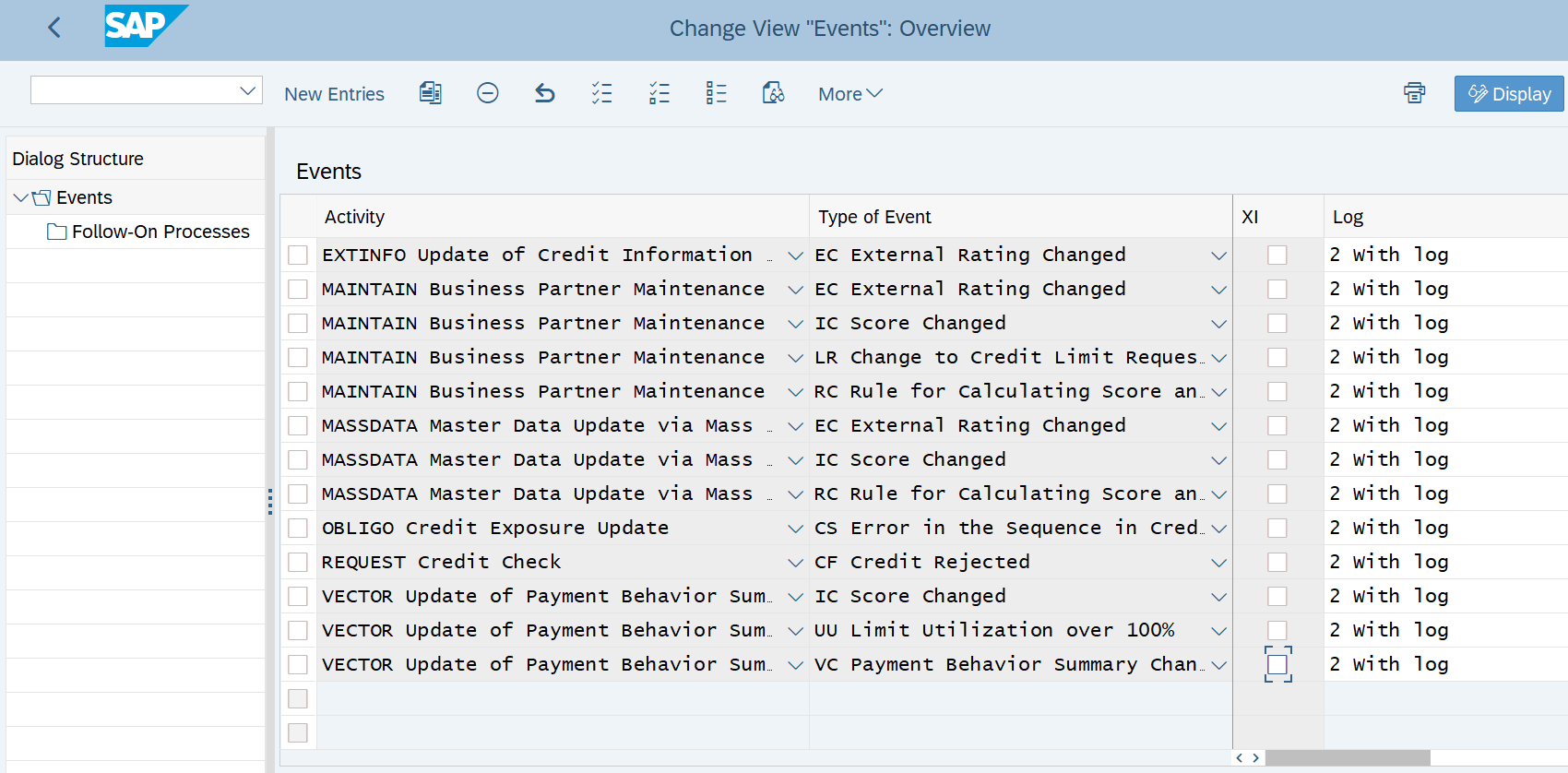

SPRO -> Financial Supply Chain Management -> Credit Management -> Credit Risk Monitoring -> Processes -> Define Events and Follow-On Processes

Reporting

Display Credit Data – Segment

Display Credit Exposure

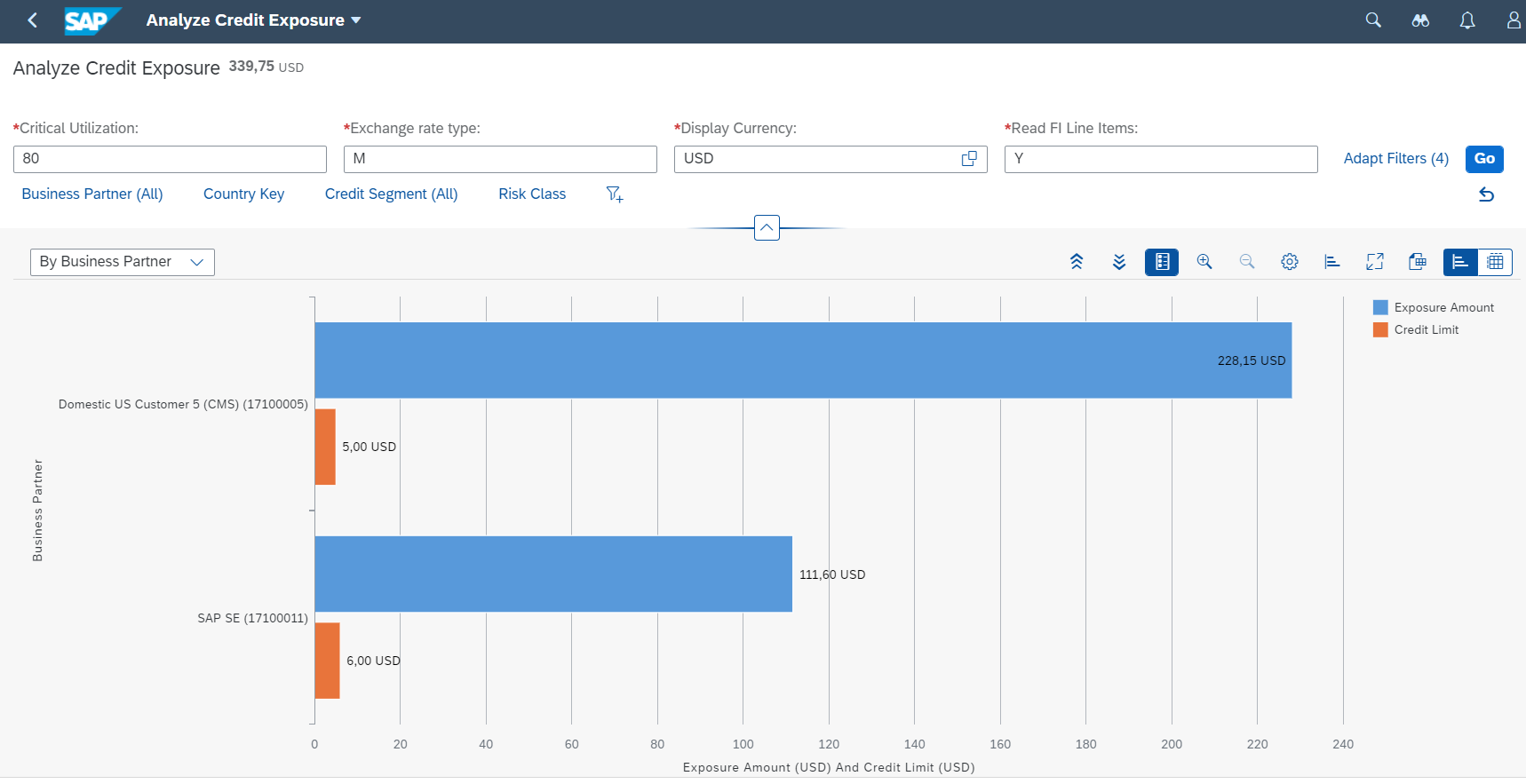

Analyze Credit Exposure

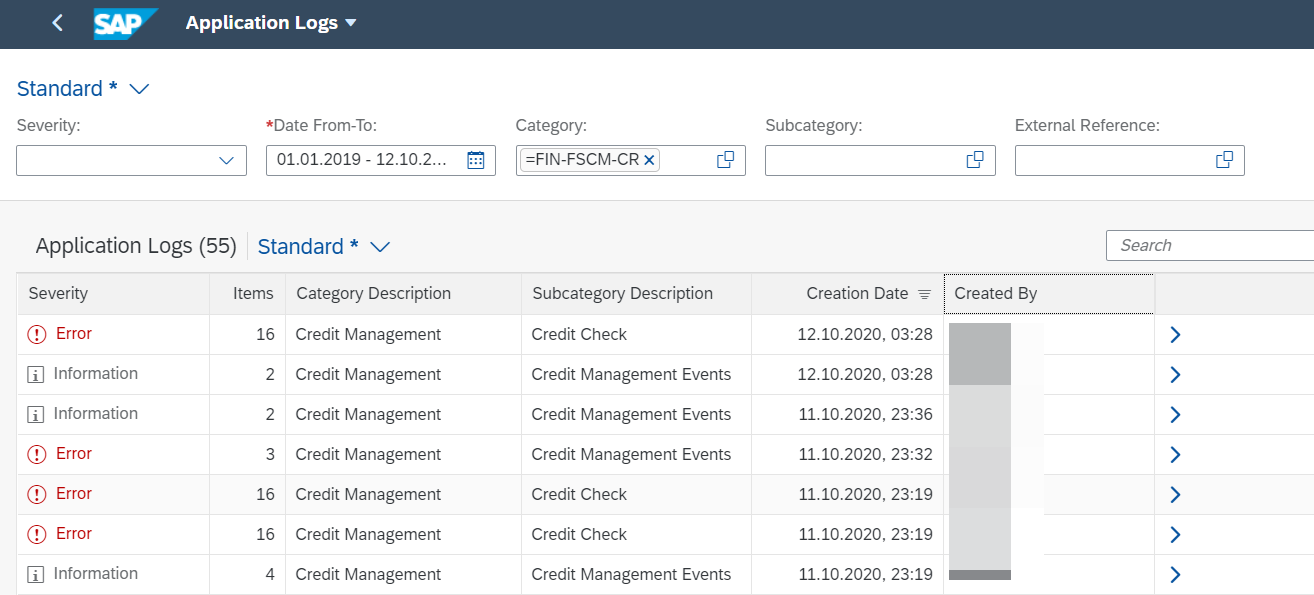

Display Credit Log

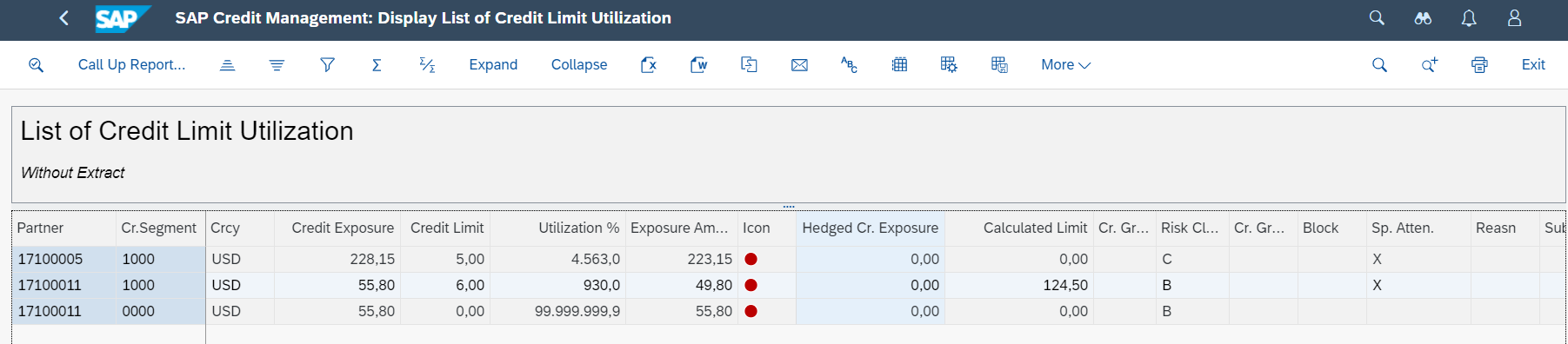

Display Credit Limit Utilization

Credit Limit Utilization (SAP S/4HANA)

Summary

This blog compared the Basic Credit Management and Advanced Credit Management in SAP S/4HANA from process, operations, and configurations aspects. You may find that the Advanced Credit Management is more flexible and automatic to manage customer credit info, you will get to know the status of your customer at early stage then reduce the risk of financial losses. Advanced Credit Management supports your company with making an early determination of the risk of losses on receivables from your business partners and with efficiently making credit decisions.

Other Fiori Credit Management Apps

- Analyze Credit Loss Allowances

- Create Credit/Debit Memos (Mass Processing)

- Schedule Credit Management Jobs

- Manage Sales Document Workflows / Manage Credit Memo Request Workflow

- Confirm Customer List (Accounting)

- Display Business Partner

- Display Credit Data – Credit Profile

- Display Credit Management Log

- Display Credit Master Data

- Display Payment Behavior

- Import External Credit Information

- Manage Business Partner – Credit Profile

- Manage Credit Cases

- Manage Credit Rules

- Manage Documented Credit Decisions

- Navigate to specific DCD

What’s New in SAP S/4HANA 2020

- Additional Information in Credit Management

- Check Configuration of Documented Credit Decisions

- Manage Credit Accounts – Fiori App

- Delete Credit Management Data – Fiori App

- Rebuild Credit Management Data – Fiori App

- Display Credit Exposure – Fiori App

- Display Credit Account Data – Fiori App

Find more innovations in What’s New Viewer – SAP S/4HANA

References

Blogs in SAP community:

https://blogs.sap.com/2019/11/06/sap-credit-management-in-s-4hana-1909/

https://blogs.sap.com/2018/03/30/s4-hana-credit-management-configuration-process/

https://blogs.sap.com/2020/04/17/conversion-of-credit-management-to-sap-s-4hana/

https://blogs.sap.com/2020/05/13/3ws-of-credit-management-high-level-comparison-of-fscm-with-ecc-cre...

https://blogs.sap.com/2020/04/30/list-of-s4hana-credit-management-reports-tables-some-issues-we-face...

https://sap4tech.net/sap-fscm-credit-management-tables/

SAP Notes

2270544 - S4TWL - Credit Management

2788718 - Configuration checklist for SAP Credit Management (FSCM)

SAP Help

SAP Credit Management Configuration Guide

What's New Viewer - SAP S/4HANA

- SAP Managed Tags:

- SAP Financial Supply Chain Management,

- SAP S/4HANA

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Business Trends

169 -

Business Trends

26 -

Catalog Enablement

1 -

Event Information

47 -

Event Information

6 -

Expert Insights

12 -

Expert Insights

53 -

intelligent asset management

1 -

Life at SAP

63 -

Life at SAP

1 -

Product Updates

500 -

Product Updates

75 -

Release Announcement

1 -

SAP Digital Manufacturing for execution

1 -

Super Bowl

1 -

Supply Chain

1 -

Sustainability

1 -

Swifties

1 -

Technology Updates

187 -

Technology Updates

19

- SAP Digital Manufacturing's Real-Time Monitoring View new capability in REO in Supply Chain Management Blogs by SAP

- Enhancing Field Service: SAP Business AI Unveils Intelligent Filtering and Equipment Insights in Supply Chain Management Blogs by SAP

- Digital Twin Administration, Your Gateway to Advanced Data Ecosystems in Supply Chain Management Blogs by SAP

- Fast track your SAP IBP Real time integration journey in Supply Chain Management Blogs by SAP

- SAP Field Service Management 2405 – AI Driven Field Service Management is here! in Supply Chain Management Blogs by SAP

| User | Count |

|---|---|

| 6 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |