- SAP Community

- Groups

- Interest Groups

- Enterprise Architecture

- Knowledge Base

- Architecture Decisions for Revenue and Cost Recogn...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

- Document History

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on 01-29-2024 8:00 AM

Summary

When planning target architecture based on business capability assessments, the Revenue and Cost Recognition capability under the SAP RBA (Reference Business Architecture) model lists the SAP Revenue Accounting and Reporting solution capability in addition to SAP S/4HANA. This leads to the requirement to understand how the solution capabilities are relevant in terms of capability fulfillment and what is relevant for specific target architecture.

This article provides an overview of related evaluation and decision criteria related to solutions to support revenue accounting. Cost related accounting is not discussed as the architecture discussion with the above solutions is differentiated on the revenue side.

Please refer the article Solution Selection for Overhead Cost Accounting - SAP Community Groups for a view on cost accounting capability.

Business Requirements

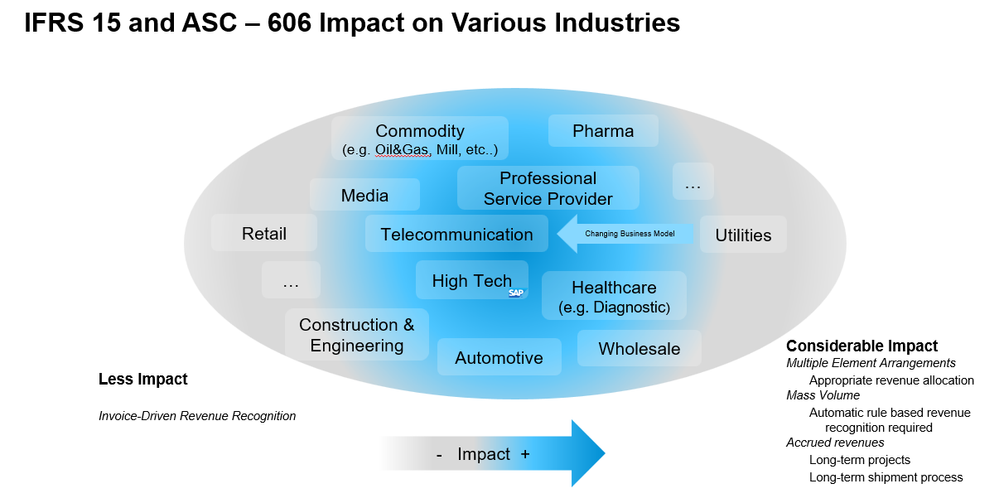

The Revenue and Cost Recognition capability is defined in the RBA model as the ability to address requirements to recognize revenue (such as based on IFRS 15) or to accrue them as future revenue according to the state of fulfillment of contracts. Revenue recognition methods are covered by accounting standards - ASC 606 and IFRS 15.

The target solution capability for this business capability therefore needs to provide the solution capability to correctly account for revenue related to all of an organization’s sales streams.

Solution Options

The following solutions are available for the definition of target architecture with the SAP Intelligent Suite.

- SAP S/4HANA

- SAP Revenue Accounting and Reporting

Characterization of the Solution Options

1. SAP S/4HANA

SAP S/4HANA is at the heart of the SAP Intelligent Suite solutions for Finance. It serves as the system of record for Finance and is mandatory target architecture to support all core finance processes.

From an SAP S/4HANA solution capability perspective, revenue recognition is classified broadly into event-based and contract-based revenue recognition.

Event-based revenue recognition refers to the method of recognizing revenue against events that denote transfer of value to counterparties. The basic requirement is that a defined event occurs based on which contracted revenue and proportionate costs are accounted. The simplest example of this type of revenue recognition is sales against delivery and billing, assuming that there is no substantial lag between the events in terms of the accounting of revenue and related cost. Other examples include accounting for services revenue, normally handled using projects, against revenue recognition events such as milestones and period-based events such as results analysis. The availability of event-based revenue recognition functionality differs between SAP S/4HANA Private Cloud and SAP S/4HANA Public Cloud. In SAP S/4HANA Private Cloud, as with earlier SAP ECC, the functionality is available for projects and requires related configuration.

Contract-based revenue recognition provides the capability to perform sophisticated revenue recognition steps, not possible with only an event-based approach. This requires the implementation of the SAP Revenue Recognition and Accounting Solution.

2. SAP Revenue Recognition and Accounting (RAR)

The RAR solution is technically part of SAP S/4HANA. RAR is a comprehensive revenue management solution that allows organizations to handle the below five-step model for recognizing revenue in compliance with ASC 606 AND IFRS 15.

- Identify the contract with the customer.

- Identify all the performance obligations in the contract.

- Determine the transaction price.

- Allocate the price to the performance obligations.

- Recognize revenue as the performance obligations are fulfilled.

For further details on these steps, one can refer to publicly available information such as on the IFRS website.

This FAQ or RAR provides an overview of features and deployment related topics.

In all cases, please refer to the latest SAP product collateral available on these topics to stay on top of current releases. A good starting point is the Finance and Risk Hub.

Criteria to determine the most suitable target solution

The architecture decision that is to be made based on the solution capability is not at a product level. The RAR solution is an integral part of SAP S/4HANA. The key determinant for implementation of RAR in target SAP S/4HANA architecture is the presence of complex revenue streams that required explicitly the five-step approach based on accounting standards.

In some organizations, there is often a consideration whether SAP RAR should be a hub deployment (distributed system scenarios) or embedded. This is based on the overall landscape situation at the customer and performance considerations; no generic guidance can be provided. Ideally, an embedded approach is optimal.

There are some industries that generally have revenue streams that necessitate the use of RAR more so than others. This is illustrated in the diagram below.

Conclusion

The use of SAP Revenue Accounting and Reporting to support the business capability Revenue and Cost Recognition is a functionality topic and not a product level decision regarding target architecture. The capability is an integral part of SAP S/4HANA.

- SAP Managed Tags:

- SAP Revenue Accounting and Reporting,

- SAP S/4HANA Finance