- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- All you need to know about Electronic Bank Stateme...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

29ratul

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-04-2021

2:29 PM

Most of the articles on EBS talk about step by step configuration guide. They talk about concepts & end to end process very rarely. I hope we all agree that step by step configuration guide is quite easy to follow, but the main challenge is to understand the concept. If we understand the concept, it becomes easier for us to implement the process in live systems. In this blog, I have tried to explain how the EBS process works in SAP. At least I found it hard to implement when I started working on EBS in my project. I wish my blog makes EBS process easy to my SAP colleagues across the globe.

This is a techno-functional blog, prepared to help both technical and functional consultants.

Electronic Bank Statement is provided to the account holders in standard formats, e.g. CAMT, MT940, BAI2 etc. As a part of Payment Transaction processing, EBS can be imported and posted in SAP for reconciliation.

The camt.054 format provides you with the required information on all transactions entered on your account. This includes the information on SEPA transactions in standard Euro payments. The reports in camt.054 allow you to carry out the processing of individual transactions entered on your account as a total figure. The camt.054 is an alternative to MT900 Confirmation Debit, and MT910 Confirmation Credit.

Almost every bank that supports CAMT 054 provides a file specification explaining the file structure and the information it can hold. You can find a sample in the below link.

https://online.swedbank.se/ConditionsEarchive/download?bankid=1111&id=WEBDOC-PRODE23208726

CAMT 054 is an XML file with complex structure, so it is almost impossible to understand the file content just going through the file.

Worried!!!??? Don’t be.

SAP has already provided a transformation for this file format. So, SAP program can automatically transform the file content and load it in SAP tables. But yes, for that we need to complete basic EBS settings. If you want to review how the file will look like after transformation, follow the below steps.

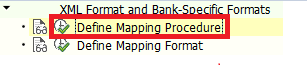

Execute the following node in SPRO and check if the transformation exists for CAMT 054. It should be there.

The HTML output will show how the data is transformed and mapped to SAP back end tables.

There are mainly 4 tables that holds EBS information – FEBKO, FEBEP, FEBRE & FEBCL

1. Run the transaction FF_5. Output Control parameters are important. Do remember to check all of them.

2. After importing the bank data from the XML, the program first transforms the bank data into SAP format (XSLT transformation)

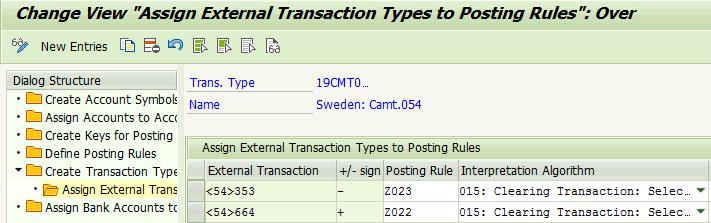

3. Based on the Bank account in the file, program finds out the transaction types, in our case it is 19CMT054

4. Program then interprets the bank data based on External Transaction types in the bank statement and interpretation algorithm set up in the configuration.

External transaction types are used in bank statement to notify what kind of transaction it is. It is a common identifier between the bank and the target system. In SAP, we will have to configure all possible external transaction types for the bank statement format, in our case it is CAMT 054. Some example transaction types are <54>353 used for withdrawal, <54>664 used for deposits.

Interpretation algorithm defines how the note to payee information from the bank statement will be interpreted. Refer to the below link for more details.

https://help.sap.com/saphelp_46c/helpdata/en/43/0bd56743de11d1896f0000e8322d00/content.htm?no_cache=...

You can use standard interpretation algorithm or create your own. Refer to the SAP note: 2032814 for the instruction on how to create Z interpretation algorithm.

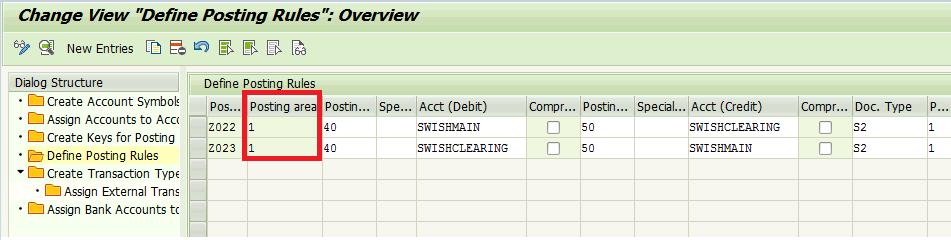

5. Based on the Posting rules (Z022 & Z023) defined for each bank transaction type the bank items are matched with the company data.

Posting rules will decide what to do with the incoming EBS transaction. Posting rules are assigned with the External transaction types. Choose + or – depending on whether the transaction increases (+) (deposit) or decreases (-) (withdrawal) the bank account balance.

6. There are 2 posting areas that we can post to while EBS processing in SAP.

In our example, we have used only posting area 1. That means only 1 accounting posting will happen in Bank Accounting for each external transaction type. Refer to accounting entry 3 & 6 below. Please note that SWISHMAIN & SWISHCLEARING are just account symbols. The GLs have already been assigned with the account symbols.

If we choose Posting Area 2, another account posting will happen, that will clear the sub ledger directly. Refer to entry 2 & 5 below. This configuration will look like below. Posting type must be chosen correctly. The following posting types are available and needs to be assigned with the Posting rules.

Posting type 8 - Clear cred.subl.acct has been used for sub ledger clearing.

If both Posting Area 1 and 2 is chosen, 2 postings will happen for each external transaction type. First one will clear the Bank Accounting and the second one will clear the sub ledger.

Accounts Payable –

1. Vendor Invoice

Dr GR/IR Account

Cr Vendor Recon Account

2. Payment to Vendor

Dr Vendor Recon Account

Cr Bank Outgoing Clearing Account

3. Post EBS in SAP

Dr Bank Outgoing Clearing Account

Cr Bank Main Account

Accounts Receivables –

4. Customer Invoice

Dr Customer Reconciliation Account

Cr Revenue Account

5. Incoming Payment from Customer

Dr Bank Incoming Clearing Account

Cr Customer Reconciliation Account

6. Post EBS

Dr Main Bank Account

Cr Bank Incoming Clearing Account

Journal Entries & Bank Statements

External Transaction type can be seen in the BTC - Business Transaction Code column. Here BTC is <54>. Payment notes can be interpreted by Interpretation Algorithm.

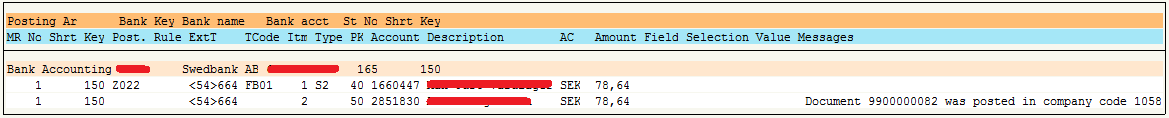

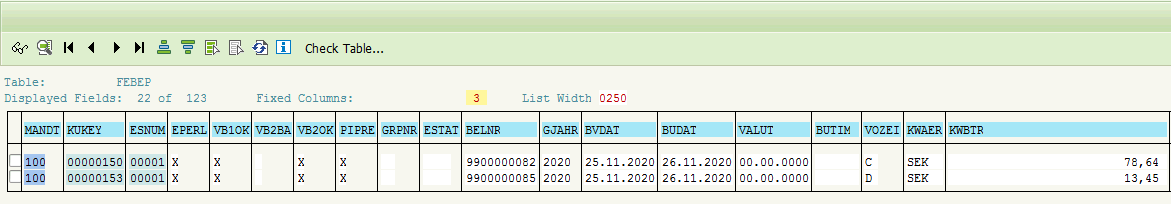

Now let us understand the bank end tables in EBS. To understand EBS and how it works, it is important to understand how EBS is processed in SAP back end tables. We will see the table contents based on the above processed statements.

KUKEY is the statement ID found on the top right of the bank statements

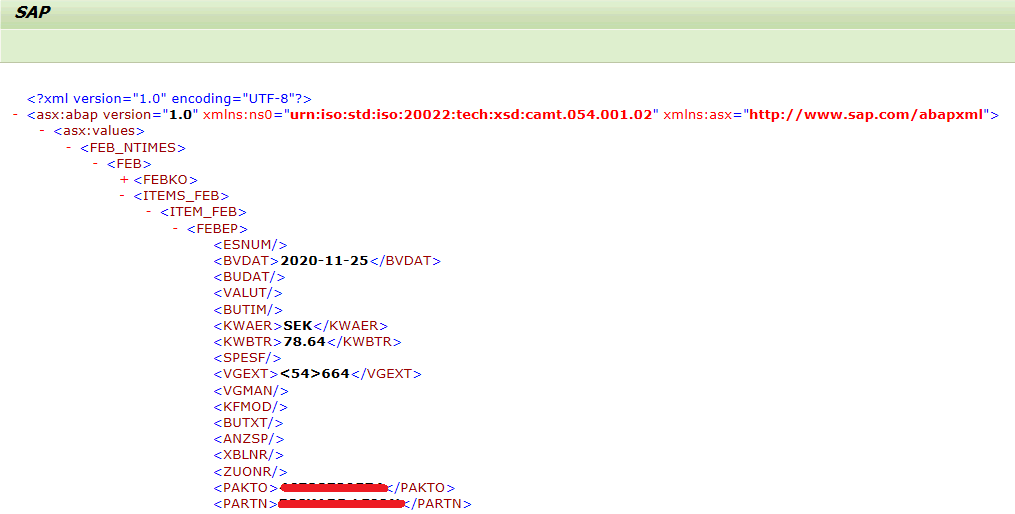

External Transaction Keys are stored in VGEXT field. In our case, VGEXT = <54>-353 & <54>-664

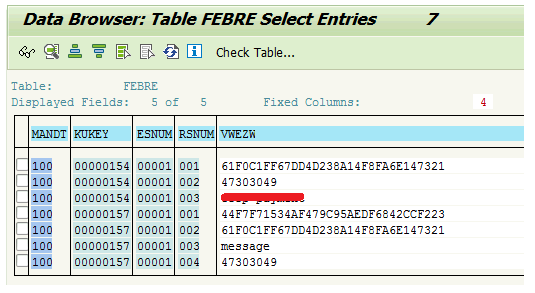

FEBCL holds the clearing information related to the processed EBS. In our case, we are using Assignment number (ZUONR) for clearing. The field SELVON is populated from the Payment Notes column in the bank statement. This table information can be customized using Z interpretation algorithm.

Data in the VWEZW field will match with the Payment Notes information in the Bank Statement.

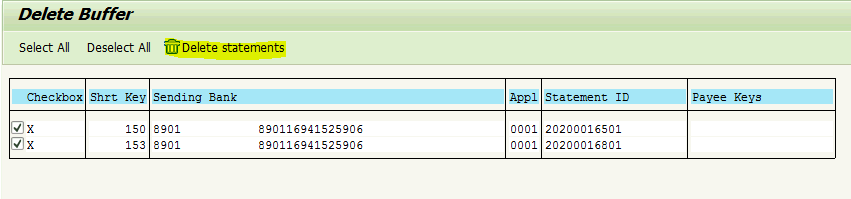

Run the report RFEBKA96 with Application as 0001 & bank statement IDs. In our case, it is 150 & 153.

I hope you enjoyed this blog. Please share your thoughts/corrections/suggestions in the comments below. Also you can reach out to me in the below link. Let's learn together.

You can reach out to me directly here https://www.linkedin.com/in/theratulchakraborty/

This is a techno-functional blog, prepared to help both technical and functional consultants.

What is EBS?

Electronic Bank Statement is provided to the account holders in standard formats, e.g. CAMT, MT940, BAI2 etc. As a part of Payment Transaction processing, EBS can be imported and posted in SAP for reconciliation.

What is CAMT 054 format?

The camt.054 format provides you with the required information on all transactions entered on your account. This includes the information on SEPA transactions in standard Euro payments. The reports in camt.054 allow you to carry out the processing of individual transactions entered on your account as a total figure. The camt.054 is an alternative to MT900 Confirmation Debit, and MT910 Confirmation Credit.

Understanding the file format and how to map it with SAP tables:

Almost every bank that supports CAMT 054 provides a file specification explaining the file structure and the information it can hold. You can find a sample in the below link.

https://online.swedbank.se/ConditionsEarchive/download?bankid=1111&id=WEBDOC-PRODE23208726

CAMT 054 is an XML file with complex structure, so it is almost impossible to understand the file content just going through the file.

Worried!!!??? Don’t be.

SAP has already provided a transformation for this file format. So, SAP program can automatically transform the file content and load it in SAP tables. But yes, for that we need to complete basic EBS settings. If you want to review how the file will look like after transformation, follow the below steps.

Step 1:

Execute the following node in SPRO and check if the transformation exists for CAMT 054. It should be there.

Step 2:

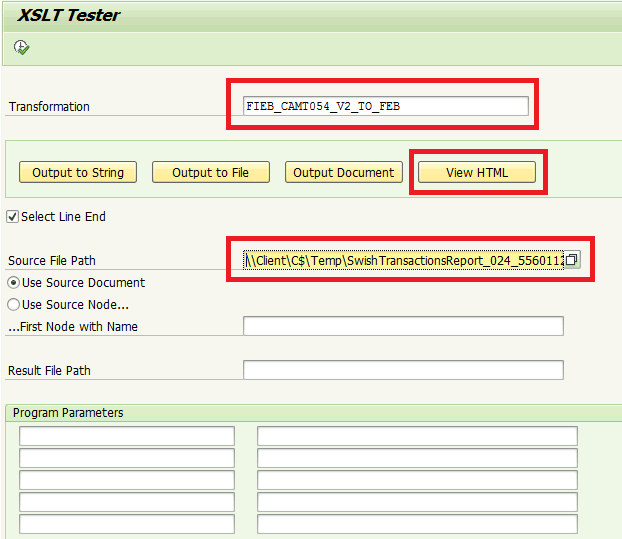

- Go to transaction STRANS and enter the transformation FIEB_CAMT054_V2_TO_FEB

- Enter the following details and Click on view HTML.

The HTML output will show how the data is transformed and mapped to SAP back end tables.

There are mainly 4 tables that holds EBS information – FEBKO, FEBEP, FEBRE & FEBCL

How EBS is processed in SAP?

1. Run the transaction FF_5. Output Control parameters are important. Do remember to check all of them.

2. After importing the bank data from the XML, the program first transforms the bank data into SAP format (XSLT transformation)

3. Based on the Bank account in the file, program finds out the transaction types, in our case it is 19CMT054

4. Program then interprets the bank data based on External Transaction types in the bank statement and interpretation algorithm set up in the configuration.

External Transaction Types:

External transaction types are used in bank statement to notify what kind of transaction it is. It is a common identifier between the bank and the target system. In SAP, we will have to configure all possible external transaction types for the bank statement format, in our case it is CAMT 054. Some example transaction types are <54>353 used for withdrawal, <54>664 used for deposits.

Interpretation Algorithm:

Interpretation algorithm defines how the note to payee information from the bank statement will be interpreted. Refer to the below link for more details.

https://help.sap.com/saphelp_46c/helpdata/en/43/0bd56743de11d1896f0000e8322d00/content.htm?no_cache=...

You can use standard interpretation algorithm or create your own. Refer to the SAP note: 2032814 for the instruction on how to create Z interpretation algorithm.

5. Based on the Posting rules (Z022 & Z023) defined for each bank transaction type the bank items are matched with the company data.

Posting rules:

Posting rules will decide what to do with the incoming EBS transaction. Posting rules are assigned with the External transaction types. Choose + or – depending on whether the transaction increases (+) (deposit) or decreases (-) (withdrawal) the bank account balance.

6. There are 2 posting areas that we can post to while EBS processing in SAP.

- Posting Area 1 – Posting in Bank Accounting

- Posting Area 2 – Posting in Subledger Accounting

In our example, we have used only posting area 1. That means only 1 accounting posting will happen in Bank Accounting for each external transaction type. Refer to accounting entry 3 & 6 below. Please note that SWISHMAIN & SWISHCLEARING are just account symbols. The GLs have already been assigned with the account symbols.

If we choose Posting Area 2, another account posting will happen, that will clear the sub ledger directly. Refer to entry 2 & 5 below. This configuration will look like below. Posting type must be chosen correctly. The following posting types are available and needs to be assigned with the Posting rules.

Posting type 8 - Clear cred.subl.acct has been used for sub ledger clearing.

If both Posting Area 1 and 2 is chosen, 2 postings will happen for each external transaction type. First one will clear the Bank Accounting and the second one will clear the sub ledger.

EBS posting accounting entries:

Accounts Payable –

1. Vendor Invoice

Dr GR/IR Account

Cr Vendor Recon Account

2. Payment to Vendor

Dr Vendor Recon Account

Cr Bank Outgoing Clearing Account

3. Post EBS in SAP

Dr Bank Outgoing Clearing Account

Cr Bank Main Account

Accounts Receivables –

4. Customer Invoice

Dr Customer Reconciliation Account

Cr Revenue Account

5. Incoming Payment from Customer

Dr Bank Incoming Clearing Account

Cr Customer Reconciliation Account

6. Post EBS

Dr Main Bank Account

Cr Bank Incoming Clearing Account

- After Posting the report will be shown as below. As per the import file, 2 bank statements are posted.

Journal Entries & Bank Statements

External Transaction type can be seen in the BTC - Business Transaction Code column. Here BTC is <54>. Payment notes can be interpreted by Interpretation Algorithm.

- Bank Statements can be reprinted using FF_6.

Understanding the EBS Back end tables:

Now let us understand the bank end tables in EBS. To understand EBS and how it works, it is important to understand how EBS is processed in SAP back end tables. We will see the table contents based on the above processed statements.

FEBKO - Electronic Bank Statement Header Records

KUKEY is the statement ID found on the top right of the bank statements

FEBEP - Electronic Bank Statement Line Items

External Transaction Keys are stored in VGEXT field. In our case, VGEXT = <54>-353 & <54>-664

FEBCL - Clearing data for an electronic bank statement line item

FEBCL holds the clearing information related to the processed EBS. In our case, we are using Assignment number (ZUONR) for clearing. The field SELVON is populated from the Payment Notes column in the bank statement. This table information can be customized using Z interpretation algorithm.

FEBRE - Reference record for electronic bank statement line item

Data in the VWEZW field will match with the Payment Notes information in the Bank Statement.

How to delete Bank statements from the buffer tables?

Run the report RFEBKA96 with Application as 0001 & bank statement IDs. In our case, it is 150 & 153.

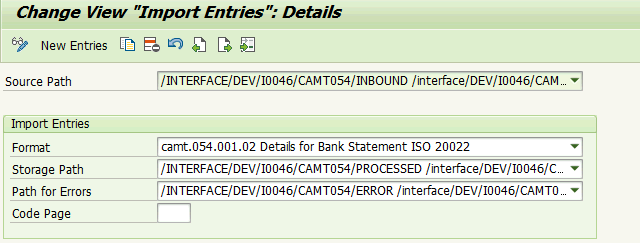

Customizations in EBS upload:

How EBS processing can be automated?

- SAP PI/PO or any middleware can get the CAMT 054 files from bank SFTP folder and upload in designated folder in AL11. The folder can be configured in SPRO.

- 3 logical paths to be configured for the Inbound files, Processed and Errored files.

- Above logical paths to be set up in the Define Import Parameter step

- Run the transaction FEB_FILE_HANDLING with the source file path /INTERFACE/DEV/I0046/CAMT054/INBOUND

- If the processing the successfully, the file is moved from Inbound folder to the Processed folder. If any error, the file is moved to Error folder.

I hope you enjoyed this blog. Please share your thoughts/corrections/suggestions in the comments below. Also you can reach out to me in the below link. Let's learn together.

You can reach out to me directly here https://www.linkedin.com/in/theratulchakraborty/

- SAP Managed Tags:

- SAP S/4HANA,

- FIN (Finance),

- FIN Cash Management,

- FIN Treasury

55 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

abap cds

1 -

ABAP CDS Views

1 -

ABAP CDS Views - BW Extraction

1 -

ABAP CDS Views - CDC (Change Data Capture)

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

API and Integration

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

CDS Annotations

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

2 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Employee Central Integration (Inc. EC APIs)

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP CPI (Cloud Platform Integration)

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Subcontracting Process

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

- Beyond Basic (1): Certificate-Based Authentication in Enterprise Resource Planning Blogs by SAP

- How Do I Process Cash Dividends in SAP Treasury and Risk Management? in Enterprise Resource Planning Blogs by SAP

- Electronic Bank Statement config for 17BAI external code 856 in Enterprise Resource Planning Q&A

- Database getting smashed by particular query - OILM/OBTL/ILM1 in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 7 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |