- SAP Community

- Products and Technology

- Human Capital Management

- HCM Blogs by Members

- Detailed CPF calculation (with wage types) in Sing...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Employee basic Salary has been increased from 19899 $ to 20595 $ w.e.f from 1st January 2023. But this change has been done in April 2023. So, the system will automatically trigger retro accounting.

Employee Allowances = 550 SGD. (SGD->Singapore dollar)

Now, PCR RC40 will populate /T02 during retro payroll calculation for the period of 01/2023 in period 04/2023.

/T02= Old Value of OW in January i.e (19899+550) =20449 SGD.

/102 = New Value of OW for January i.e (20595+550) =21145 SGD.

/F02= (21145-20449) = 696 SGD.

For 3 months (696*3) = 2088 SGD.

PCR RC10 creates the /103 in the current period for the difference amount (2088 $) in the OW brought forward to current period. Thus, the value of /103 will be added with the value of /F02 from 01/2023. This also means that the retro changes have now triggered an AW calculation of CPF and not an OW calculation for CPF.

Suppose, a bonus payment of 102512 SGD has also been made on April 2023, which will be treated as AW.

Total gross = /101 = (20595+550+102512) = 123657 SGD

OW for CPF = /102 = (20595+550) = 21145 SGD

AW for CPF = /103 = (102512+2088) = 104600 SGD.

For calculating CPF technical wage types, function RSCPF will take P0002 Table (for age and DOB) and SV Table (for fund type details) as input.

OW for CPF after prorate = /302 = 21145 SGD.

AW for CPF after prorate = /303 = 104600 SGD.

TW for CPF after prorate = /304 = (/302 + /303) = 125745 SGD.

CPF OW ceiling as per Law 6000 $ up to August 2023.(Maintained in CAPOW constant in T511K)

OW of CPF after capping = /399 = 6000 SGD.

AW Ceiling as per law:

[102000 – (OW subjected to CPF of the year)] = [102000- (6000*12)] = 30000 SGD.

If there is a change in the additional wages (AW) of the previous month then also the difference is brought forward from /F03 to /103. Let's say the amount is 675 SGD.

Then, New AW Ceiling = (30000 - 675)= 29325 SGD.

AW paid to CPF = /309 = 29325 SGD.

AW unpaid to CPF = /310 = (/303 - /309) = (104600-29325) = 75275 SGD.

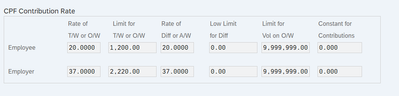

For current OW, Calculation will be based on contribution rates maintain in V_T5R1C.

Employee TW/OW CPF Contribution = /350 = 1200 (from config table V_T5R1C)

Employee DW/AW CPF Contribution = /352 = (/309 * 20%) = (29325 * 20%) = 5865

Employer TW/OW CPF Contribution = /354 = 2220 (from config table V_T5R1C)

Employer DW/AW CPF Contribution = /356 = (/309 * 37%) = (29325 * 37%) = 10850.25

Employee CPF TW/OW Contribution base = /3BA = 21145 SGD.

Employee CPF DW/AW Contribution base = /3BB = 29325 SGD.

Employer CPF TW/OW Contribution base = /3BC = 21145 SGD.

Employer CPF DW/AW Contribution base = /3BD = 29325 SGD.

Employee Limit for TW/OW CPF = /3LA = 1200 SGD. (config table)

Employee Limit for DW/AW CPF = /3LB = 29325 SGD. (AW Ceiling)

Employer Limit for TW/OW CPF = /3LC = 2220 SGD. (config table)

Employer Limit for DW/AW CPF = /3LD = 29325 SGD. (AW Ceiling)

Employee CPF Current contribution/ sum = /305 = (/350+/352) = (1200+5865) = 7065 SGD.

Total CPF Current contribution/ sum = /306 = (/354+/356) = (2220+10850) = 13070 SGD.

Employer CPF Current contribution/ sum = /307 = (/306-/305) = 6005 SGD.

- SAP Managed Tags:

- HCM Payroll,

- SAP Community

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

1H 2024 Product Release

5 -

2H 2023 Product Release

1 -

ACCRUAL TRANSFER

1 -

Advanced Workflow

1 -

Anonymization

1 -

BTP

1 -

Business Rules

1 -

Canvas Report

1 -

Career Development

1 -

Certificate-Based Authentication

1 -

Cloud Platform Integration

1 -

Compensation

1 -

Compensation Information Management

1 -

Compensation Management

1 -

Compliance

2 -

Content

1 -

Conversational AI

2 -

Custom Data Collection

1 -

custom portlet

1 -

Data & Analytics

1 -

Data Integration

1 -

Dayforce

1 -

deep link

1 -

deeplink

1 -

Delimiting Pay Components

1 -

Deprecation

1 -

Employee Central

1 -

Employee Central Global Benefits

1 -

Employee Central Payroll

1 -

employee profile

1 -

Employee Rehires

1 -

external terminal

1 -

external time events

1 -

Generative AI

2 -

Getting Started

1 -

Global Benefits

1 -

Guidelines

1 -

H2 2023

1 -

HR

2 -

HR Data Management

1 -

HR Transformation

1 -

ilx

1 -

Incentive Management Setup (Configuration)

1 -

Integration Center

2 -

Integration Suite

1 -

internal mobility

1 -

Introduction

1 -

learning

3 -

LMS

2 -

LXP

1 -

Massively MDF attachments download

1 -

Mentoring

1 -

Metadata Framework

1 -

Middleware Solutions

1 -

OCN

1 -

OData APIs

1 -

ONB USA Compliance

1 -

Onboarding

2 -

Opportunity Marketplace

1 -

Pay Component Management

1 -

Platform

1 -

portlet

1 -

POSTMAN

1 -

Predictive AI

2 -

Recruiting

1 -

recurring payments

1 -

Role Based Permissions (RBP)

2 -

SAP Build CodeJam

1 -

SAP Build Marketplace

1 -

SAP CPI (Cloud Platform Integration)

1 -

SAP HCM (Human Capital Management)

2 -

SAP HR Solutions

2 -

SAP Integrations

1 -

SAP release

1 -

SAP successfactors

5 -

SAP SuccessFactors Customer Community

1 -

SAP SuccessFactors OData API

1 -

SAP Workzone

1 -

SAP-PAYROLL

1 -

skills

1 -

Skills Management

1 -

sso deeplink

1 -

Stories in People Analytics

3 -

Story Report

1 -

SuccessFactors

2 -

SuccessFactors Employee central home page customization.

1 -

SuccessFactors Onboarding

1 -

successfactors onboarding i9

1 -

Table Report

1 -

talent

1 -

Talent Intelligence Hub

2 -

talents

1 -

Tax

1 -

Tax Integration

1 -

Time Accounts

1 -

Workflows

1 -

XML Rules

1

- New 1H 2024 SAP Successfactors Time (Tracking) Features in Human Capital Management Blogs by SAP

- Automate Recurring Deduction Creation in Human Capital Management Blogs by SAP

- Integrating Azure Data Factory with SAP SuccessFactors Incentive Management via sFTP Connector in Human Capital Management Blogs by SAP

- New 2H 2023 SAP Successfactors Time (Tracking) Features in Human Capital Management Blogs by SAP

| User | Count |

|---|---|

| 15 | |

| 12 | |

| 4 | |

| 3 | |

| 3 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |