- SAP Community

- Groups

- Interest Groups

- Enterprise Architecture

- Knowledge Base

- Solution Selection for Overhead Cost Accounting

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

- Document History

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

09-07-2023 9:32 PM - edited 09-08-2023 9:37 PM

Summary

In this article we describe alternative options of SAP solutions to cover Overhead Cost Accounting.

Business Requirements

Ability to perform cost center accounting and to record and summarize overhead costs by area of responsibility. This also includes the ability to settle and allocate costs and report on these as part of the closing process.

Solution Options

There are mainly two solution options out of the SAP solution portfolio.

- SAP S/4HANA with its application areas in CO: Cost center accounting, cost object controlling etc.

- SAP Profitability and Performance management (PaPM)

Characterization of the Solution Options

SAP S/4HANA Controlling

Controlling is an integral part of SAP S/4HANA Finance. It is not as strictly separated from (general ledger) accounting as in earlier versions of SAP products, as in ECC, but is seen as just another aspect of the general accounting solution. As an expression of that approach there are no separate CO-documents any longer, but aspects of overhead cost accounting are stored in the universal journal like all other accounting document.

Overhead Cost Accounting in SAP help Portal

Overhead Cost Controlling component enables you to plan, allocate, control, and monitor overhead costs. It is an important preparation for a strong profitability analysis, as well as for a precise product costing.

By planning in the overhead area, you can specify standards that enable you to control costs and valuate internal activities.

All overhead costs are assigned to the cost centers where they were incurred, or to the jobs that triggered them. The SAP system provides numerous methods for overhead allocation. Using these tools, you can allocate overhead costs true to their origins. Some of the overhead ("designated overhead") can be assigned with minimum effort to cost objects and in this way converted into direct costs.

At the end of a posting period, when all allocations have been made, the plan costs are adjusted according to the operating rate, and these target costs are then compared against the corresponding actual costs. You can analyze the causes of any target/actual variances to derive further control measures that can be applied to eliminate these variances.

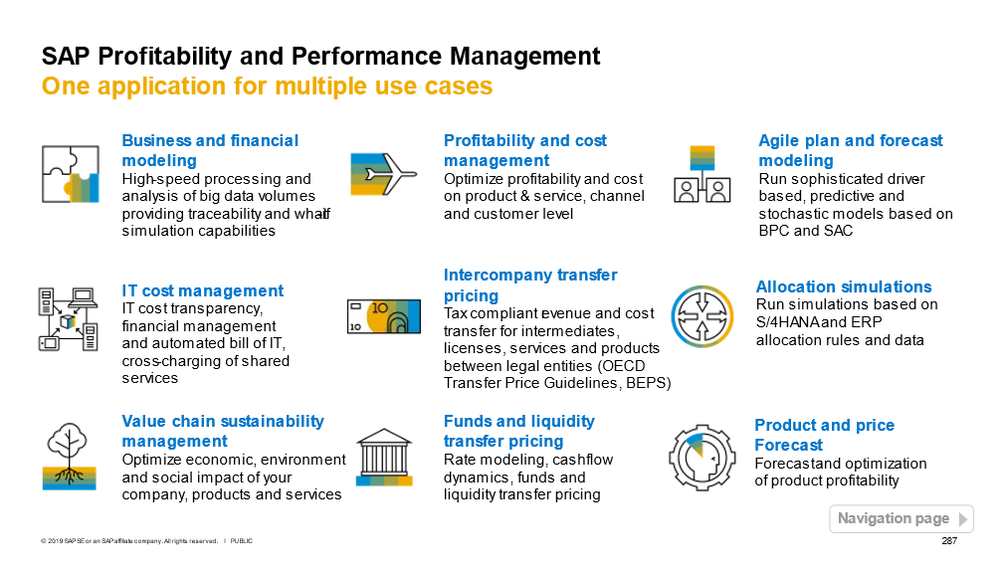

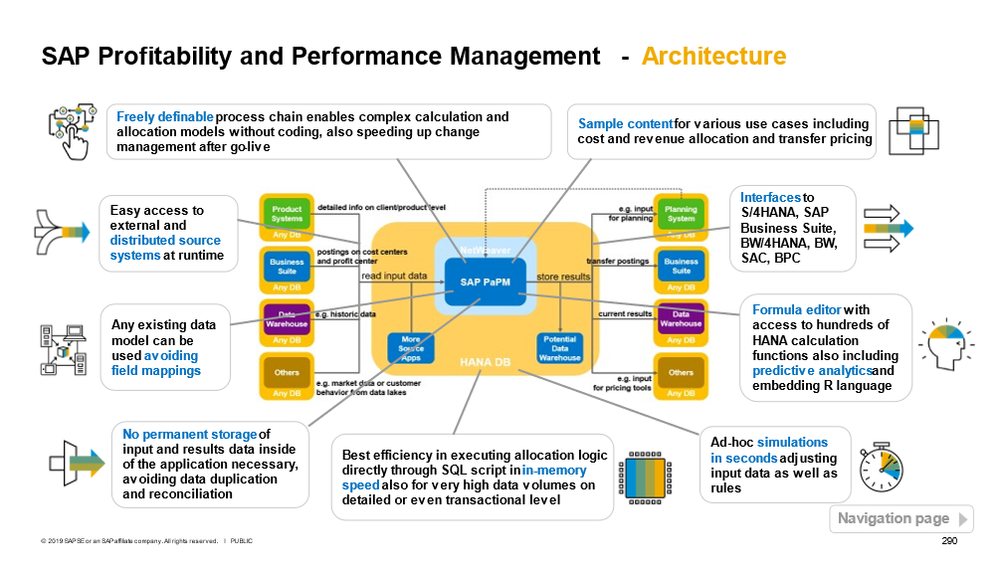

SAP Profitability and Performance Management

SAP Profitability and Performance Management on SAP.com

Amplify your performance and profitability insights. Enable strategic decision-making that can improve the performance of your business and maximize your profitability. Empower business users to make better decisions using advanced business modeling, granular profit and cost analysis, and simulation capabilities in the SAP Profitability and Performance Management solution.

- Cloud and on-premise environments

- Advanced business modeling of complex processes

- Amplified insights with multidimensional profit and cost analysis

- Real-time results, scenario modeling, and simulations

Criteria to determine the most suitable target solution

1. Is the business satisfied with the possibilities overhead cost accounting offered in a predecessor ECC system?

If the answer is yes, probably S/4HANA overhead cost accounting alone is the best option.

In case of no, it has to be said that the capabilities in the area in S/4HANA are not going far beyond what it offered in ECC, and it will also not be much more flexible or more performant. PaPM might be an alternative for some use cases, depending on the requirements that the business raises. This might be the case for instance in service industries with millions of customers and products/services, if allocations should go down to this detailed level. Another driver might be reusing costing methodology in further processes such as transfer pricing.

2. Does the business see the need for more simulations, flexibility and agility?

Both solutions together will offer that. Like for calculations with actual data, simulations in PaPM might provide more flexibility for adjusting application data, cost drivers, as well as calculation rules.

3. Is data to be taken into account coming from different sources?

PaPM offers connectors and data load to multiple sources

4. Are you willing to pay additional license fees?

S/4HANA overhead cost accounting is included without extra fees, while PaPM is licensed extra.

5. Are you willing to manage an additional application environment in the landscape?

PaPM can either be embedded into S/4HANA or BW, can be a separate system on Premise or be used as cloud solution.

S/4HANA Controlling comes as integral part of your digital core, thus needing no extra implementation work or system management.

Conclusion

Many Companies will be sufficiently served with the offerings of S/4HANA for overhead cost accounting, but SAP Profitability and Performance Management offers coverage of attractive additional use cases. If these are desired, usually both solutions would run side by side and cover different scenarios.

- SAP Managed Tags:

- SAP Profitability and Performance Management,

- SAP S/4HANA Finance

- Mark as Read

- Mark as New

- Bookmark

- Permalink

- Report Inappropriate Content

Thank you Udo for posted another insightful Knowledge Base article that people can use as a reference on the topic.