- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Financial Management Series Blog #3: Architecture ...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Organizations around the world are evaluating and moving to SAP S/4HANA Cloud. Sometimes the decisions are driven by the IT department, because of cloud software economics or simplicity of access to the latest innovations. This situation can lead Finance teams to ask: “what’s new or different for us and our financial management processes?”

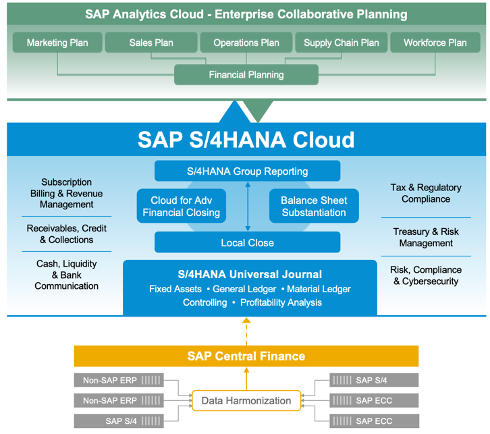

I’ll begin my explanation with a “marketecture” view of S/4HANA Cloud to set the stage, highlighting what’s new in SAP S/4HANA Cloud – you’ll see the graphic is divided into 3 core areas.

Finance in SAP S/4HANA Cloud

At the center, in blue, is SAP S/4HANA Cloud and its financial management capabilities and record-to-report capabilities called out in dark blue.

- The SAP S/4HANA universal journal is the most significant change in financial management. It brings together all dimensions of financial and managerial accounting into each journal line. This not only eliminates the need for reconciliation, but it means that all dimensions are immediately available for analysis. Real-time profitability analysis by product, channel, customer? No problem!

- The second-most significant change to financial management in SAP S/4HANA is that the functionality for corporate-level reporting, including financial consolidation capabilities that eliminate intercompany relationships, and properly account for investments, currencies, and other key financial dimensions, is now part of the core stack. SAP S/4HANA for group reporting provides this functionality without requiring corporate finance teams to export the data into a separate EPM (enterprise performance management) environment. This aligned data model between local and group accountants leads to new collaboration possibilities, which this blog series will cover in the future.

- SAP S/4HANA Cloud for advanced financial closing is SAP’s strategic closing orchestration hub to automate and manage closing steps and programs for optimal efficiency. SAP Account Substantiation and Automation by BlackLine rounds out the automation support for manual account-balance substantiation activities done by accountants at period-end, so that they can focus their time on reviewing the highest-risk accountants.

- Surrounding these core capabilities which support the record-to-report process, SAP S/4HANA Cloud has modular functionality which can be easily adopted to meet advanced requirements in the areas of services businesses (for example subscription management including real-time revenue recognition), or additional capabilities for finance operations teams that manage receivables and payables, cash and treasury capabilities, tax and risk and compliance capabilities.

The next area that is critical for finance teams to consider is shown in green; advanced analytics are provided by SAP Analytics Cloud (SAC). Again, this is a significant departure from SAP’s legacy architecture which usually included the replication of data into an on-premise Business Warehouse. Dashboards were built on this replicated and aggregated data, leading to outdated reporting with limited drill-down capabilities. SAP S/4HANA Cloud takes advantage of the significant evolution of data storage and processing capabilities seen in the last decade. Instant data availability and analytics that run on all devices mean that your business users always have access to the latest steering data.

- While role-specific dashboards are provided by SAP S/4HANA Cloud based on real-time data, advanced modeling is provided by SAC.

SAP Analytics Cloud

- SAC has predictive and scenario-modeling capabilities, as well as artificial intelligence-driven insights for finance teams.

- Business content and SAC stories for financial planning are available so that finance teams can quickly create plans with links to other operational plans.

- SAP’s strategy mandates that all advanced analytical capabilities will be delivered with SAP Analytics Cloud – these capabilities will not be made available in on premise releases.

Finally, the golden area at the bottom of the marketecture shows how SAP S/4HANA for central finance can help larger, more complex companies move to SAP S/4HANA Cloud. Some organizations take a finance-first approach to moving to S/4HANA Cloud, private edition, while others require a separate finance-led platform for additional divisional reporting needs – and this particular capability provides an interface to other ERP systems or logistical systems. SAP S/4HANA for central finance is a key adoption path to SAP S/4HANA Cloud, private edition.

No other enterprise software provider has more than SAP’s 50 years of accounting experience, and the latest solution release, SAP S/4HANA Cloud is delivering key benefits to our customers, including:

- Access to best practice content based on our experiences running businesses in countries around the world

- Innovations delivered on a semi-annual basis without the disruption of major upgrade projects

- Modular approaches to record to report, allowing customers to adopt optimization engines as they need to address business challenges.

Specifically for finance teams, SAP S/4HANA Cloud delivers:

- Embedded legal valuation – support for international and local accounting standards

Multinational corporations have the challenge of meeting the requirements of potentially dozens of GAAPs simultaneously. The SAP S/4HANA universal journal supports these requirements from a single journal, with optimized data storage to support flexible reporting.

- Reduced labor cost – process automation via artificial intelligence

SAP S/4HANA Cloud has embedded the latest technologies in our processes so that companies do not have to integrate multiple AI solution providers. Dozens of intelligent robotics process automation (iRPA) bots have been delivered for record-to-report, leveraging stablepre-defined integration points in the sub-processes, for example for journal entry postings. Additionally, compliance features and controls are built into processes to reduce manual control activities.

- Scale to meet growing business needs – reduced need for period-end manual operations and adjustments

Let’s take revenue recognition, for example. Whether the sales process begins with a single sales order, contains multiple elements, or is a solution order comprising products and services, the evaluation of fair value and revenue recognition postings are built into the process. When finance teams evaluate moving to subscription models, they know their processes will scale.

In my next blog, I’ll address how finance teams are specifically benefitting from SAP S/4HANA Cloud for better managing their intercompany processes.

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA,

- SAP S/4HANA Finance,

- SAP S/4HANA Public Cloud

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

27 -

Expert Insights

114 -

Expert Insights

181 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,682 -

Product Updates

261 -

Roadmap and Strategy

1 -

Technology Updates

1,500 -

Technology Updates

97

- SAP Activate Realize and Deploy phase activities in the context of Scaled Agile Framework in Enterprise Resource Planning Blogs by SAP

- Why YCOA? The value of the standard Chart of Accounts in S/4HANA Cloud Public Edition. in Enterprise Resource Planning Blogs by SAP

- Packaging Agreements Collaboration : From the lens of User Experience Design in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Service in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Research and Development in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 10 | |

| 6 | |

| 5 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 | |

| 2 |