- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by SAP

- “Mind the Gap” – Improves ROI, Cost & Margin by Me...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

SAP Integrated Business Planning (IBP) as part of the XP&A process

Dr. David Paynter & Jay Foster

The expression "Mind the Gap" was initially recorded by Oswald Laurence over 50 years ago and broadcast continually to passengers boarding London's tube trains across the entire tube network. The “gap” being referenced was the difference in height between different train operators sharing the station. The biggest “gap” arose when the boarding platforms were necessarily built on a curve and the trains, being straight, enlarged the “gap”. Fifty years of continual aural reminders have indelibly imprinted that reminder on all passengers who now instinctively know to "Mind the Gap."

How can we achieve the same crisp focus in our businesses to “Mind the Gap”?

The “gap” in today’s business environment is the difference between the company’s financial plan and the current operational plan.

The company’s financial plan is a representation of the aspirational direction of the company’s strategy. The operational plan is a representation of the constrained realities of resource availability. These two plans must be aligned to achieve the company’s financial goals and objectives. Let’s break down the operational planning processes based on the Oliver Wight Methodology and see how we can “Mind the Gap.”

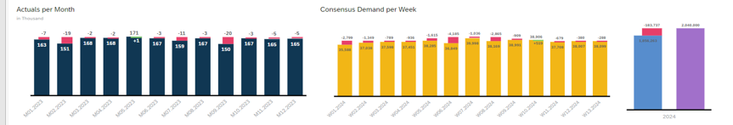

Leveraging SAP’s unified planning platform for operational planning, Integrated Business Planning (IBP), it is possible to show gaps in historical performance as well as gaps between the operational forecast and the financial business targets over the relevant planning horizons, fiscal year projections for finance and longer-term operational horizons. The operational plan is based on the balance between the forecast by the sales team to “Mind the Gap” between the company revenue plan and the sales revenue plan and the operational team that “Minds the Gap” between the revenue plan and the constrained realities in resources and materials.

How can we “Mind the Gap” across all areas of the business?

The business process known as Integrated Business Planning as defined by the Oliver Wight company consists of 5 steps or phases; Portfolio Review, Demand Review, Supply Review, Reconciliation Review and Management Business Review – each of which has their own distinct set of KPIs and business activities which can be set up and managed in SAP IBP to provide clear definition to “mind the gap” in volumetric and financial performance against target.

How to “Mind the Gap” in Product Review?

“Gaps” arise when a product in a portfolio has an underperforming contribution margin and delivering a return on investment below the ROI of the average of all products in the portfolio.

Products enter a product portfolio based on a business case to deliver a return on the investment in product development (ROI) over the life of the product. Hence, to “mind the gap”, the margin delivered on a product needs to be measured to assure that the business case is met, and if not, then action is required. Given that the margin needs to cover both direct and indirect costs of production, there is a point in the lifecycle where the net return delivered by a product goes negative and it is financially better for the firm to bring an end to the product life. Hence, the financial health of the business depends on “mind the gap” on products that have a negative net return.

Product Review and portfolio management is normally considered the realm of marketing and product. Decisions made around what product to invest in, what product to have in the portfolio and what product to retire, has a direct impact in terms of return on investment (ROI) of the business – products with low ROI reduce the overall business ROI. Bringing overhead cost recovery across from SAP Analytics Cloud (SAC) into IBP enables all product/product families to be reviewed and ranked by their net margin contribution each month.

In this way, Product Teams can review real-time how to evolve the product portfolio in the forthcoming months to continuously improve portfolio ROI. Actions to close the gap can be prepared as scenarios in SAP IBP.

How to “Mind the Gap” in Demand Review ?

“Gaps” arise when there is a difference between top-down revenue and margin targets from financial planning and bottom-up consensus demand realities.

Targeted or forecast demand for products is based on balancing customer requirements (sales) against the resources of the business to deliver that requirement (capital and operating expenses). Hence, to “mind the gap”, the sales volume needs to be measured against the sales forecast to assure consistency. Furthermore, forecast error needs to be measured as a “gap” that drives reduced financial performance and delivered margin. Forecast error from under-forecasting sales drives extraordinary expediting expense and error from over-forecasting drives increased working capital investment for inventory, both of which eat into margins.

Demand review differs from a sales meeting. The primary purpose of Demand Review is to define and determine the company's operational commitment to customers and to “Mind the Gap” to company targets for revenue and margin. Unfortunately, Demand Reviews too often focus on sales reviews and top line revenue, at the expense of forecast accuracy thus driving additional costs in the operational side of the business, reducing margins and ROI. Optimal business financial results can be achieved by “Minding the Gap” on forecast accuracy, forecast bias, sales overs/unders and margin to targets. Actions to close the gap can be prepared as scenarios in SAP IBP.

How to “Mind the Gap” in Supply Review ?

“Gaps” arise in supply when there is a difference between the financial budgets set for the business and the operating and capital expenditure used to achieve the desired top line target.

To deliver customer requirements, production capacity needs to be planned. Production capacity requires capital and labor, both of which take time to acquire at the lowest reasonable cost. Furthermore, to isolate supply from demand volatility, investment in inventory (working capital) is required. Hence, to “mind the gap” in supply, operating expenses, working capital, network load smoothing and capacity utilization needs to be measured against targets.

Supply Review, takes the outputs of the Demand Review and puts in place a plan to deliver what is required by the market at the lowest reasonable operating expense and capital expense This is where the consistency and accuracy of the demand plan makes the difference in profitability of the business and where ROI is impacted – Investment made in plant and equipment needs to be recovered by the margin on the products made and sold.

Long-term insight provided by the statistical forecasting developed in the demand review, provides the supply review with the insight into what future capacity will be required. Rough cut capacity planning performed in SAP IBP identifies where future capital expenditures may be required or where soft demand suggests older equipment could be removed from service and/or refurbished. The focus of supply review is to minimize the operating expenditure by using standard time instead of overhead time, reduction in waste, use of standard transportation, and more cost-effective procurement. Optimizing the level of investment required to meet customer demand improves business ROI. Actions to close the gap can be prepared as scenarios in SAP IBP.

How to “Mind the Gap” in Reconciliation Review?

“Gaps” arise in the reconciliation review phase when all contributors in the planning process are not in agreement with the plan, options, challenges, recommendations and required decisions prior to the Management Business Review Meeting.

All too frequently, failure to monetize the operational plan leads to sub-optimal performance against revenue, profit and investment targets which all have negative downstream effects. Plans created, recommendations made, alternatives proposed, and decisions made without integrating financial implications of each means decisions are made based on what can be done, not what should be done. “Minding the Gap” in the Reconciliation Review phase of Integrated Business Planning means ensuring that the financial implications of all alternatives are adequately and correctly represented.

How to “Mind the Gap” in Management Business Review

“Gaps” arise in the Management Business Review when there is a difference between the financial targets set by the shareholders for the business and the earnings and ROI delivered by the operating team of the business.

Profit, the difference between sales revenue and the expenses to run the business at a level of ROI that exceeds comparable investment options, is the key deliverable of all product making businesses. Hence, to “mind the gap” in Management Business Review, real-time performance of product, demand and supply needs to be measured against their respective financial targets, as above, and where targets are not being met, investment options to “close the gap” need to be compared in order to correct the course of the business at the best possible ROI.

Management Business Review brings the monthly cycle to a close. Scenarios put forward by each of the separate product, demand, and supply reviews, are assessed from a financial perspective towards achieving what the business has committed to customers, the ownership of the business, and ultimately to the capital markets. It is in the Management Business Review that all gaps with financial and operational implications are assessed. Commitments and decisions are made around investment (products, promotions or plant) to close those gaps. SAP IBP and SAP Analytics Cloud together provide visibility of the gap. “Mind the Gap” enables the continuous monthly improvement in the financial operational performance of the business and ensures that the business ROI exceeds the ROI of alternate investment for investors.

How is XP&A different to IBP?

XP&A as a process “Minds the Gap” for Financial Planning and Analysis by representing operational planning considerations in financial terms projecting the impact on the profit and loss statement and the balance sheet. More specifically XP&A provides financial flow ‘timing’ that relates to the recognition of revenue and the timing of expenses and ultimately the predicted, balance sheet and cash flows for the business as a whole for the financial reporting.

SAP IBP and SAC working together, provides the most robust financial and operational planning landscape for the business based on real numbers from sales and operational experts from shop floor to the top floor.

How do you “Mind the Gap”?

- SAP Managed Tags:

- SAP Analytics Cloud,

- SAP Integrated Business Planning for Supply Chain

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Business Trends

169 -

Business Trends

24 -

Catalog Enablement

1 -

Event Information

47 -

Event Information

4 -

Expert Insights

12 -

Expert Insights

46 -

intelligent asset management

1 -

Life at SAP

63 -

Product Updates

500 -

Product Updates

67 -

Release Announcement

1 -

SAP Digital Manufacturing for execution

1 -

Super Bowl

1 -

Supply Chain

1 -

Sustainability

1 -

Swifties

1 -

Technology Updates

187 -

Technology Updates

18

- SAP Best Practices for SAP Integrated Business Planning for Supply Chain – 2405 in Supply Chain Management Blogs by SAP

- RISE with SAP advanced manufacturing package in Supply Chain Management Blogs by SAP

- SAP Business Network for Logistics 2404 Release – What’s New? in Supply Chain Management Blogs by SAP

- SAP Named a Leader in the 2024 Gartner Magic Quadrant for Transportation Management Systems in Supply Chain Management Blogs by SAP

- Adverse Media Monitoring: How to improve overall Supply Chain Management in Supply Chain Management Blogs by Members

| User | Count |

|---|---|

| 6 | |

| 4 | |

| 3 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |