- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- SAP Document and Reporting Compliance - 'Colombia'...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This blog offers insights into the contingency process feature within the SAP DRC Colombia solution and details the steps required for setting it up.

Occasionally, users encounter difficulties submitting eDocuments to the Colombian tax authorities (DIAN) owing to technical glitches within the system or communication errors. These issues may arise from the electronic bill issuer's end or from DIAN itself, resulting in the unsuccessful submission of eDocuments.

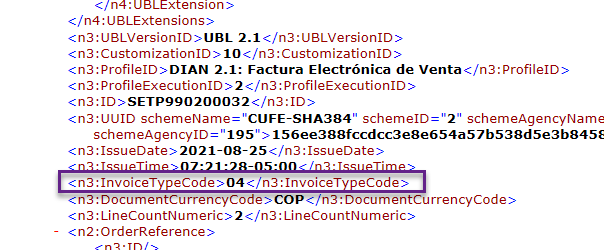

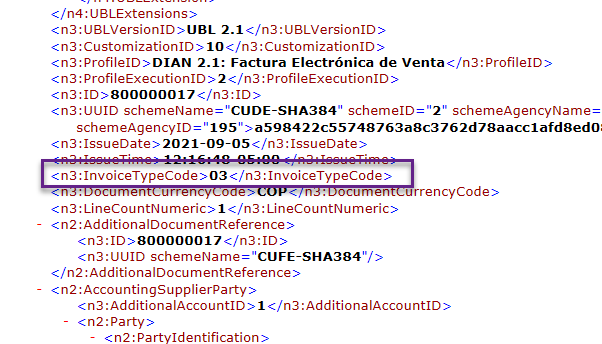

The different types of contingencies are distinguished based on the '<InvoiceTypeCode>' tag. The value 03 represents contingency due to technical issues on the electronic bill issuer's side, and 04 represents contingency due to technical issues on DIAN.

DIAN Contingency - Tipo - 04

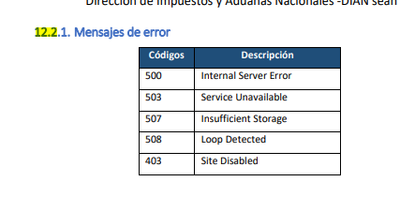

Technological problems generated by DIAN for the prior validation of electronic invoicing. Electronic billers can set up this contingency process when one of the following error messages are received from DIAN.

Error Handling: If an error (specifically mentioned in section 12.2.1) is detected when transmitting an electronic sales invoice, the invoice must be re-transmitted to DIAN 20 seconds after the error is detected. If the error persists after three attempts (one minute after the first attempt), the invoice should be issued directly to the buyer without prior validation from DIAN.

Error Documentation: Providers must maintain records of the errors encountered as specified in section 12.2.1.

Figure 1.1 - Possible error codes during DIAN Contingency

Follow the link to DIAN documentation for more information.

Invoice Generation with Errors: In case of persistent technological issues, invoices should be issued with an InvoiceTypeCode of 04, maintaining the same prefix and number, and should be re-signed and delivered without DIAN’s validation response.

Monitoring DIAN Services: Providers should monitor DIAN’s electronic billing web services 30 minutes after an error is first reported to check if the service has been restored. Monitoring should continue until the service is fully operational.

Post-Recovery Actions: Once the DIAN service is active again, providers should generate, transmit, and issue electronic documents normally.

Reporting Timeline: Electronic billers have 48 hours to report to DIAN any invoices issued due to technological issues once they verify that DIAN's services are operational.

Electronic Bill Issuer Contingency - Tipo -03

Technological problems at electronic bill issuer system. If a technical problem prevents you from sending eDocuments to DIAN, you define in Customizing that all eDocuments are created in contingency mode.

The steps outline procedures for electronic billers to follow during technological issues in the issuer system:

Issuing Invoices During Contingency: If there are technological problems, billers should issue sales invoices manually or through electronic systems, using either booklet or paper formats.

Communication of Issues: Billers must draft a letter detailing the technological issue or its resolution, signed by the company’s legal representative. This letter should be sent to a specified email address, with certain required details in the subject, attachment, and body of the email.

Post-Issue Procedures: Once the technological issue is resolved, billers should resume normal operations of generating, transmitting, issuing, and receiving electronic documents.

Documentation and Notification: During the contingency period, information from manually issued invoices must be transcribed into an electronic transmission document. Notifications of acceptance or rejection from DIAN (the tax authority) will follow within 48 hours of resolving the issue.

Specific Documents Without Contingency Plans: CreditNote, DebitNote, and ApplicationResponse documents should not use contingency numbering but instead follow the established numbering by the biller.

For further information about this type of contingency, please refer to the DIAN documentation link.

SDC Colombia Contingency Process setup:

When an eDocument submitted from edoc cockpit and if it results in one of the below statuses, then the documents are must be processed in DIAN contingency mode (InvoiceTypeCode - 04) / Electronic Bill Issuer contingency mode (InvoiceTypeCode - 03) :

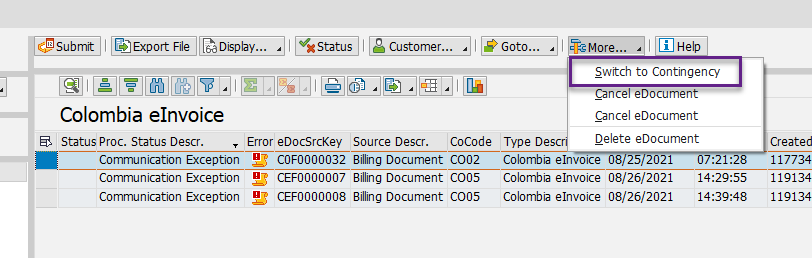

Communication Exception Status in EDOC Cockpit

This situation occurs when there is a communication issue at DIAN, and the document does not reach its system. You can perform the following steps to complete the process:

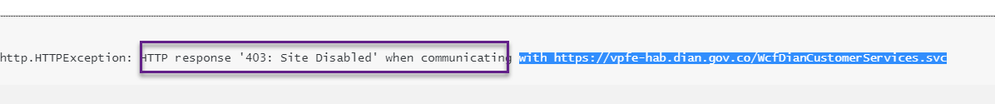

- Validate if the error messages received from DIAN is one of the following

If you are not able to see the error code in the application log or interface log in the cockpit, you must check it in the CPI logs; here is an example screenshot-

If you receive the message "Time out" while transmitting electronic documents, it is a declared delay in the DIAN system, you should attempt again after two minutes, if the error persist attempt four times more each two minutes, if the problem persist in spite of the five attempts, it is declare the contingency type 04, you should keep the evidence of the delay in the DIAN services.

Steps to be followed for DIAN Contingency mode:

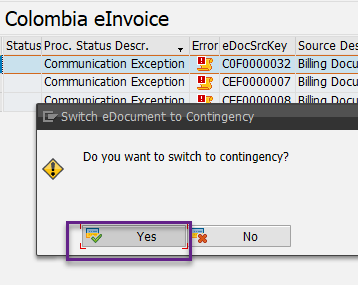

- Select the eDocument with the status 'Communication Exception' and choose the 'Switch to Contingency' action

- Choose Yes in the next dialog box.

- The status changes to 'Switched to DIAN Contingency'

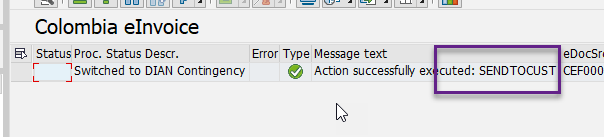

- Send an electronic invoice to the customer without validations from DIAN

- Select eDocument and choose Customer-->Send to Customer option

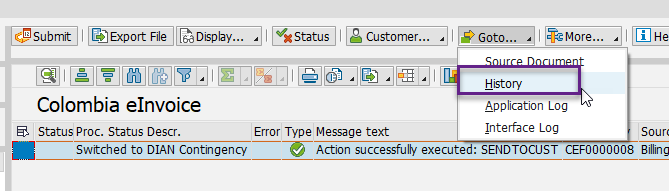

The system allows sending email to customer in this situation; you can confirm this in the History section

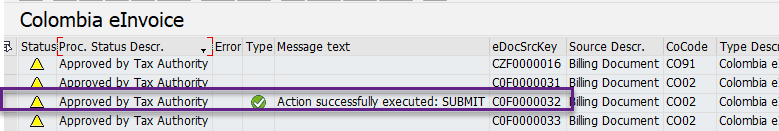

Once the technological issues are resolved on DIANs side you must submit the edocument again and DIAN performs the validations, Approves and Rejects the edocuments.

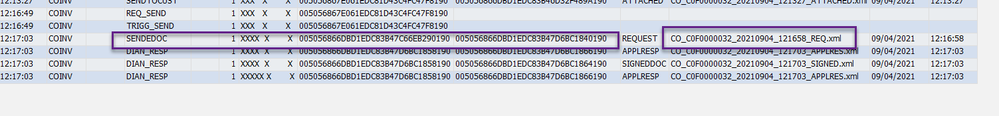

The resubmitted document must have the InvoiceTypeCode 04. The History section of the edocument can show this.

Sending to DIAN requested

There is a technical issue in the electronic invoice issuer system, and the eDocument cannot be sent to DIAN. If the issue cannot be resolved quickly, you can switch the eDocument to contingency. After that, you manually reverse/cancel the source document related to this eDocument in the source application.

Note:

- If the issue is related to data and can be resolved easily, switching to the contingency mode is unnecessary. Correct the data and resubmit the data again.

- You must have prenumbered forms approved by DIAN

Steps to be followed for Contingency at the invoice issuer's System:

Once you identify the technological issues in the system that cannot be solved quickly, follow the steps to create eDocuments in contingency mode (Electronic bill issuer contingency - 03)

- Choose the eDocument with the status 'Sending to DIAN Requested' and select 'Switch to Contingency' action

Choose Yes in the next dialog.

Status of the eDocument changes to 'Switched to Contingency'

Cancel the Invoice

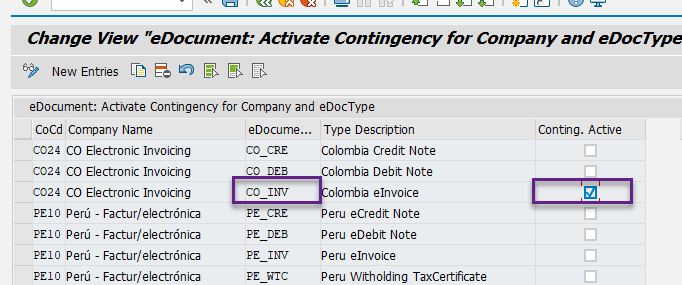

Perform the configuration to allow the creation of the eDocuments in contingency mode

In the source applications, you create new documents for the eDocument you have switched to contingency. Before posting the documents, you enter the number of the prenumbered document you used for the contingency documents:

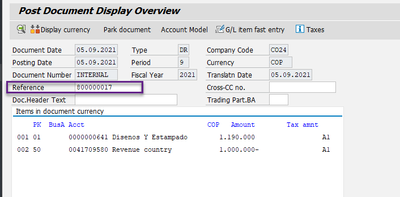

- For FI documents, you enter the number of the prenumbered form in the Reference Number field of the new source document.

- For SD documents, you enter the number of the prenumbered form in the Reference field of the new source document when you are creating the sales order (VA01 transaction)

- Example:

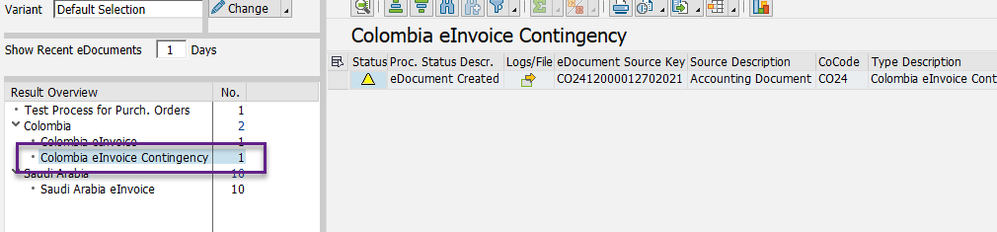

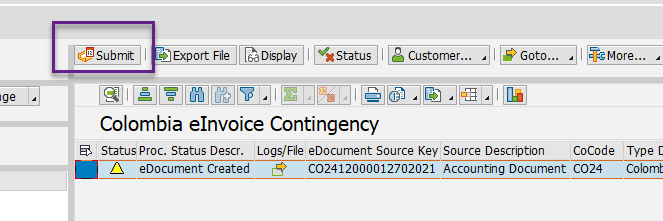

- The newly created eDocument will be seen in the 'Colombia eInvoice Contingency' process in cockpit

- Once the technological issues are resolved, submit the eDocuments

- Note: The InvoiceTypeCode will be 03.

- Note: The InvoiceTypeCode will be 03.

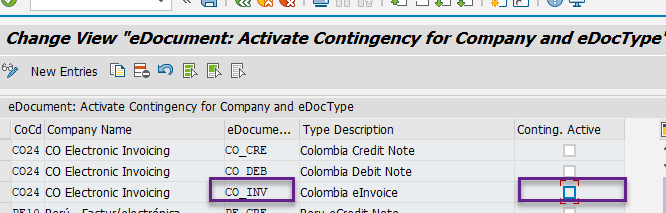

- Reverse the contingency configuration to allow the creation of the eDocuments normally

- After reversal, the configuration appears as below:

In summary, effectively managing the contingency processes within the SAP DRC Colombia solution is crucial for maintaining compliance with DIAN regulations during technological disruptions. This blog has explored the necessary steps and considerations for setting up and navigating through contingency modes, whether the challenges arise from the electronic bill issuer's end or directly from DIAN.

Understanding the differentiation between 'InvoiceTypeCode' 03 and 04 helps in pinpointing the origin of the issue and deciding the appropriate response strategy. The outlined procedures ensure that, even in the face of technological difficulties, businesses can continue their operations by issuing invoices in contingency modes and maintaining necessary documentation for compliance and verification.

As technology evolves and challenges emerge, staying informed and prepared to handle such issues with the appropriate contingency plans will safeguard the integrity of electronic document transactions and support uninterrupted business operations.

- SAP Managed Tags:

- SAP Document and Reporting Compliance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

105 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

70 -

Expert

1 -

Expert Insights

177 -

Expert Insights

336 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

GraphQL

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

14 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,575 -

Product Updates

378 -

Replication Flow

1 -

REST API

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,872 -

Technology Updates

468 -

Workload Fluctuations

1

- Currency Translation in SAP Datasphere in Technology Blogs by Members

- SAP Datasphere + SAP S/4HANA: Your Guide to Seamless Data Integration in Technology Blogs by SAP

- Hack2Build on Business AI – Highlighted Use Cases in Technology Blogs by SAP

- 10+ ways to reshape your SAP landscape with SAP Business Technology Platform – Blog 4 in Technology Blogs by SAP

| User | Count |

|---|---|

| 18 | |

| 12 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 6 | |

| 6 | |

| 6 | |

| 6 |