- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Retention Process

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member60

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-27-2019

9:24 AM

What is Retention Process?

Retention process is Holding back a portion of payment to vendors who works for your organization.For example, the retention amount is released to the vendor when certain expectations are met or on a specified date that your vendor has agreed upon.

An organization can have an agreement with the vendor that a certain percentage or amount will be retained from the total amount that needs to be paid to be vendor. The agreement can have a retention date on which the help back amount will be paid to the vendor or when certain expectations are attained.

The Purpose of this Blog is to Explain the SAP flow of the Retention process.

Functionality that needs to be activated is : LOG_MMFI_P2P via tcode SFW5.

Customization:

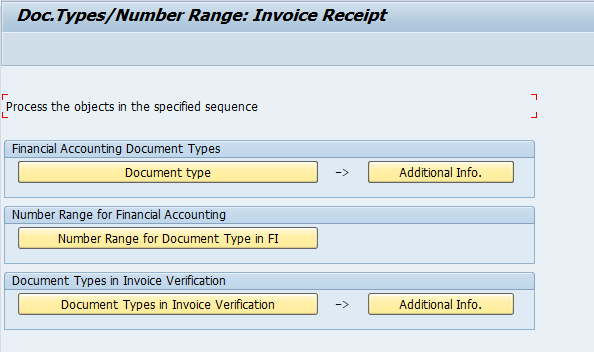

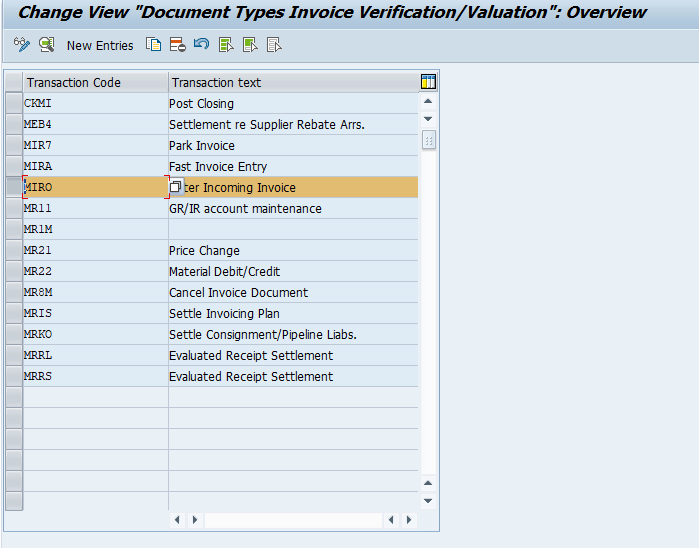

A new document type needs to be created for the retention process.

Tcode - OMR4.

Click on "Document types in Invoice Verification" tab.

Select the "MIRO" transaction code line and display its details.

The tab highlighted in yellow is where we maintain the document type for Retention process which will then flow while we are Invoicing the Purchase order.

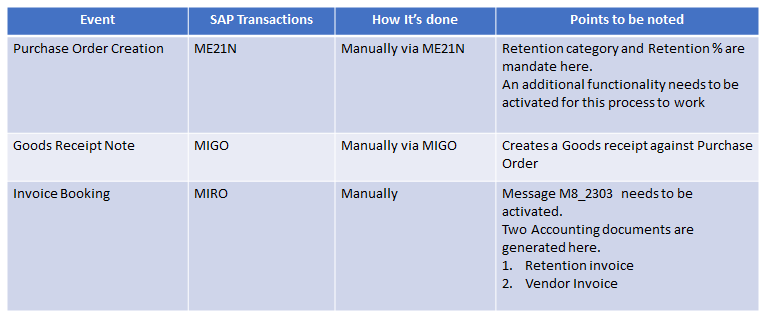

The Steps to be done in SAP are given below:

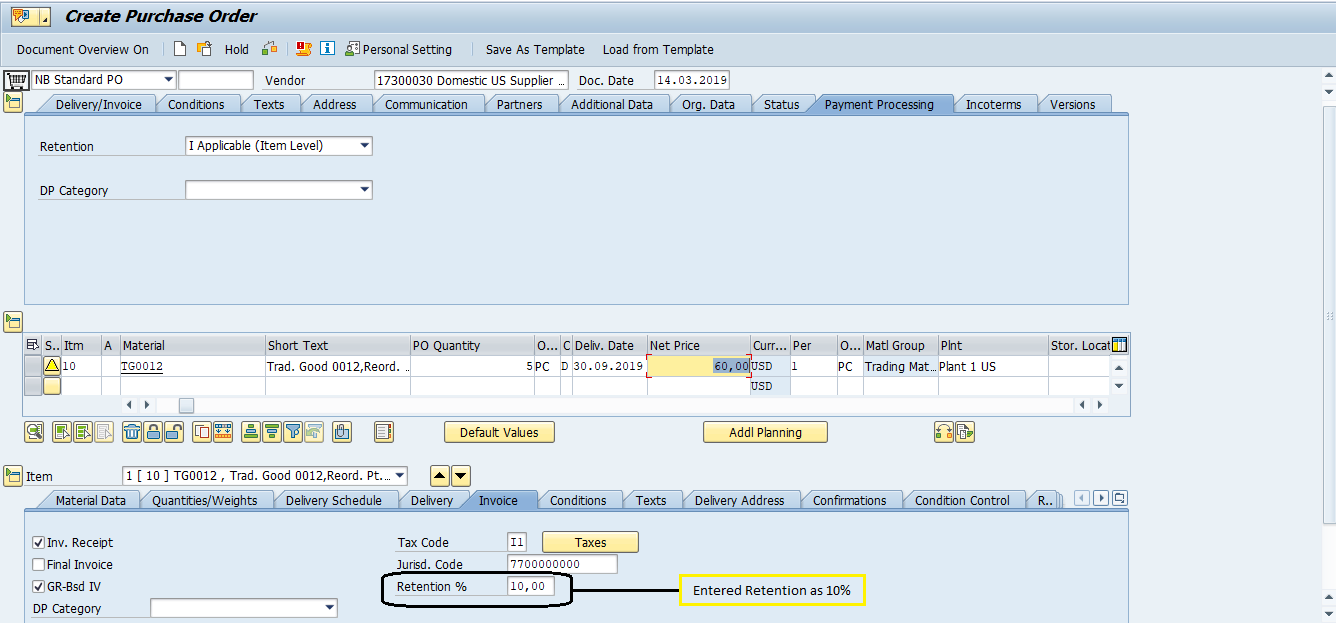

Create Purchase order.

Tcode – ME21N

Enter all the relevant details such as Material, Quantity, Unit Price, Plant, Vendor and Retention category.

We will enter 10% as retention.

Save the Purchase order.

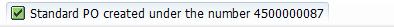

PO 4500000087 has been created.

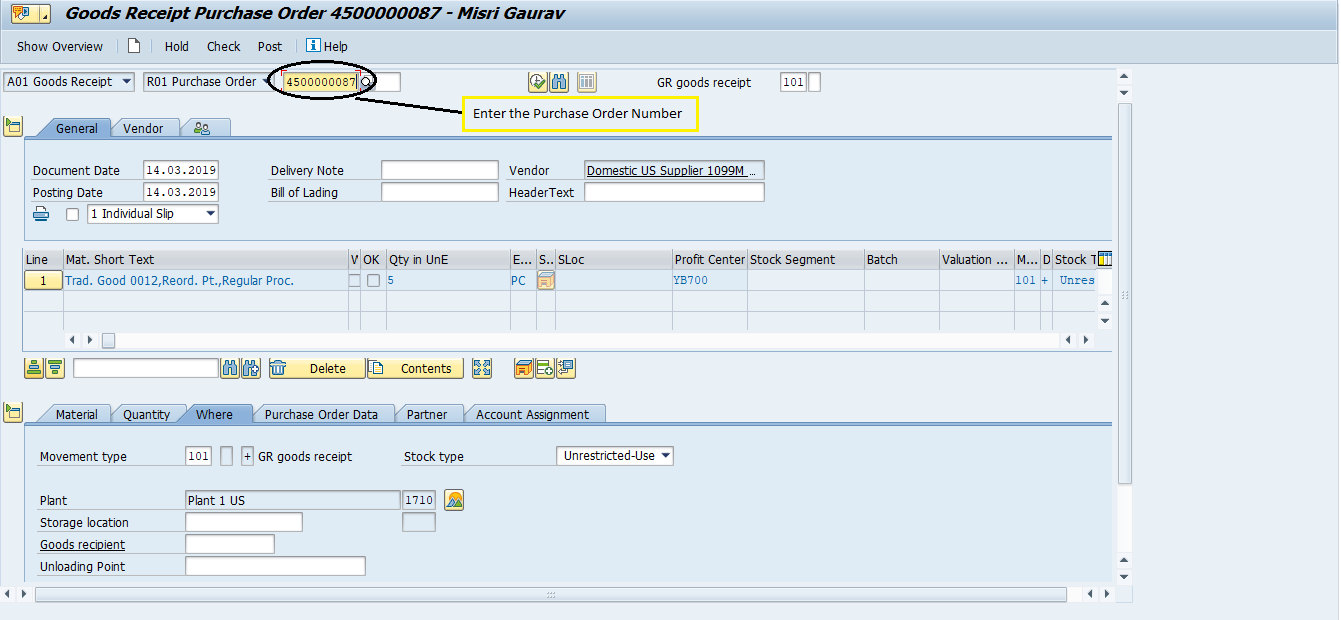

Create GRN.

Tcode – MIGO

Enter the Storage location and tick on “Item OK” icon.

Click on “Post“ icon to Post the GRN.

GRN 5000000164 has been created.

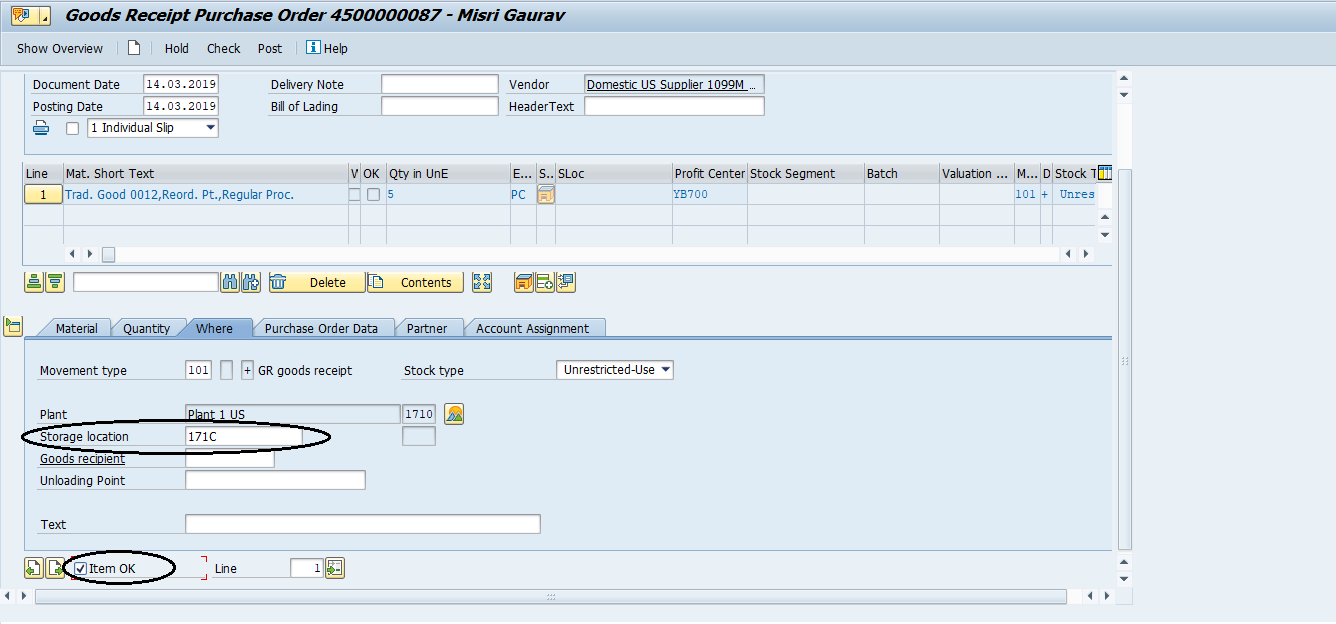

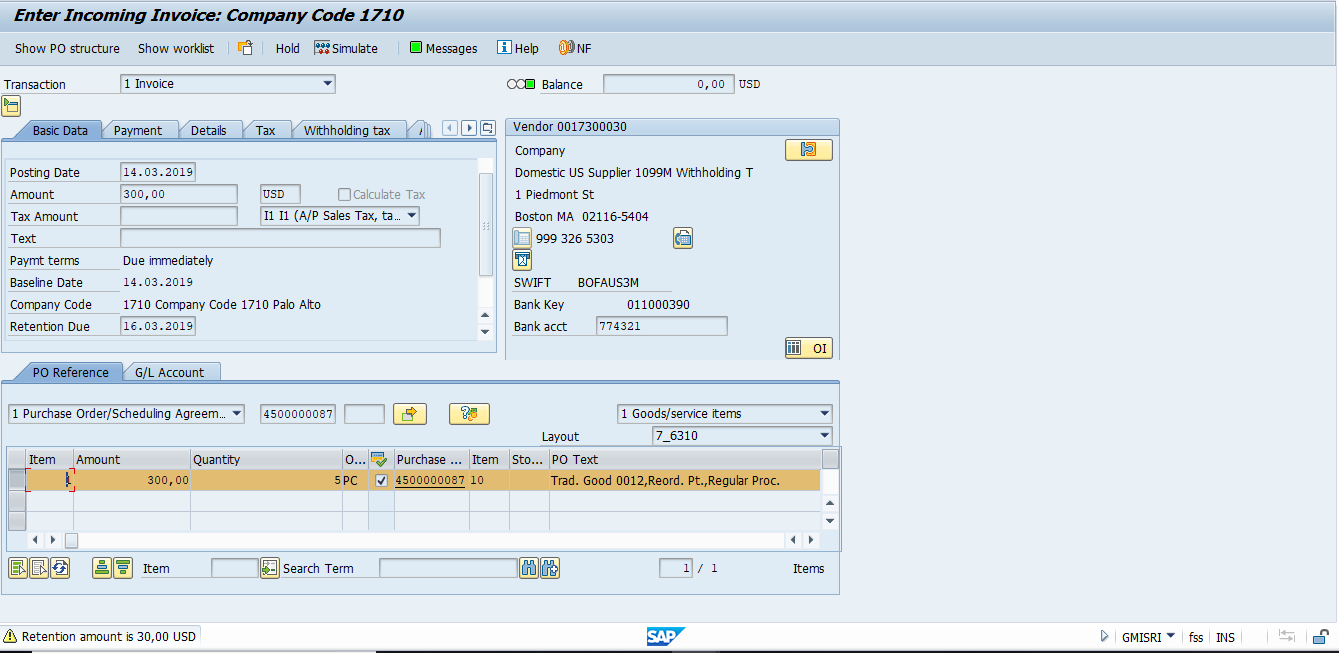

Book the Vendor Invoice

Tcode – MIRO

Enter the PO Number, Invoice date and reference field and hit Enter.

Enter the Amount, Retention due date and Hit Enter.

Click on “Messages” icon to view the message log.

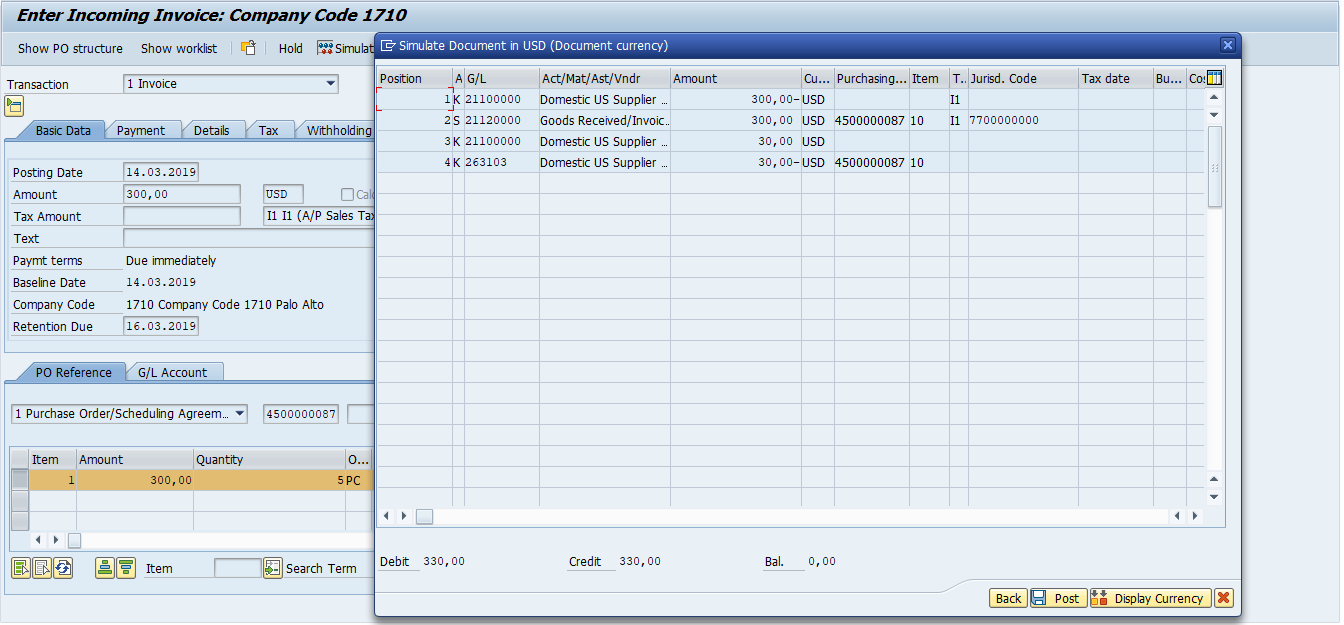

Click on the “Simulate” icon

Hit Enter

Click on the “Post” icon to book the Invoice.

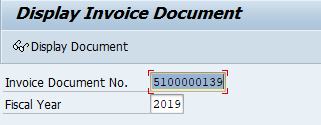

Document 5100000139 has been created.

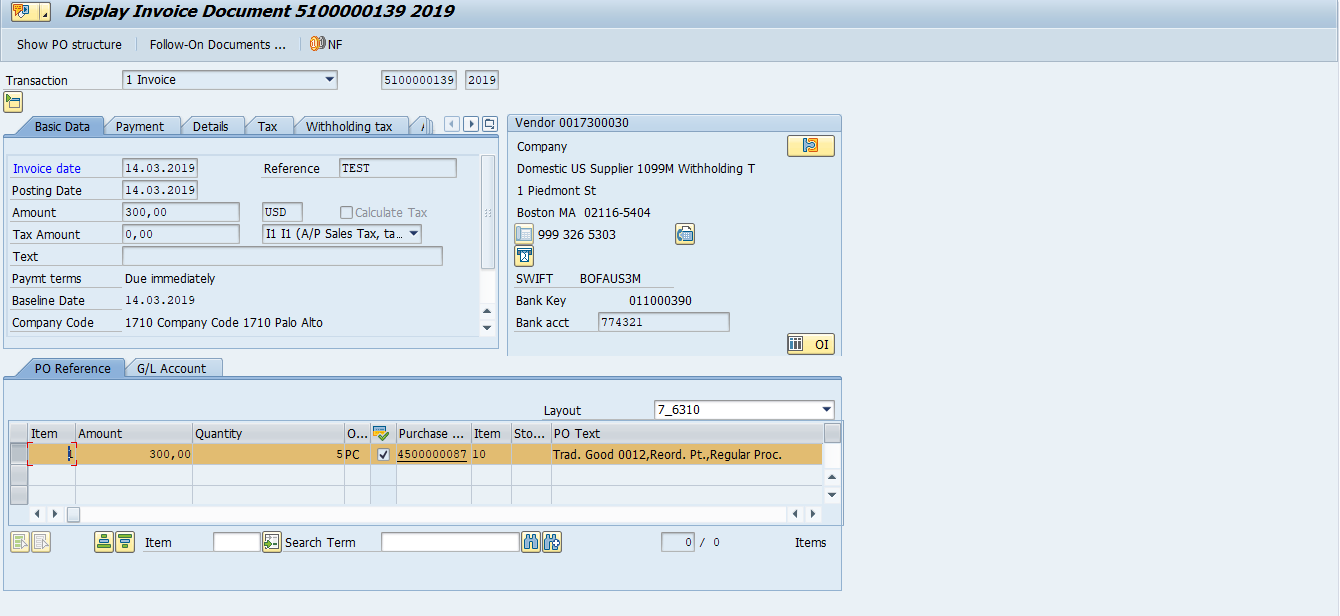

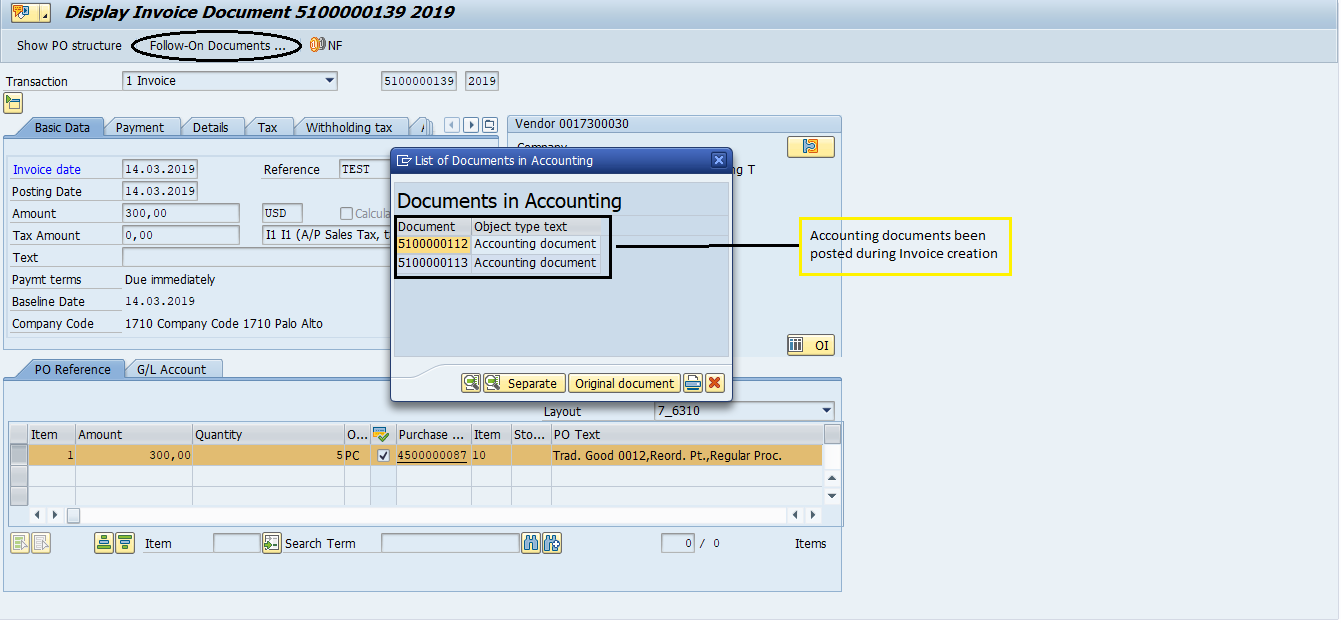

Display Invoice document to check for the GL accounts that are hit in Retention process.

Two accounting document will be generated :

1. Original vendor invoice

2. Retention amount invoice.

Tcode – MIR4

Enter the Invoice document and Fiscal year.

Hit Enter

This is the document we just posted via MIRO.

Click on Follow-On documents icon.

We have got 2 Accounting documents been generated here.

The screenshot given below is the subsequent accounting entries for Accounting document 5100000112.

Subsequent accounting entries for Accounting document 5100000113.

Note - Payment to vendor can be done via Tcode F-53.

Conclusion :

- LOG_MMFI_P2P functionality needs to be activated.

- Message M8_2303 needs to be activated.

- A special G/L indicator needs to be created for Retention process so that correct G/L accounts will be hit from the FI side.

- Two Accounting entries will be generated after booking the Invoice.

- Retention percentage and category in the PO and Retention due date in MIRO are a mandate.

I hope you liked the blog, and if you have any suggestions or questions please let me know.

- SAP Managed Tags:

- SAP Supply Chain Management,

- MM Purchasing

23 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

POSTMAN

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP CI

1 -

SAP Cloud ALM

1 -

SAP CPI

1 -

SAP Data Quality Management

1 -

SAP ERP

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Periodic LSMW or RPA? in Enterprise Resource Planning Q&A

- Project Task wise Approval Set up in the purchase order in Enterprise Resource Planning Q&A

- Manage Customer Consignment pick up with Advance Returns in Enterprise Resource Planning Q&A

- Understand Upgrading and Patching Processes of SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Preferred Success Round Table Discussion with SAP Customers on 29th April @ SAP NOW India. in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |