- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- NF-e Technical Note 2019.001 v1.62: New Fields Add...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hello, everybody

The Brazilian government has published technical note 2019.001 v1.62-SEFAZ, which provides for the inclusion of fields for presumed credit information and the addition of a fiscal benefit code for base reduction within CST 51 (Tax Situation Code 51), when there is accumulation with deferment, as well as the creation and updating of validation rules. Click here for the Portuguese version.

In this blog post, we will cover the following topics available for SAP S/4HANA and SAP ERP:

- Updates related to the new and changed fields.

- Relevant SAP Notes for this legal requirement.

New fields added to the system

New table and fields for presumed credit information

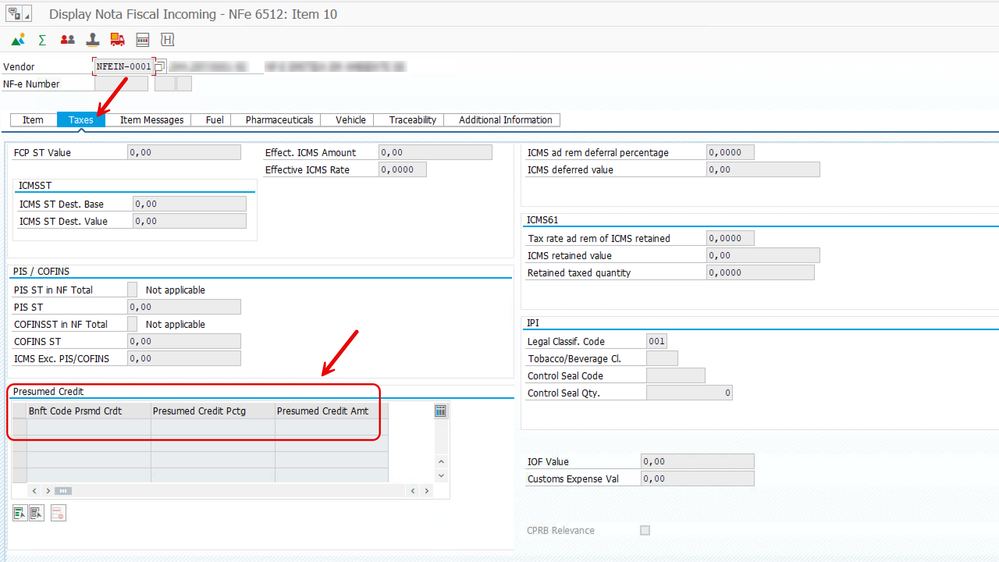

To meet this legal requirement, the new fields State Fiscal Benefit Code of Presumed Credit (C_CRED_PRESUMIDO), Presumed Credit Percentage (P_CRED_PRESUMIDO), and Presumed Credit Amount (V_CRED_PRESUMIDO) have been added to the new table Nota Fiscal Presumed Credit (J_1BNFPRSMD_CRDT).

The fields refer to the presumed credit benefit code defined by the UF of the nota fiscal issuer, the percentage of the presumed credit, and the presumed credit value related to the presumed credit tax benefit.

New field for fiscal benefit code

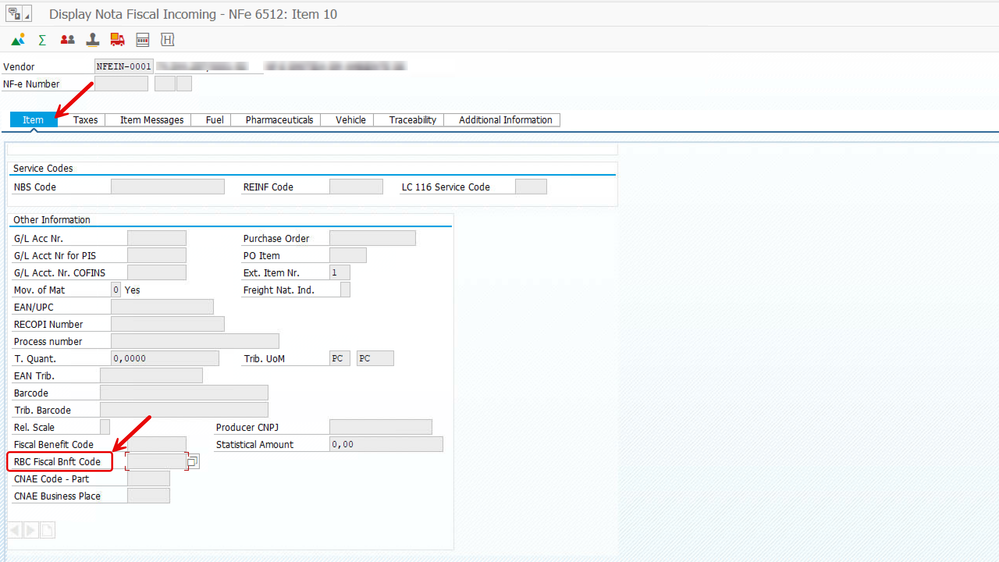

The field State Fiscal Benefit Code ICMS Deferral with Base Reduction (CBENEF_RBC) has been added to the existing structure Nota Fiscal Additional Item Fields (J_1BNFLIN_ADD). This field specifies the code related to fiscal benefits (cBenefRBC) in case tax base reduction (RBC) accumulates with ICMS deferral (CST51), applied to each state according to the item inserted in your Electronic Nota Fiscal (NF-e).

The changes mentioned in this blog post are available in the following system objects for SAP ERP, SAP S/4HANA:

- Nota Fiscal Writer Transactions (J1B*N)

- Nota Fiscal Presumed Credit (J_1BNFPRSMD_CRDT), under the Taxes tab.

- Nota Fiscal line items (J_1BNFLIN), under the Items tab

- Nota Fiscal System – Create Object from data (BAPI_J_1B_NF_CREATEFROMDATA) BAPI

- Nota Fiscal: List details of a Nota Fiscal (BAPI_J_1B_NF_READDATA) BAPI

- Additional Data for Nota Fiscal (J_1BNF_ADD_DATA) BAdI

In both BAPIs, the parameter for Nota Fiscal Presumed Credit is OBJ_PRESUMED_CREDIT. In the BAdI the parameter is ET_PRSMD_CRDT.

Relevant SAP Notes for this legal requirement

You can install the following SAP Notes to update your solution:

- SAP Note 3423951 – NF-e Technical Note 2019.001 v1.61: Prerequisite objects for SAP Note 3423952

- SAP Note 3423952 – NF-e Technical Note 2019.001 v1.61: New Fields Added to Nota Fiscal for Presumed Credit and Fiscal Benefit Code

- SAP Note 3440649 – Outbound NF-e: Prerequisite Objects of SAP Note 3447619

- SAP Note 3447619 – Outbound NF-e: NF-e Technical Note 2019.001 v1.62 and 2023.004 v1.11

These SAP Notes deliver the new gCred group and the new cBenefRBC field on the ICMS51 group in the layout of the XML file. Additionally, the product information will now include three new fields (cCredPresumido, pCredPresumido, and vCredPresumido) for presumed credit.

You can also implement the changes for the SAP Electronic Invoicing for Brazil (SAP NFE) solution by following the instructions on SAP Note 3426933 – NF-e NT2019.001 & NT2023.004.

Use the regulatory change manager tool to find out if a solution is planned for a legal change. For the NF-e Technical Note 2019.001 v1.61, check the URL NF-e Technical Note 2019.001 v1.61. Take a look at the SAP Knowledge Base Article 3421995 and the Regulatory Change Manager page to understand how to use this tool.

For more information, check the SAP Knowledge Base Article 2955945 - NF-e Technical Note 2019.001 v1.61 Troubleshooting Guide

Update - 05 April, 2024

Follow the steps on the SAP Notes below to implement the updates in the SAP Document and Reporting Compliance, inbound invoicing option for Brazil:

- SAP Note 3444168 – Incoming NF-e: Technical Note 2019.001 v1.62 and 2023.004 v1.11

- SAP Note 3441355 – eDocument Brazil Inbound NF-e: Prerequisite Objects for SAP Note 3447713

- SAP Note 3447713 – eDocument Brazil Inbound NF-e: Technical Note 2019.001 v1.62 and 2023.004 v1.11

Did you like this post? Give it a Like (kudo) and share the content with your colleagues. Feel free to leave feedback, comment, or question in the space below. And don’t forget to follow the SAP S/4HANA Logistics for Brazil tag in the SAP Community to stay tuned for the latest news.

Regards,

Luize Boyen

- SAP Managed Tags:

- SAP S/4HANA Logistics for Brazil,

- SAP ERP,

- Localization

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

159 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

219 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- NF-e Nota Técnica 2019.001 v1.62 novos campos adicionados à nota fiscal in Enterprise Resource Planning Blogs by SAP

- Updates on Conhecimento de Transporte Eletrônico and Manifesto Eletrônico de Documentos Fiscais in Enterprise Resource Planning Blogs by SAP

- Purchase Ordre Accrual in S/4HANA - Part 1 in Enterprise Resource Planning Blogs by Members

- NF-e Technical Note 2023.004 v1.10: New Fields Added to Nota Fiscal (Cloud) in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |