- SAP Community

- Products and Technology

- Human Capital Management

- HCM Blogs by SAP

- Create or Update Benefit Enrollments for Employee ...

Human Capital Management Blogs by SAP

Get insider info on SAP SuccessFactors HCM suite for core HR and payroll, time and attendance, talent management, employee experience management, and more in this SAP blog.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-09-2020

11:33 AM

The SAP SuccessFactors H2 2020 Release brings with it a new enhancement that allows admins to set up a new type of job (Create or Update Benefit Enrollments for Employee Master Data changes) to create or update enrollment records whenever there is a change in Employee master data.

The ‘Benefits Auto Enrollment’ Job analyzes all employee records with each run, even those records where there are no changes as per the eligibility rule.

This approach slows down jobs, affecting the performance with respect to time. Occasionally, it also makes the job fail due to memory consumption issues if the volume to be processed is too high for some customers based on their setup and number of employees.

During the ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ job run, a new ‘Benefits Employee Master Data Change Tracker’ object is queried to find the employees with master data changes:

As this job processes only those employees with master data changes, it reduces the volume that needs to be processed and increases the processing efficiency of the job.

Note: The records will be created in ‘Benefits Employee Master Data Change Tracker’ object when there is a change in employee master data. We use rules to trigger such changes, and this is explained in the additional configurations section below.

Whenever there is a change in employee master data, this job will perform the below mentioned actions on the benefits as per the eligibility rule defined in the Benefit.

For example:

If an employee loses eligibility for a benefit due to change in Job classification, then the job will terminate/delimit the enrollment record.

Yes, currently there is a limitation and if it is not acceptable in your business scenario you must continue to use the Benefits Auto Enrollment job for the following scenario:

Subsequent auto updates to the enrollments based on custom date related eligibility changes are not supported.

For example:

If the eligibility rule of the benefit is defined based on any custom date field or any other date fields that we have not listed in the ‘Create Benefits Eligibility Date Configuration’.

New approach works solely based on identifying that there is a master data change for employee. This is done by using business rule. Rules must be configured using the rule functions listed below for the master data objects maintained in the benefit eligibility rules.

For example, if your eligibility rule is defined based on the parameters Job Information, Biographical Information, Personal Information then create the rules using the below rule functions and attach to the mentioned parameters as a ‘Post save’ or ‘On save’ rule for all three entities (Job Information, Biographical Information, Personal Information)

When there is a change to any of the fields in these parameters (Job information, Biographical Information, Personal Information etc.), this rule will trigger and create an entry into the ‘Benefits Employee Master Data Change Tracker’ object.

If the Benefit eligibility rules are defined on certain dates, such as Date of Birth, Date of Hire, Probation Date, and so on, you should create the Benefits Eligibility Date Configuration object. The object will determine the date on which the benefit eligibility of the employee changes and will create tracker records for the determined dates. On those dates the jobs will evaluate the employee for the specific benefit.

Example:

Employees of a company are eligible for ‘Fuel Allowance’ benefit only if they complete 3 years in the organization. Let us consider two employees Steve and Jason have hire dates as July 15, 2018 and August 1, 2019 respectively. The Benefit Eligibility Date Configuration object should be created as below for this requirement.

The job is run on August 1st, 2021. On this date, Steve is eligible for the benefit, so enrollment records will be created for Steve.

However, Jason is not eligible for the benefit as he has not completed three years in the company.

A tracker record will be created for Jason with the planned job run date as August 1st, 2022.

When the job runs on August 1st, 2022, it will create the required enrollment records for Jason. If there are no more changes to employee master data of Jason until August 1st, 2022, then this job will execute only on August 1st, 2022 for employee Jason and in all the previous runs it will not execute for this user as there are no changes expected to his enrollment record

Below is the sample rule

If the benefit eligibility rule is defined on any date specific fields, please create the below configuration. If no date specific fields are defined in the eligibility rule, then you can skip this set up.

For example, if the base date is Employee Date of Birth and the benefit need to be evaluated on every year on employee’s birth date.

Answer: When there is any change to the employee master data like Job information or Personal information, it will create an entry in the ‘Benefits Employee Master Data Change tracker’ object with the ‘Job Processed Status’ as ‘Not processed’.

Once the job runs successfully, the status will be changed to ‘Success’.

Due to any reason if job fails, the status will be marked as ‘Failed’ and when the job run next time it will reconsider this entry for execution.

Note: Please note if the job failed yesterday and when the job runs today, it will execute the eligibility rule as of today only and not as of yesterday.

2.I do not see the Benefit selection in ‘Create or Update Benefit Enrollments for Employee Master Data Changes’, which benefits will be considered for Job processing?

Answer: This job is based on Legal entity selection. Since this job updates enrollment records based on employee master data changes, those changes should be applicable for all relevant benefits. Hence the benefit selection is not required, system updates the enrollment records for all applicable benefits of type Allowance, Pension, and Insurance.

3.The ‘Benefit Auto Enrollment’ job works only for Allowance, Pension and Insurance type benefits, how about the ‘Create or Update Benefit Enrollments for Employee Master Data Changes‘ job?

Answer: This job also will create or update the enrollment records for Allowance, Pension and Insurance Benefits only.

4.When an employee is terminated, the Benefits auto enrollment job delimits the enrollment record once the job runs. Why is the new job not delimiting the enrollment record?

Answer: As a leading practice we recommend that customers use the Termination Intelligent Service event for delimiting the enrollment records as it has the flexibility to set up the effective dates (back dated or future dated) while delimiting the enrollment and deduction records.

5.I created my initial enrollments using Benefit auto enrollment job and using the ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ for updates. Now if an employee becomes newly eligible due to a change in pay grade or due to a change in marital status, can this job create enrollment for this employee?

Answer: Yes, ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ job will create enrollments. The change in Job information (Pay grade) or the change in Personal information (Marital status) will be recorded in Benefits employee master data change tracker object (if the rules are configured in Job information and Personal information).

Job will run the eligibility rule for the employee as it finds an entry in the ‘Benefits Employee Master Data Change Tracker’ object and creates enrollment record.

6.Where do I need to assign the rules for the parameters used in eligibility rule?

Answer: Assign the rule at ‘OnPostSave’ for ‘Job information’ parameter and for any MDF object. For all other parameters assign it at ‘OnSave’. For the rules assigned at ‘OnSave’, please make sure this rule is assigned as the last rule in sequence.

7.The ‘Allow automatic updates’ field was not available for manual type Insurance benefit previously but with the H2 2020 release I see this field. Why this change? And is this selection applicable for both jobs?

Answer: Yes, you need to set the ‘Allow Automatic Updates’ field to ‘Yes’ in the benefit for any updates to the enrollment records. This is applicable for both the jobs (‘Benefit Auto Enrollment’ and ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ jobs).

Since we don’t have the Benefits selection in the new job, this job will process the manual insurance benefits for any updates only if the field ‘Allow Automatic Updates’ is enabled.

Thank you.

Bijo

Global Benefits Product Management

Reason for introducing this new job

The ‘Benefits Auto Enrollment’ Job analyzes all employee records with each run, even those records where there are no changes as per the eligibility rule.

This approach slows down jobs, affecting the performance with respect to time. Occasionally, it also makes the job fail due to memory consumption issues if the volume to be processed is too high for some customers based on their setup and number of employees.

How does this new job work?

During the ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ job run, a new ‘Benefits Employee Master Data Change Tracker’ object is queried to find the employees with master data changes:

- If the system doesn’t find any records of any such employees belonging to the selected legal entity, the job will log the result and exit.

- If it finds records, it processes only those employees. After the execution, the job will update the status in the tracker object whether the job has processed successfully or not.

As this job processes only those employees with master data changes, it reduces the volume that needs to be processed and increases the processing efficiency of the job.

Note: The records will be created in ‘Benefits Employee Master Data Change Tracker’ object when there is a change in employee master data. We use rules to trigger such changes, and this is explained in the additional configurations section below.

Use cases addressed by this Job

Whenever there is a change in employee master data, this job will perform the below mentioned actions on the benefits as per the eligibility rule defined in the Benefit.

- Create enrollment

- Update enrollment

For example:

- If an employee becomes newly eligible for a benefit due to change in Department, then the job will create an enrollment record.

- If an employee becomes eligible for a benefit with higher entitlement amount due to change in Pay grade, then the job will update the enrollment record with the new amount.

If an employee loses eligibility for a benefit due to change in Job classification, then the job will terminate/delimit the enrollment record.

Are there any limitations with this job?

Yes, currently there is a limitation and if it is not acceptable in your business scenario you must continue to use the Benefits Auto Enrollment job for the following scenario:

Subsequent auto updates to the enrollments based on custom date related eligibility changes are not supported.

For example:

If the eligibility rule of the benefit is defined based on any custom date field or any other date fields that we have not listed in the ‘Create Benefits Eligibility Date Configuration’.

What additional configurations are introduced to set up this job?

1. Configure rules for the master data objects:

New approach works solely based on identifying that there is a master data change for employee. This is done by using business rule. Rules must be configured using the rule functions listed below for the master data objects maintained in the benefit eligibility rules.

For example, if your eligibility rule is defined based on the parameters Job Information, Biographical Information, Personal Information then create the rules using the below rule functions and attach to the mentioned parameters as a ‘Post save’ or ‘On save’ rule for all three entities (Job Information, Biographical Information, Personal Information)

- Create Benefit Tracker for Employment Info Changes ()

- Create Benefit Tracker for Employment Info Changes with Effective Date ()

- Create Benefit Tracker for Personal Info Changes ()

- Create Benefit Tracker for Personal Info Changes with Effective Date ()

When there is a change to any of the fields in these parameters (Job information, Biographical Information, Personal Information etc.), this rule will trigger and create an entry into the ‘Benefits Employee Master Data Change Tracker’ object.

2. Configure Benefit Eligibility Dates:

If the Benefit eligibility rules are defined on certain dates, such as Date of Birth, Date of Hire, Probation Date, and so on, you should create the Benefits Eligibility Date Configuration object. The object will determine the date on which the benefit eligibility of the employee changes and will create tracker records for the determined dates. On those dates the jobs will evaluate the employee for the specific benefit.

Example:

Employees of a company are eligible for ‘Fuel Allowance’ benefit only if they complete 3 years in the organization. Let us consider two employees Steve and Jason have hire dates as July 15, 2018 and August 1, 2019 respectively. The Benefit Eligibility Date Configuration object should be created as below for this requirement.

- Base Date: Employee Hire Date

- As of Day: No Selection

- As of Month: No Selection

- As of Year: No Selection

- Recurring: No

- Offset Value: 3 Year

The job is run on August 1st, 2021. On this date, Steve is eligible for the benefit, so enrollment records will be created for Steve.

However, Jason is not eligible for the benefit as he has not completed three years in the company.

A tracker record will be created for Jason with the planned job run date as August 1st, 2022.

When the job runs on August 1st, 2022, it will create the required enrollment records for Jason. If there are no more changes to employee master data of Jason until August 1st, 2022, then this job will execute only on August 1st, 2022 for employee Jason and in all the previous runs it will not execute for this user as there are no changes expected to his enrollment record

End to End setup of ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ Job

1. Setup the Benefit

- Create Benefits with eligibility rules (This job is supported only for Allowance, Pension, and Insurance type Benefits)

- While creating benefits, please note the below points.

- Select the Enrollment type as ‘Automatic’. Note: Enrollment type ‘Manual’ is also supported but only for ‘Insurance’ type benefit. The first enrollment must be done manually, and job is used for any updates.

- Choose ‘Allow automatic updates’ field to ‘Yes’ to enable updates to enrollment records through jobs. Please note, from b2011 release ‘Allow automatic updates’ filed is available for ‘Manual’ type benefit as well.

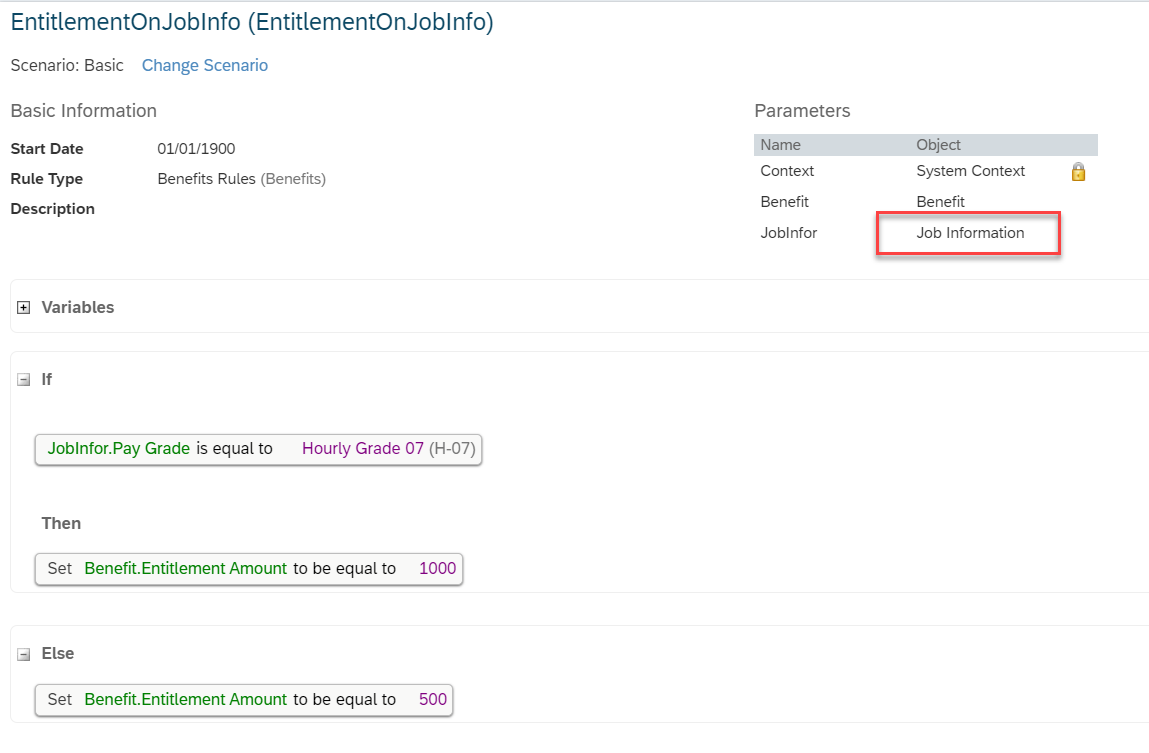

- Below is a sample eligibility rule used in the benefit (we can use this rule as a base to complete the sample scenario in the coming sections)

2. Set Up the Rules for Parameters Used in the Eligibility Rule

- Navigate to Admin Center --> Manage Business Configuration.

- Choose the object that you need to assign the rule. If the eligibility rule is created with the fields in ‘Job information’ then choose the ‘Job Information’ object.

- Create a rule and assign it under the ‘Trigger rules’ section

Below is the sample rule

![]()

- Save the configuration

3. Create Benefits Eligibility Date Configuration

If the benefit eligibility rule is defined on any date specific fields, please create the below configuration. If no date specific fields are defined in the eligibility rule, then you can skip this set up.

- Go to Admin Center-->Benefits Admin Overview-->Create New-->Benefits Eligibility Date Configuration.

- Choose Base Date based on the type of date used in the benefit eligibility configuration. The system supports most standard dates, such as Employee Hire Date, Employee Date of Birth, Dependent Date of Birth, and so on. However, if you use custom date or any date that is not available in the Base Date field, you should use the Benefits Auto Enrollment Job for benefit enrollment update scenarios.

- The fields As of Day, As of Month, and As of Year are optional. Choose these fields if you want to evaluate Base Date of an employee on a specific date and not on the job execution date. If these fields are not selected, the Base Date is evaluated on the job execution date and appropriate enrollment records or tracker records are created.

- Choose Recurring as Yes if the benefit needs to be evaluated on a recurring basis.

For example, if the base date is Employee Date of Birth and the benefit need to be evaluated on every year on employee’s birth date.

- In the Set Duration from Base Date section, set the value and units to be added to the base date.

- Select the benefits that should be evaluated by the job on the determined dates of benefit eligibility change.

- Choose Save.

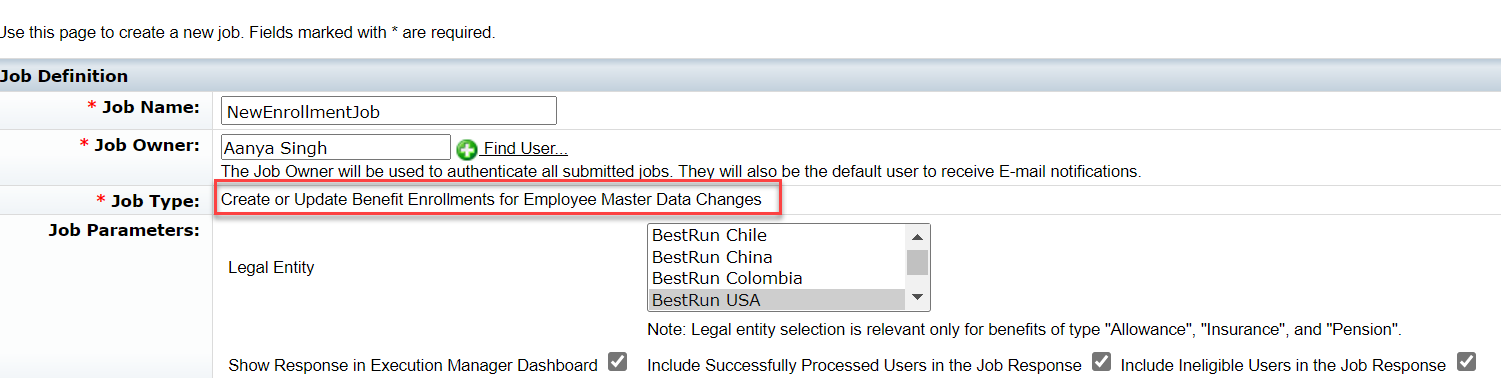

4. Set up the job in Provisioning:

- Login to Provisioning and select the Company

- Choose ‘Manage scheduled Jobs’ from ‘Manage Job Scheduler’

- Click on ‘Create New Job’

- Enter the Job name and Job owner

- Choose the Job type ‘Create or Update Benefit Enrollments for Employee Master Data Changes’

- Choose the Legal entities. Please note, in this job Benefit selection is not available.

- Enable ‘Show response in execution manager dashboard’ checkboxes to view the execution results in ‘Execution manager dashboard’ once the job is completed.

- Save the job

How does the new job create or update the enrollment records?

- Employee ‘Rick Smolla’ was already enrolled in an allowance benefit with 500 USD per month (As per the eligibility rule defined in the benefit, refer the eligibility rule screenshot in the Benefit set up section)

- The Admin/HR Manager has changed Rick Smolla’s pay grade to ‘H-07’ in the Job information portlet.

- This change will create an entry in ‘Benefits Employee Master Data Change Tracker’ object. Also note that the field ‘Job processed status’ will be set to ‘Not Processed’. This status will be changed once job process this record.

![]()

- Now when the job runs as per the schedule, it will look for the ‘Benefits Employee Master Data Change Tracker’ object and executes the eligibility rule for the employee ‘Rick Smolla’ and not for any other employees. Because there are no changes to other employees’ master data.

- As a result, the enrollment record will get updated with the new amount 1000 USD.

- Since the job ran successfully and updated the enrolment record, the ‘Job Processed Status’ in ‘Benefits Employee Master Data Change Tracker’ object will get updated with ‘Success’.

![]()

Frequently Asked Questions:

1.What is the significance of the field ‘Job Processed Status’ in ‘Benefits Employee Master Data Change Tracker’?

Answer: When there is any change to the employee master data like Job information or Personal information, it will create an entry in the ‘Benefits Employee Master Data Change tracker’ object with the ‘Job Processed Status’ as ‘Not processed’.

Once the job runs successfully, the status will be changed to ‘Success’.

Due to any reason if job fails, the status will be marked as ‘Failed’ and when the job run next time it will reconsider this entry for execution.

Note: Please note if the job failed yesterday and when the job runs today, it will execute the eligibility rule as of today only and not as of yesterday.

2.I do not see the Benefit selection in ‘Create or Update Benefit Enrollments for Employee Master Data Changes’, which benefits will be considered for Job processing?

Answer: This job is based on Legal entity selection. Since this job updates enrollment records based on employee master data changes, those changes should be applicable for all relevant benefits. Hence the benefit selection is not required, system updates the enrollment records for all applicable benefits of type Allowance, Pension, and Insurance.

3.The ‘Benefit Auto Enrollment’ job works only for Allowance, Pension and Insurance type benefits, how about the ‘Create or Update Benefit Enrollments for Employee Master Data Changes‘ job?

Answer: This job also will create or update the enrollment records for Allowance, Pension and Insurance Benefits only.

4.When an employee is terminated, the Benefits auto enrollment job delimits the enrollment record once the job runs. Why is the new job not delimiting the enrollment record?

Answer: As a leading practice we recommend that customers use the Termination Intelligent Service event for delimiting the enrollment records as it has the flexibility to set up the effective dates (back dated or future dated) while delimiting the enrollment and deduction records.

5.I created my initial enrollments using Benefit auto enrollment job and using the ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ for updates. Now if an employee becomes newly eligible due to a change in pay grade or due to a change in marital status, can this job create enrollment for this employee?

Answer: Yes, ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ job will create enrollments. The change in Job information (Pay grade) or the change in Personal information (Marital status) will be recorded in Benefits employee master data change tracker object (if the rules are configured in Job information and Personal information).

Job will run the eligibility rule for the employee as it finds an entry in the ‘Benefits Employee Master Data Change Tracker’ object and creates enrollment record.

6.Where do I need to assign the rules for the parameters used in eligibility rule?

Answer: Assign the rule at ‘OnPostSave’ for ‘Job information’ parameter and for any MDF object. For all other parameters assign it at ‘OnSave’. For the rules assigned at ‘OnSave’, please make sure this rule is assigned as the last rule in sequence.

7.The ‘Allow automatic updates’ field was not available for manual type Insurance benefit previously but with the H2 2020 release I see this field. Why this change? And is this selection applicable for both jobs?

Answer: Yes, you need to set the ‘Allow Automatic Updates’ field to ‘Yes’ in the benefit for any updates to the enrollment records. This is applicable for both the jobs (‘Benefit Auto Enrollment’ and ‘Create or Update Benefit Enrollments for Employee Master Data Changes’ jobs).

Since we don’t have the Benefits selection in the new job, this job will process the manual insurance benefits for any updates only if the field ‘Allow Automatic Updates’ is enabled.

Thank you.

Bijo

Global Benefits Product Management

- SAP Managed Tags:

- SAP SuccessFactors Employee Central

Labels:

12 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

1H 2023 Product Release

3 -

2H 2023 Product Release

3 -

Business Trends

104 -

Business Trends

5 -

Cross-Products

13 -

Event Information

75 -

Event Information

9 -

Events

5 -

Expert Insights

26 -

Expert Insights

24 -

Feature Highlights

16 -

Hot Topics

20 -

Innovation Alert

8 -

Leadership Insights

4 -

Life at SAP

67 -

Life at SAP

1 -

Product Advisory

5 -

Product Updates

499 -

Product Updates

46 -

Release

6 -

Technology Updates

408 -

Technology Updates

14

Related Content

- Some issues with the SuccessFactors Microsoft Teams integration in Human Capital Management Q&A

- Group Rating in Human Capital Management Q&A

- Rules on Benefit Claim portion reimbursement in Human Capital Management Q&A

- LOA - Manager not updated in Human Capital Management Q&A

- API doubts with SFAPI user to extract employee´s goal info in Human Capital Management Q&A

Top kudoed authors

| User | Count |

|---|---|

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |