- SAP Community

- Groups

- Interest Groups

- Sustainability

- Blogs

- If not now, then soon: Sustainability becomes a ma...

Sustainability Blogs

Delve into SAP sustainability blogs. Gain insights into tech-driven sustainable practices and contribute to a greener future for businesses and the planet.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Verena_Berger

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-30-2023

8:21 AM

Holistic Steering & Reporting with SAP Sustainability Control Tower | Part 3 – Sustainability Regulations for Swiss Companies

Part 1: Sustainability Reporting

Part 2: SAP Sustainability Control Tower Overview [2022.10]

Part 3: Sustainability Regulations for Swiss Companies – you are here 😊

Part 4: Blog in Progress – future content will be published & linked here

This is the third part of a blog series that is going to published about the SAP Sustainability Control Tower and Sustainability Reporting in general. It's a guest post to which I was invited by Isabeau Stender. I took the opportunity to delve even deeper into the regulatory side of sustainability reporting. In my past I have dealt with many sustainability issues, including sustainable consumption and behavioral change. Be invited to share your reporting know-how in the comments. Insights are very welcome.

This blog series is continuously updated.

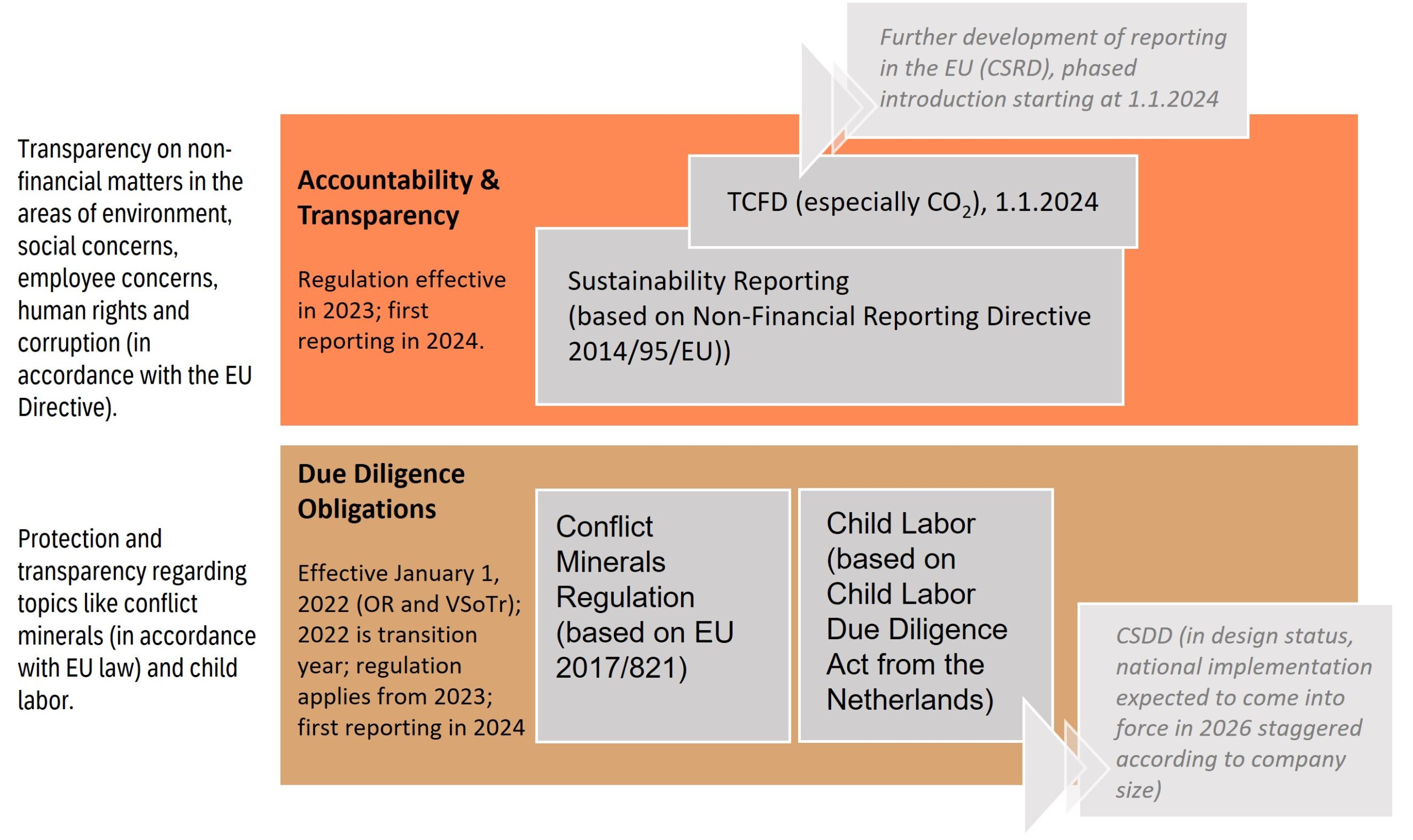

With the reporting obligation on non-financial matters, new regulatory requirements in the area of sustainability reporting become relevant for Swiss companies. Although these only apply to large companies in the first step, they indirectly affect smaller suppliers as well, increasing pressure across the market.

In addition to the new provisions that the Federal Council has put into force in the Swiss Code of Obligations (CO) as of January 1, 2022, as well as the corresponding implementing provisions, the developments in the EU, such as the regulations of the "Corporate Sustainability Reporting Directive" (CSRD) on non-financial information are also affecting companies by means of a stepwise introduction from the beginning of 2024. The CSRD not only affects EU companies, but also Swiss companies that generate net sales of more than EUR 150 million in the EU and having at least one subsidiary or branch in the EU.

Next to the counter-proposal and the CSRD, which will replace the NFRD in the future, companies that are subject to the NFRD are also required to report in accordance with the EU Taxonomy (see also EU-Offenlegungspflichten im Nachhaltigkeitsbereich und Schweizer Investitionen im Energiebereich, only availabe in german, serach for «Offenlegungspflichten»).

In the future, the group of companies concerned is expected to rise significantly, showing how important it is to adress this topic.

The focus in the following blogpost is primarily on the Swiss perspective and is intended to give a rough overview of what SMEs can expect in the future, before we demonstrate how to create the basis for credible and effective reporting in a follow-up.

The obligations of the counter-proposal to the responsible business initiative must be carried out by companies from the reporting year 2023.

These include:

The report must be published and publicly available for at least 10 years.

In general, there are some measures that there are some criteria that exempt companies from the reporting requirements. These are capital market orientation, company size, balance sheet total and control.

The following requirements must be met for a company to be subject to report non-financial issues (Accountability & Transparency):

Regarding conflict minerals and child labor (Due Diligence Obligations), companies are concerned that

Due diligence obligations include, in particular, the maintenance of a management system, the preparation of a risk management plan, and the examination of an external, independent expert in the case of minerals and metals. In the area of child labor, an external audit is not required.

As with reporting on non-financial matters, companies must also report on how they implement due diligence in the areas of "conflict minerals" and "child labor".

There are some further details and exceptions such as quantity thresholds for conflict minerals or a risk rating. There are also exceptions for small companies. Also companies that already follow regulations of the OECD or the regulation (EU) 2017/821 on conflict minerals are exempted from the obligation in the area of minerals and metals.

In the area of child labor, compliance with the ILO Conventions or the OECD Due Diligence Guidance for Responsible Business Conduct exempts from due diligence and reporting.

Details can be found in the Explanatory Report on the Ordinance on Due Diligence and Transparency Regarding Minerals and Metals ...

Within the ESG universe, it is required to report on the so-called material topics. What exactly the relevant topics are must be determined by the company itself within the framework of a materiality analysis. In order to be transparent and credible, it is appropriate to determine the relevant topics in a systematic and structured process and to document this.

Companies that apply GRI are actually already familiar with the so called materiality analysis. It identifies what impacts the company has on the environment and society and, on the other hand, how environmental and social sustainability issues affect the business activity. Thus, "outputs and impacts" are identified, and these are clustered and assessed. The result is usually presented in a two-dimensional materiality matrix. This forms the basis for determining the material issues, which in turn should form the basis of the sustainability strategy and are addressed in the reporting. Now the term "double materiality" as well as outside-in and inside-out perspective is often mention in the reporting context. What does that mean exactly?

The outside-in perspective involves determining how sustainability aspects affect the business result, the situation and the course of business. This may include, for example, the expectations of other market participants, investors, stakeholders or shareholders, the general conditions in which a company or SME operates (political regulations, availability of raw materials, environmental risks), and social developments (demographic trends, diversity, migration and equality).

The inside-out approach addresses the company's impact on environmental and sustainability aspects. For example, one persue the question of what influence the SME has on environmental pollution and biodiversity or to what extent the company's strategy prevents and counteracts corruption.

It sounds complex, but the principle of double materiality leads a company to understand interrelationships in both directions. It is therefore not only a matter of seeing oneself as an affected actor, but also of dealing with one's own impact on climate protection, human rights and social issues and of seeing oneself as an active actor in the area of sustainability and combating climate change.

Since the analysis should be repeated at least every two years, it makes sense to follow a standardized procedure to ensure comparability. The effort required for such a procedure should not be underestimated, as the external view of the relevant stakeholders should also be obtained. Accordingly, it is worthwhile to start at an early stage.

In addition to transparency obligations for larger companies, the counter-proposal to the Corporate Responsibility Initiative also introduces new due diligence and transparency in relation to minerals and metals from conflict-affected areas and c...These also affect smaller companies with 250 or more employees. The aim is to ensure that there are no risks regarding conflict minerals and child labor in their own value chain. If a company imports minerals or metals from conflict areas, then additional legal requirements must be complied with. These must also be complied with if a company sources raw materials or goods from countries where child labor cannot be ruled out.

The additional legal requirements include:

With regard to due diligence, the EU draft of the Corporate Sustainability Due Diligence Directive (CSDDD) published in February 2022 is more demanding. It not only describes "conflict minerals" and child labor, but also includes environmental areas and human rights and requires more extensive audits and expands potential liability. Although the directive is still the subject of much debate, Swiss companies with significant operations in the EU would do well to keep abreast of developments in the directives and prepare for the more far-reaching EU regulations, especially since the Federal Council reaffirmed its intention to seek internationally coordinated regulation of corporate sustainability.

Overall, it is expected that the requirements for non-financial reporting will increase in the future. Transparency, fact-based information that permits classification and comparisons are required. A reliable and up-to-date, valid data basis is therefore indispensable to be able to show and report key figures on relevant topics as well as targets, measures, progress and setbacks. It is obvious that a standalone sustainability strategy is not sufficient. Sustainability must be an integral part of the corporate strategy in order to ensure serious and credible management of the organization and safeguard sustainable corporate development.

Smaller companies often ask themselves whether reporting is worthwhile for them at all. From conversations, it appears that the prevailing opinion is that effective contributions to climate protection comprise measures such as the installation of a solar systems or energy-saving measures, or to make a social contribution through certain training or support programs for its employees. There is no doubt about that. Nevertheless, at some point the question arises as to what the measures have been achieved. Was the investment worthwhile? What has been saved in terms of electricity or CO2? Has employee satisfaction increased, staff turnover reduced or my reputation as a good employer improved? Answers to these questions are only possible if the topic is approached systematically. Of course, you don't have to launch a reporting system, and even if you are not legally obligated to report as a small company, the creation of a sustainability report with the corresponding data collection can be a good first assessment. A report can be valuable tool that can support continuously improvement and makes commitment visible internally and externally. The most important thing here (much more important than meeting a standard) is honest and transparent documentation and metrics that are not used as a target.

In view of the latest IPPC report (IPCC, 2023), it should be clear that the issue of sustainability and acting within planetary and social boundaries will obviously and inevitably determine business. The consequences of the hitherto exploitative behavior on an ecological and social level will be of concern. SAP Insights show that resource scarcity and climate change are among the risks that are currently most visible and tangible for business leaders (SAP, 2021). At the same time, economic stagnation is most often cited. If one follows approaches such as that of the economy for the common good, also an approach (and mindset) of sustainability reporting, it quickly becomes clear that there are alternative economic models that turn back the traditional thinking of ever more growth and profit orientation, because it simply does not work in the long run. Only when money is seen as a means to an end, to create good living for all and to protect our earth - our livelihood -, then economic stagnation need not be a risk, but simply an orientation or condition that is sustainable.

To sum up, we all know sustainability is a complex issue. In addition, there are now further regularizations, that must be observed. If these are also to be complied with, simply adhering to the requirements will not be enough to stop climate change. Nevertheless, you should now at least have an overview of what is coming and some ideas on how to prepare.

On May 4 it’s all about Holistic Steering and Reporting! Don’t miss the SAP Discovery Day for Sustainability, a virtual event series focusing on sustainability management solutions for sustainable supply chains, decarbonization, circular economy and ESG reporting.

Related topics and sources:

EJPD (2021). Erläuternder Bericht zur Verordnung über Sorgfaltspflichten und Transparenz bezüglich Mineralien und Metallen aus Konfliktgebieten und Kinderarbeit (VSoTr). https://www.ejpd.admin.ch/dam/bj/de/data/wirtschaft/gesetzgebung/verantwortungsvolle-unternehmen/erl...

IHK (2021). Leitfaden für Unternehmer, München, https://www.ihk-uenchen.de/ihk/documents/CSR-Ehrbarer-Kaufmann/Leitfaden-Nachhaltigkeitsberichtersta...

IPCC, 2023: Climate Change 2023: Synthesis Report. A Report of the Intergovernmental Panel on Climate Change. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, (in press)

SAP (2021). Bridging the Gap Between Sustainability and Financial Metrics. https://www.sap.com/germany/insights/research/bridging-the-gap-between-sustainability-and-financial-...

Sustainability Topic Page

Here you can ask questions about Sustainability and follow

Read other Sustainability blog posts and follow

Please follow verena_007 and isabeau for future posts

Blog Series Content

Part 1: Sustainability Reporting

Part 2: SAP Sustainability Control Tower Overview [2022.10]

Part 3: Sustainability Regulations for Swiss Companies – you are here 😊

Part 4: Blog in Progress – future content will be published & linked here

Introduction

This is the third part of a blog series that is going to published about the SAP Sustainability Control Tower and Sustainability Reporting in general. It's a guest post to which I was invited by Isabeau Stender. I took the opportunity to delve even deeper into the regulatory side of sustainability reporting. In my past I have dealt with many sustainability issues, including sustainable consumption and behavioral change. Be invited to share your reporting know-how in the comments. Insights are very welcome.

This blog series is continuously updated.

Agenda

- What the new guidelines mean for Swiss companies

- Who needs to act?

- What needs to be reported?

- Reporting: Much more than just KPI

Introduction

With the reporting obligation on non-financial matters, new regulatory requirements in the area of sustainability reporting become relevant for Swiss companies. Although these only apply to large companies in the first step, they indirectly affect smaller suppliers as well, increasing pressure across the market.

In addition to the new provisions that the Federal Council has put into force in the Swiss Code of Obligations (CO) as of January 1, 2022, as well as the corresponding implementing provisions, the developments in the EU, such as the regulations of the "Corporate Sustainability Reporting Directive" (CSRD) on non-financial information are also affecting companies by means of a stepwise introduction from the beginning of 2024. The CSRD not only affects EU companies, but also Swiss companies that generate net sales of more than EUR 150 million in the EU and having at least one subsidiary or branch in the EU.

Next to the counter-proposal and the CSRD, which will replace the NFRD in the future, companies that are subject to the NFRD are also required to report in accordance with the EU Taxonomy (see also EU-Offenlegungspflichten im Nachhaltigkeitsbereich und Schweizer Investitionen im Energiebereich, only availabe in german, serach for «Offenlegungspflichten»).

In the future, the group of companies concerned is expected to rise significantly, showing how important it is to adress this topic.

The focus in the following blogpost is primarily on the Swiss perspective and is intended to give a rough overview of what SMEs can expect in the future, before we demonstrate how to create the basis for credible and effective reporting in a follow-up.

What the new guidelines mean for Swiss companies

The obligations of the counter-proposal to the responsible business initiative must be carried out by companies from the reporting year 2023.

These include:

- Non-financial reporting, which is based on the EU's Non-Financial Reporting Directive (NFRD). This is to include annual reporting on environmental and social issues, employee issues, respect for human rights and the fight against corruption.

- Regulation on reporting on climate issues. It is based on the guidelines of the Task Force on Climate-related Financial Disclosures (TCFD) and makes binding recommendations for implementation.

- Due diligence and transparency obligations with regard to minerals and metals from conflict and high-risk areas and suspected child labor.

The report must be published and publicly available for at least 10 years.

Source: Verena Berger, own illustration based on EJPD (2021) | Regulatory areas of the counter-proposal

Who needs to act?

In general, there are some measures that there are some criteria that exempt companies from the reporting requirements. These are capital market orientation, company size, balance sheet total and control.

The following requirements must be met for a company to be subject to report non-financial issues (Accountability & Transparency):

- Companies must be a "public interest company". These are public companies as well as persons who, according to the financial market laws, require a license, a recognition, an authorization or a registration by the financial market supervisory authority (e.g. banks, insurance companies).

- These companies - together with the domestic or foreign companies controlled by them - must also have at least 500 full-time employees on an annual average.

- Finally, the company must have - again together with the domestic or foreign companies it controls or foreign companies controlled by it - a balance sheet total of at least 20 million CHF or sales of at least 40 million CHF in two consecutive financial years.

Regarding conflict minerals and child labor (Due Diligence Obligations), companies are concerned that

- import minerals (ores and concentrates) or metals containing tin, tantalum, tungsten or gold from conflict or high risk areas or process them in Switzerland, or which

- offer products or services for which there are reasonable indications that they have been produced or provided by children.

Due diligence obligations include, in particular, the maintenance of a management system, the preparation of a risk management plan, and the examination of an external, independent expert in the case of minerals and metals. In the area of child labor, an external audit is not required.

As with reporting on non-financial matters, companies must also report on how they implement due diligence in the areas of "conflict minerals" and "child labor".

There are some further details and exceptions such as quantity thresholds for conflict minerals or a risk rating. There are also exceptions for small companies. Also companies that already follow regulations of the OECD or the regulation (EU) 2017/821 on conflict minerals are exempted from the obligation in the area of minerals and metals.

In the area of child labor, compliance with the ILO Conventions or the OECD Due Diligence Guidance for Responsible Business Conduct exempts from due diligence and reporting.

Details can be found in the Explanatory Report on the Ordinance on Due Diligence and Transparency Regarding Minerals and Metals ...

What needs to be reported?

Within the ESG universe, it is required to report on the so-called material topics. What exactly the relevant topics are must be determined by the company itself within the framework of a materiality analysis. In order to be transparent and credible, it is appropriate to determine the relevant topics in a systematic and structured process and to document this.

For companies doing business in the European Union, new Sustainability accounting rules soon to hit hard. Starting in 2024, the EU will require a double materiality analysis for 55,000 companies in Europe and millions more worldwide doing business in the EU.

Companies that apply GRI are actually already familiar with the so called materiality analysis. It identifies what impacts the company has on the environment and society and, on the other hand, how environmental and social sustainability issues affect the business activity. Thus, "outputs and impacts" are identified, and these are clustered and assessed. The result is usually presented in a two-dimensional materiality matrix. This forms the basis for determining the material issues, which in turn should form the basis of the sustainability strategy and are addressed in the reporting. Now the term "double materiality" as well as outside-in and inside-out perspective is often mention in the reporting context. What does that mean exactly?

The outside-in perspective involves determining how sustainability aspects affect the business result, the situation and the course of business. This may include, for example, the expectations of other market participants, investors, stakeholders or shareholders, the general conditions in which a company or SME operates (political regulations, availability of raw materials, environmental risks), and social developments (demographic trends, diversity, migration and equality).

The inside-out approach addresses the company's impact on environmental and sustainability aspects. For example, one persue the question of what influence the SME has on environmental pollution and biodiversity or to what extent the company's strategy prevents and counteracts corruption.

It costs money and resources to get up the maturity curve, but in the long run it will pay off to use reporting as a serious management tool and to act in an impact-oriented manner.

It sounds complex, but the principle of double materiality leads a company to understand interrelationships in both directions. It is therefore not only a matter of seeing oneself as an affected actor, but also of dealing with one's own impact on climate protection, human rights and social issues and of seeing oneself as an active actor in the area of sustainability and combating climate change.

Since the analysis should be repeated at least every two years, it makes sense to follow a standardized procedure to ensure comparability. The effort required for such a procedure should not be underestimated, as the external view of the relevant stakeholders should also be obtained. Accordingly, it is worthwhile to start at an early stage.

Source: Own Illustration, adapted from IHK, 2021 | Sustainability Reporting – 5 general steps

Not only transparency but also Due Dilligence and disclosure for Swiss Companies

In addition to transparency obligations for larger companies, the counter-proposal to the Corporate Responsibility Initiative also introduces new due diligence and transparency in relation to minerals and metals from conflict-affected areas and c...These also affect smaller companies with 250 or more employees. The aim is to ensure that there are no risks regarding conflict minerals and child labor in their own value chain. If a company imports minerals or metals from conflict areas, then additional legal requirements must be complied with. These must also be complied with if a company sources raw materials or goods from countries where child labor cannot be ruled out.

The additional legal requirements include:

- a statement and implementation of the management system (of the supply chain) with regard to conflict minerals and child labor, including a statement of the supply chain policy and a supply chain traceability system,

- an identification and assessment of the risks arising, including their impact,

- a draft measures and risk management plan to mitigate these risks, and

- a report on annual compliance with due diligence requirements.

With regard to due diligence, the EU draft of the Corporate Sustainability Due Diligence Directive (CSDDD) published in February 2022 is more demanding. It not only describes "conflict minerals" and child labor, but also includes environmental areas and human rights and requires more extensive audits and expands potential liability. Although the directive is still the subject of much debate, Swiss companies with significant operations in the EU would do well to keep abreast of developments in the directives and prepare for the more far-reaching EU regulations, especially since the Federal Council reaffirmed its intention to seek internationally coordinated regulation of corporate sustainability.

Overall, it is expected that the requirements for non-financial reporting will increase in the future. Transparency, fact-based information that permits classification and comparisons are required. A reliable and up-to-date, valid data basis is therefore indispensable to be able to show and report key figures on relevant topics as well as targets, measures, progress and setbacks. It is obvious that a standalone sustainability strategy is not sufficient. Sustainability must be an integral part of the corporate strategy in order to ensure serious and credible management of the organization and safeguard sustainable corporate development.

Reporting: Much more than just KPI

Smaller companies often ask themselves whether reporting is worthwhile for them at all. From conversations, it appears that the prevailing opinion is that effective contributions to climate protection comprise measures such as the installation of a solar systems or energy-saving measures, or to make a social contribution through certain training or support programs for its employees. There is no doubt about that. Nevertheless, at some point the question arises as to what the measures have been achieved. Was the investment worthwhile? What has been saved in terms of electricity or CO2? Has employee satisfaction increased, staff turnover reduced or my reputation as a good employer improved? Answers to these questions are only possible if the topic is approached systematically. Of course, you don't have to launch a reporting system, and even if you are not legally obligated to report as a small company, the creation of a sustainability report with the corresponding data collection can be a good first assessment. A report can be valuable tool that can support continuously improvement and makes commitment visible internally and externally. The most important thing here (much more important than meeting a standard) is honest and transparent documentation and metrics that are not used as a target.

Start now and be prepared!

In view of the latest IPPC report (IPCC, 2023), it should be clear that the issue of sustainability and acting within planetary and social boundaries will obviously and inevitably determine business. The consequences of the hitherto exploitative behavior on an ecological and social level will be of concern. SAP Insights show that resource scarcity and climate change are among the risks that are currently most visible and tangible for business leaders (SAP, 2021). At the same time, economic stagnation is most often cited. If one follows approaches such as that of the economy for the common good, also an approach (and mindset) of sustainability reporting, it quickly becomes clear that there are alternative economic models that turn back the traditional thinking of ever more growth and profit orientation, because it simply does not work in the long run. Only when money is seen as a means to an end, to create good living for all and to protect our earth - our livelihood -, then economic stagnation need not be a risk, but simply an orientation or condition that is sustainable.

Conclusion

To sum up, we all know sustainability is a complex issue. In addition, there are now further regularizations, that must be observed. If these are also to be complied with, simply adhering to the requirements will not be enough to stop climate change. Nevertheless, you should now at least have an overview of what is coming and some ideas on how to prepare.

On May 4 it’s all about Holistic Steering and Reporting! Don’t miss the SAP Discovery Day for Sustainability, a virtual event series focusing on sustainability management solutions for sustainable supply chains, decarbonization, circular economy and ESG reporting.

Source: SAP | SAP Discovery Days for Sustainability

Related topics and sources:

EJPD (2021). Erläuternder Bericht zur Verordnung über Sorgfaltspflichten und Transparenz bezüglich Mineralien und Metallen aus Konfliktgebieten und Kinderarbeit (VSoTr). https://www.ejpd.admin.ch/dam/bj/de/data/wirtschaft/gesetzgebung/verantwortungsvolle-unternehmen/erl...

IHK (2021). Leitfaden für Unternehmer, München, https://www.ihk-uenchen.de/ihk/documents/CSR-Ehrbarer-Kaufmann/Leitfaden-Nachhaltigkeitsberichtersta...

IPCC, 2023: Climate Change 2023: Synthesis Report. A Report of the Intergovernmental Panel on Climate Change. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, (in press)

SAP (2021). Bridging the Gap Between Sustainability and Financial Metrics. https://www.sap.com/germany/insights/research/bridging-the-gap-between-sustainability-and-financial-...

Sustainability Topic Page

Here you can ask questions about Sustainability and follow

Read other Sustainability blog posts and follow

Please follow verena_007 and isabeau for future posts

- SAP Managed Tags:

- Sustainability

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Banking

1 -

BTP for Sustainability

2 -

Circular Design

1 -

Circular Economy

1 -

Compliance

1 -

CSRD

1 -

EPR

1 -

ESG

1 -

ESRS

1 -

Financial Services

1 -

Insurance

1 -

Packaging

1 -

PCAF

1 -

Picking Strategy

1 -

Plastic Taxes

1 -

Recyclability

1 -

SAP Analytics Cloud

1 -

SAP Cloud for Sustainable Enterprises

1 -

SAP Community

1 -

SAP Datasphere

1 -

SAP Profitability and Performance Management

1 -

SAP Responsible Design and Production

1 -

SAP SCT

1 -

SAP Sustainability Control Tower

2 -

SAP Sustainability Footprint Management

1 -

SCT

1 -

Sustainability

1 -

Sustainability Control Tower

1 -

Sustainable Finance

1