- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Electronic Invoicing in Malaysia

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

What is electronic invoicing in Malaysia?

Electronic invoicing, also known as e-invoicing, is gradually gaining acceptance worldwide, including Malaysia.

In Malaysia, e-invoicing is part of the Malaysian government's initiative to promote digital transformation and a paperless environment among businesses. It's an electronic method of billing your clients for goods sold or services rendered, and it's achieved through email or any other electronic medium.

One key advantage of e-invoicing is that it supports the country's move towards digital tax monitoring. The Malaysia Royal Customs Department introduced the Sales and Service Tax (SST) in 2018. E-invoicing makes it easier for businesses to calculate, track, and pay this tax in real time.

Malaysia plans to implement a mandatory e-invoicing system for all taxpayers, regardless of their sales turnover, from July 2025. This will be a gradual implementation, with the first phase beginning in August 2024 for taxpayers with an annual turnover of MYR 100 million or more.

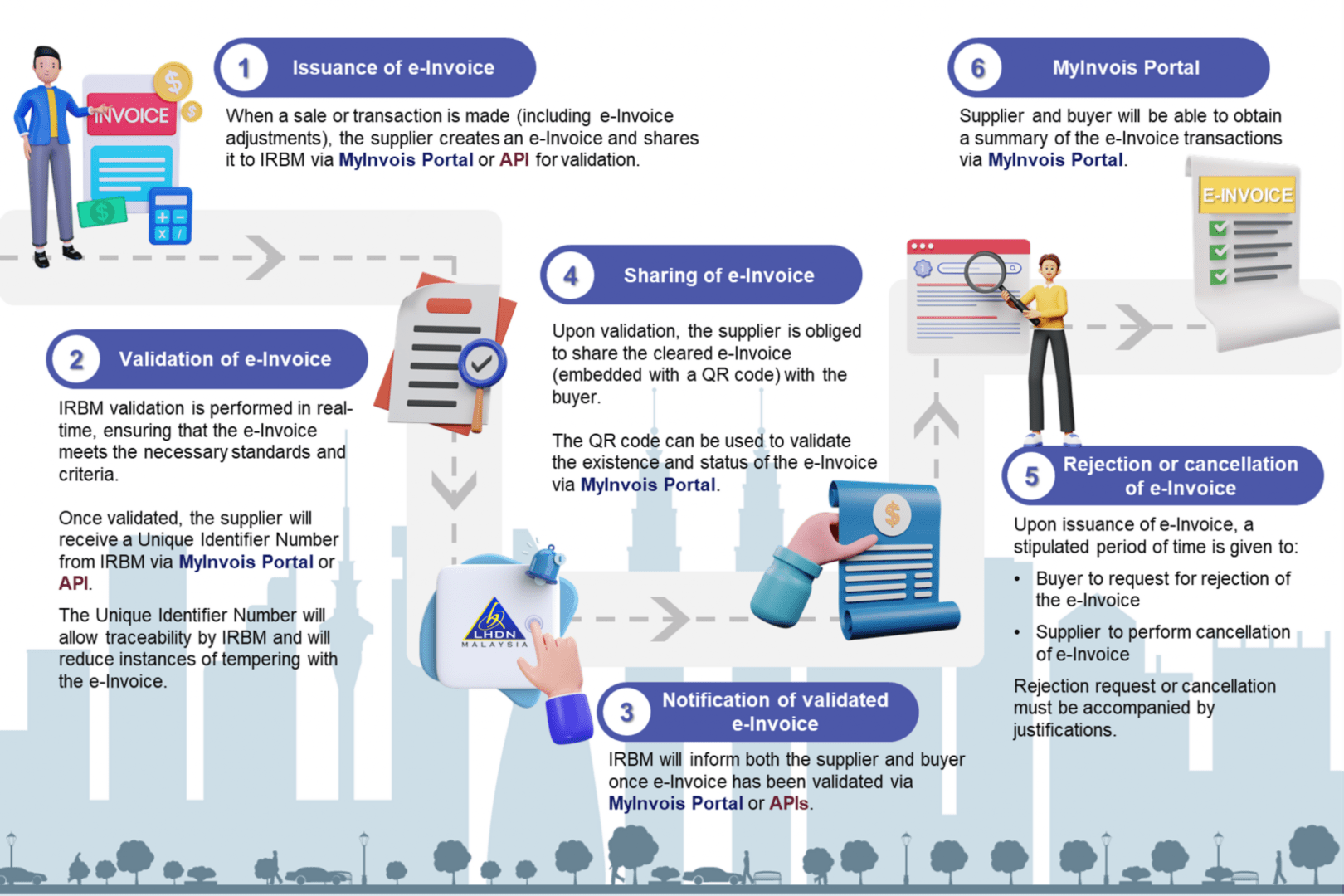

The Malaysian Inland Revenue Board (IRB) has developed two mechanisms for taxpayers to transmit their e-invoices to the IRB:

- MyInvois Portal: A web-based portal that allows taxpayers to create and submit e-invoices manually or in batches

- API integration: This allows taxpayers to integrate their e-invoicing system with the IRB's system to automate e-invoice transmission.

Taxpayers can choose the mechanism that suits their business requirements better.

Image from the website of LHDN (Lembaga Hasil Dalam Negeri)

The increasing adoption of e-invoicing in Malaysia is expected to help enhance efficiency, reduce costs, speed up payment cycles, improve financial management, and minimize errors and fraud. Businesses also get to contribute to environmental sustainability as e-invoicing reduces paper use.

Malaysian businesses will join a nationwide e-invoicing framework that adheres to international Peppol standards. This framework allows businesses to send and receive invoices over the Peppol network, regardless of their accounting solution.

How to prepare for e-invoicing?

Businesses can start preparing for e-invoicing by carrying out the following activities:

- Assess their current invoicing process to identify the areas where they can improve efficiency and reduce costs.

- Choose an e-invoicing solution that meets their specific needs and budget.

- Integrate their e-invoicing system with their ERP system to automate e-invoice transmission.

- Educate their staff on the new e-invoicing process.

As the Malaysian government continues to promote digitalization, further milestones for e-invoicing can be anticipated in the coming years.

SAP’s go-to solution to support electronic documents and statutory reporting requirements globally is SAP Document and Reporting Compliance. This would be the strategic choice to support electronic invoicing in Malaysia too.

SAP is currently analyzing the electronic invoicing requirements available. In the meantime, we are analysing the SDK Beta version which is released on 9 Feb 2024. If you’d like to explore the SAP Document and Reporting Compliance Cloud Edition solution, please visit SAP Document and Reporting Compliance

For upcoming legal changes, the recommendation is to use our Regulatory Change Manager where you can find the latest status of upcoming regulations, including Malaysia.

- SAP Business Network :

B2B electronic invoices in 2024

UPDATE Nov 1, 2023: SAP has confirmed roadmap for e-invoices in MY. Scope and timeline detailed in the links above.

UPDATE Feb 8, 2024: SAP has updated the roadmap for e-invoices in MY. Scope and timeline detailed in the links as per our Regulatory Change Manager.

- SAP Managed Tags:

- SAP S/4HANA Cloud Localization,

- Localization

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

- Introducing the market standard of electronic invoicing for the United States in Enterprise Resource Planning Blogs by SAP

- SAP Document and Reporting Compliance Brazil: Dashboard do Usage Analytics in Enterprise Resource Planning Blogs by SAP

- Learn about Localization with SAP’s Experts at the DSAG-SAP Globalization Symposium 2024 in Enterprise Resource Planning Blogs by SAP

- SAP Document and Reporting Compliance Brazil: Atualizações no CT-e MDF-e in Enterprise Resource Planning Blogs by SAP

- NF-e Nota Técnica 2019.001 v1.62 novos campos adicionados à nota fiscal in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 9 | |

| 8 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |